IME Presented Recommendations for Fighting Corruption in Kyustendil

On December 11th, 2013 the IME economists Desislava Nikolova and Petar Ganev visited Kyustendil in response to an invitation of the district’s governor Ivan Karakashki.

On December 11th, 2013 the IME economists Desislava Nikolova and Petar Ganev visited Kyustendil in response to an invitation of the district’s governor Ivan Karakashki.

On December 11th, 2013 the IME economists Desislava Nikolova and Petar Ganev visited Kyustendil in response to an invitation of the district’s governor Ivan Karakashki.

Photo: Vladi Vladimirov, Darik - Kyustendil

The economists presented the results of a study of corruption perception in the Kyustendil district and the country, which is part of the publication " Regional Profiles: Indicators of Development 2013 ".

Kyustendil is one of the districts with the highest corruption perception levels. Businesses give an average evaluation of 2.5, while the average for the country is - 3.4. The lower the score, the higher corruption perceptions are. Citizens give 2.37, while the average for Bulgaria is 2.67.

IME presented 11 recommendations to combat corruption aimed at increasing transparency and efficiency of local administrations, while involving citizens and businesses in the process.

The event was covered in several local media outlets:

After two consecutive quarters of growth on annual basis, the number of people employed once again decreased in the third quarter of 2013.

In the third quarter of 2013 the number of employed people decreased slightly on an annual basis after two consecutive quarters of growth in the first half of the year. In June-August 2013 the employees are 5000 less than in the same period in 2012.

However, in most districts (16 out of 28) there is an increase in the number of the employees on an annual basis. Some of the most interesting labor market trends in the third quarter are represented below:

