Multidimensional Analysis of Regional Development 2013

The goal of the multidimensional analysis of regional development using neural networks – Cohonen Self-Organizing Maps (SOM) is to review and analyze the overall socio-economic development of Bulgarian districts in the 2008-2011 period.

Aleksander Tsvetkov, Ph.D, Regiostat

The goal of the multidimensional analysis of regional development using neural networks – Cohonen Self-Organizing Maps (SOM) is to review and analyze the overall socio-economic development of Bulgarian districts in the 2008-2011 period, using a wide variety of indicators, grouped in seven categories: economy, infrastructure, demographics, education, healthcare, environment, social environment.

Two “fake regions” have been established for the purpose of this analysis. One is a “perfect” region, which scores best (has the highest marks) in all indicators at the same time. The other one is a “worst” region, which has the lowest marks. These “fake regions” are used as reference points and benchmarks for assessing the development of the 28 regions during this period. After the analysis, the districts have been grouped into clusters, formed by Cohonen’s self-organizing maps. This presents an overview of the development of the districts throughout the entire period, by visualizing the degree of dissimilarities between the regions, their development trends – whether they are negative or positive, as well as their cohesion.

The main conclusion of the analysis is that there is no evident cohesion between the districts. To the contrary – there is one district, Sofia (capital), which significantly differs from the others in its socio-economic development. What’s more – the gap between Sofia (capital) and the other districts keeps growing. In practice, there is no visible result from the regional development policy that the government should try and implement.

The overall socio-economic state of Sofia (capital) is the highest of all the districts, which can be seen by its proximity to the “perfect region”. The districts Blagoevgrad and Varna are also close, but despite their good overall condition, they are far less developed than the capital. This conclusion is confirmed by the colour on the border between the cluster of Sofia (capital) and the other two districts – highly saturated color, that implies significant differences.

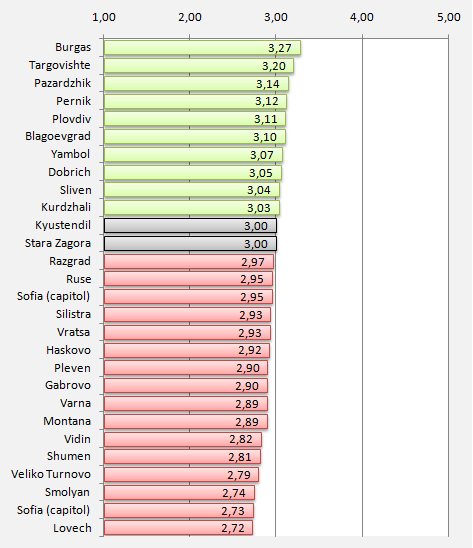

- Sofia (capital) has the best developed economy of all Bulgarian districts, followed by Varna. The weakest economic development is observed in the districts Silistra, Razgrad and Vidin.

- Sofia (capital) also has the best developed infrastructure, especially in the end of the period (2010 and 2011).

- Vidin, Lovech and Montana have the worst demographic state during the entire period, while Gabrovo demonstrates pronounced worsening trends.

- The regions with worst-developed education systems are Sliven, Targovishte, Razgrad and Silistra.

- Stara Zagora has both the best healthcare systems and worst state of the environment during the entire period.

- Unlike the other categories (economy, for instance), the social environment indicators have more pronounced dynamics. The color saturation on the map demonstrates negative development trends in the most regions, for example – Blagoevgrad, Sofia (capital), Gabrovo, Ruse, Stara Zagora and so on. In practice, Smolyan had the best social environment in the country for 2011, what’s more the positive trend is present during the entire period.

The full text of the analysis and all Cohonen maps are available here.

The study was presented on November 14th 2013.

The study was presented on November 14th 2013.