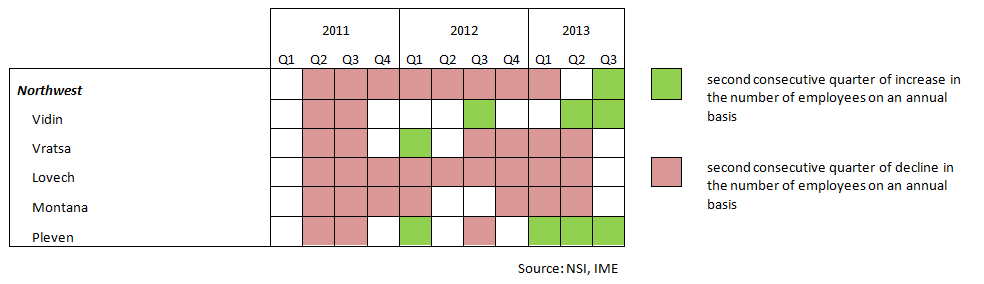

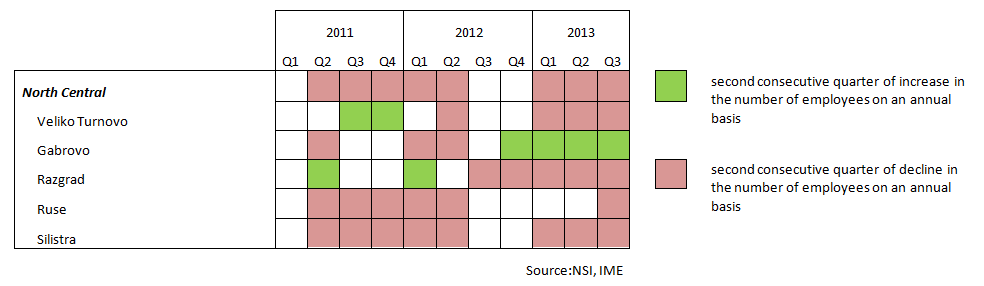

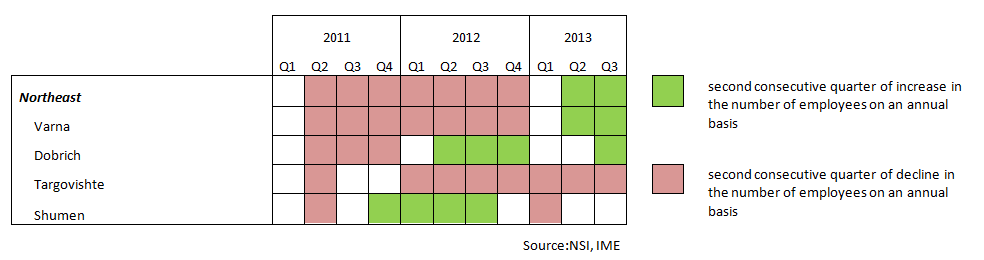

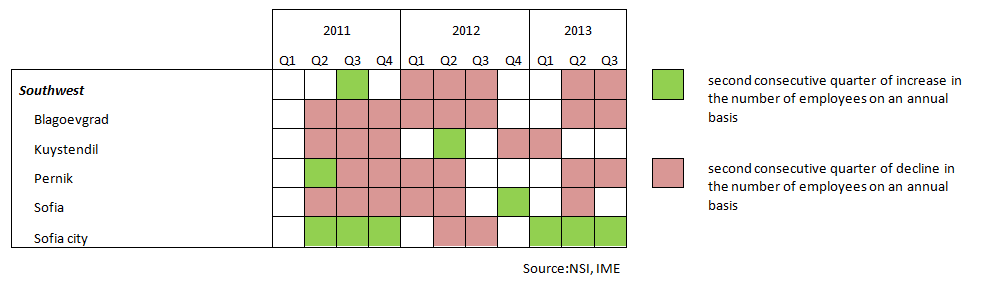

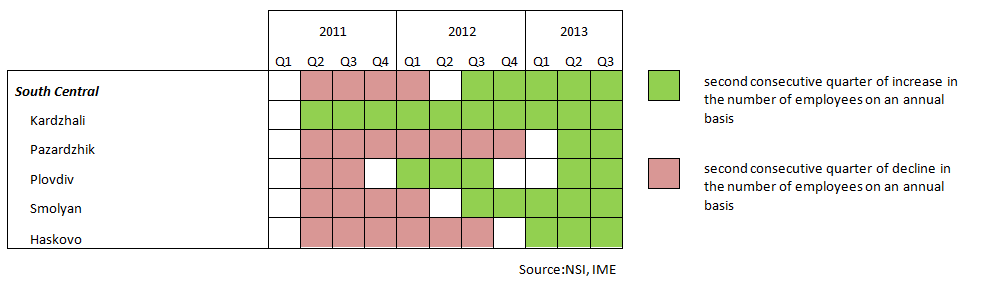

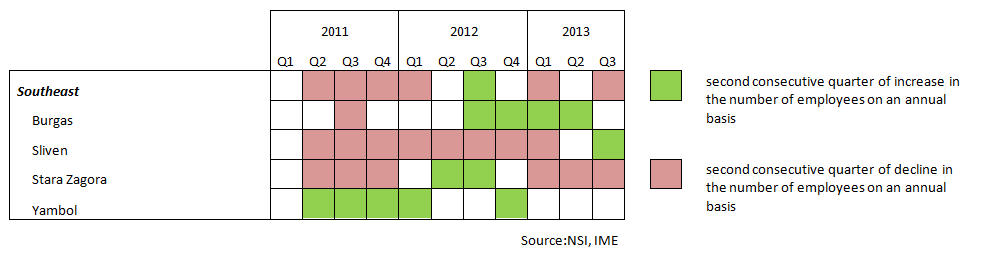

Methodology of the results: In the majority of the regions the recovery of the labor market began in 2011. We use both the number of employees and the employment rate of the population over the age of 15 in order to monitor the recovery process during the period from the first quarter of 2010 till the third quarter of 2013. The tables, that precede the analysis of each statistical region, are intended to illustrate the existence of clear trends in the dynamic of the number of employees in the local economy annually. For this purpose, the second consecutive quarter of increase in the number of employees on an annual basis is highlighted in green, and every second consecutive quarter of decline in the number of employees on an annual basis - in red.

For the first time since 2010, the Northwest region has shown a steady increase (two consecutive quarters) in the number of employees on an annual basis. In the third quarter of 2013, the number of employed people increased in all districts compared to the same period of last year. The trends remain most clearly positive in Vidin and Pleven. An important change of direction is observed in Lovech, where there is a break, be it moderate, in the trend of annual decrease in the number of employees after 10 consecutive quarters of decline. Positive trends are recorded in Montana and Vratsa, although employment rate in both districts remains among the lowest in the country.

Gabrovo is the only district in this region, which has had a sustainable increase in the number of employees since the summer of 2012. The district is also a leader with 49,6% employment rate during the third quarter of 2013. This sustainable growth in the number of the employees does not apply for the other four districts. Razgrad and Silistra remain two of the four districts in the whole country with an employment rate lower than 40%. In two of the last three quarters, the number of employees in Ruse falls below 90,000 compared to 105,000 in 2010.

For a third consecutive quarter, the employment rate in the Northeast region is increasing, mainly due to the significant increase in the number of employees during the summer months in Varna. For the first time since the summer of 2010, the number of employees in the largest district in the region approaches 200,000 people. Fairly stable is the labor market in Dobrich, which registers the highest employment rate in the region in the last two quarters due to the growing seasonal trends in the local labor market over the past three years. Since the beginning of 2012, Targovishte can’t escape from the cycle of steadily declining number of employees annually. Thus, the employment rate of that district is the lowest in the last quarter compared to the others in the region - only 41.1%.

The employment rate in the Southwest region has been steadily declining for three consecutive quarters. Sofia City district and Sofia district are the two districts that are exceptions to the region for the third quarter of 2013. However, they fail to offset the decline in the others, although 75% of employees across the region work in them. Only in the capital there is a steady growth in employment rate and it remains the highest (56.5%) in the country. The sharpest decline in the number of employees is in Blagoevgrad - 6.3% on annually basis.

The number of employees in all districts of the South Central region has increased on an annual basis for the third consecutive quarter. In the third quarter of 2013, the number of employed people in this region exceeded 600,000 for the first time since the summer of 2010. Compared to the same period last year, the most remarkable growth in employment is recorded in Pazardjik and Haskovo. Although the employment rate in both districts remains below the average for the region, persistent trends in the labor market are of paramount importance, because over 35% of the employees in the whole region work there. The good data for Pazardzhik means that employment rate has reached its bottom at the end of last year, while the average index for 2013 will report values above 40%. The sustained job growth in Plovdiv and Smolyan last year, and the traditionally strong last quarters of the year in these districts, give reasons for further increase in employment rate at the end of the year.

There is a minimal decline in the number of employees in Burgas in the third quarter of 2013 on an annual basis, after five consecutive quarters of growth. At the same time the strong first two quarters of the year and the increasing resilience of the labor market in the winter months’ trend in recent years make reaching the highest levels of average employment in the region since 2008 a viable expectation.

The collapse of employment in Stara Zagora is surprising with regard to the good 2012 for the whole region, but is understandable against the background of lay-offs taken in a number of businesses in the district this year. Since the last quarter of 2012, the employed people in the district have been at least 10,000 less than during the same quarters of the previous year. The incurred and the expected cuts in healthcare and energy systems as well as the conclusion of construction activities surrounding “Trakia” highway had a negative impact on employment across the region.

Only Sliven district manages to maintain its employment growth, which began in the previous quarter, while Yambol struggles.

*Borislav Tonchev is an intern at IME

The study was presented on November 14th 2013.

The study was presented on November 14th 2013.

The study "Regional Profiles: Indicators of Development 2013" (Bulgarian version) presents the social and economic development of bulgarian districts. The study is based on 58 indicators, divided into eight categories: Economy, Administration and Taxes, Infrastructure, Demography, Education, Healthcare, Environment and Social Environment. A seperate profile of each of the districts can be found on our webpage.

The English version of the study will be available in January 2014 and will include all of the available analysis and data.

Some of the analysis included in the study show:

There is a connection between the assessment of businesses about the quality of administrative services and corruption perceptions

The speed and quality of the administrative services and the rule of law are two of the leading elements that determine local business environment. In May 2013 IME carried out a countrywide survey among 1680 companies as part of the upcoming second edition of the study “Regional profiles: Indicators of Development”[1].

Conclusions:

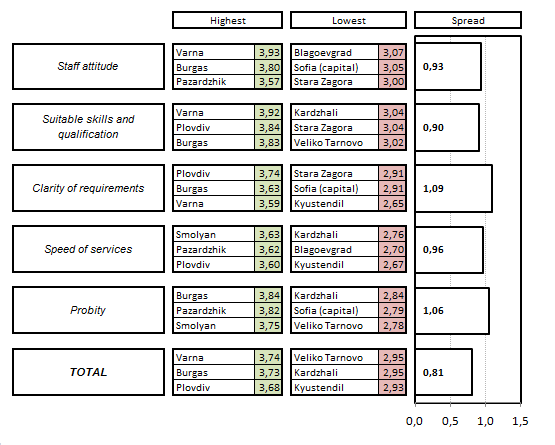

The assessment consists of several criteria such as staff qualification, skills and attitude, speed of the administrative services, clarity of local requirements and regulations and overall corruption perception. The overall assessment of the administration’s performance in 2013 is lower (3.3/5.0) than in 2012 (3.5/5.0).

Source: IME, „Regional profiles: Indicators of Development 2013“

Note: The spread shows the difference between the highest and the lowest ratings for every single characteristic of the administrative services. The evaluation is based on a five-point scale where 1 stands for ”very bad”, 3 means “average”, and 5 means “very good”.

The attitude of the staff and their qualification are the highest rated characteristic of local administrations in Bulgaria. . Even the lowest rated districts achieve results above 3 (average).

Meanwhile the speed of the administrative service and the clarity of local requirements of the administration remain the most problematic areas. The most considerable regional differences are also connected with these two characteristics.

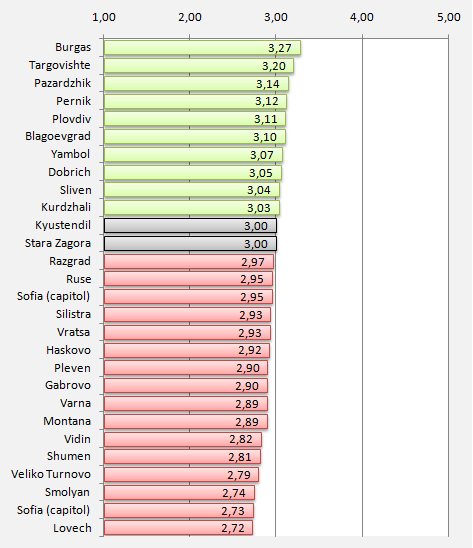

Trends: Some minor structural changes in the business survey make a direct comparison between data from 2012 and 2013 improper. However, it is important to note that for a second consecutive year Burgas is one of the top 3 most highly rated districts, while Kyustendil is one of the districts that receives one of the lowest ratings. Among the five best performing districts for a second consecutive year are also Smolyan and Pazardzhik, whereas the administration services in Stara Zagora are still perceived as one of the worst.

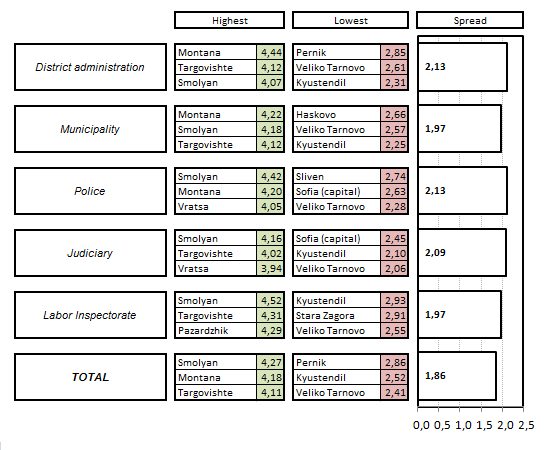

The survey evaluates the corruption perception of local businesses in regard to the district and municipality administrations, police and judicial authorities, as well as the local Labor Inspectorate. In 2013, the overall corruption perception in the country has deteriorated from 3.4/5.0 to 3.3/5.0.

Source: IME, „Regional profiles: Indicators of Development 2013“

Note: The spread shows the difference between the highest and lowest rated districts in regard to corruption perception in each of the listed institutions. The evaluation is based on a five-point scale, where score 1 stands for “very high level of corruption”, 3 means “average levels of corruption” and 5 means “very low level of corruption”.

In terms of corruption perceptions there are serious discrepancies. The highest levels of corruption are considered to be in the municipalities and the judiciary system. The lowest levels of corruption are in the local sub-divisions of the Labor Inspectorate. Corruption is the highest in Veliko Turnovo, Kyustendil and Pernik, and the lowest levels are in Smolyan, Montana and Targovishte.

Trends: For second consecutive year, Smolyan and Targovishte are among the three regions with the lowest perception of corruption, while Pernik and Kyustendil have some of the highest. Veliko Turnovo once again ranks among the 5 regions with the highest corruption in the country.

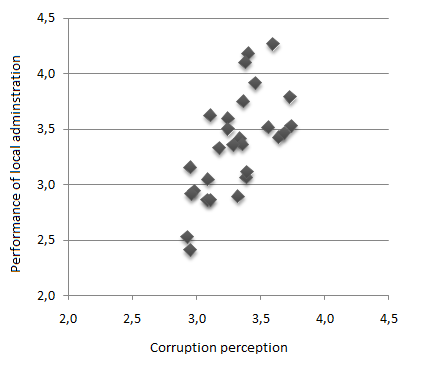

Administrative services and corruption - For a second consecutive year the data show a connection (moderate positive correlation- 0.65) between business’ assessment for the quality of administrative services and corruption in the country.

Source: IME, „Regional profiles: Indicators of Development 2013“

Note: The assessment of the performance of local administration is based on a five-point scale, where score of 1 means “very bad”, 3 is “average” and 5 is “very good”. In evaluating corruption score 1 means “very high level of corruption”, 3 is “average” and 5 - “very low level of corruption”.

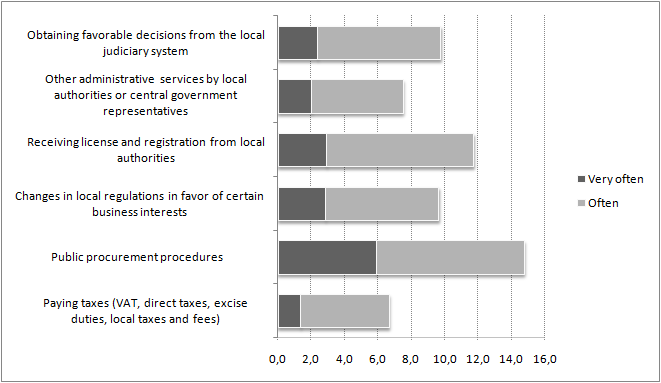

Irregular payments - nearly 15% of the respondents think that illegal payments from companies in their sector to the administration are made “often” or “very often” in order to obtain public procurement contracts. Around 12 % believe that it happens “often” or ‘very often” when it comes to getting registrations and permits from local authorities.

Source: IME, „Regional profiles: Indicators of Development 2013“

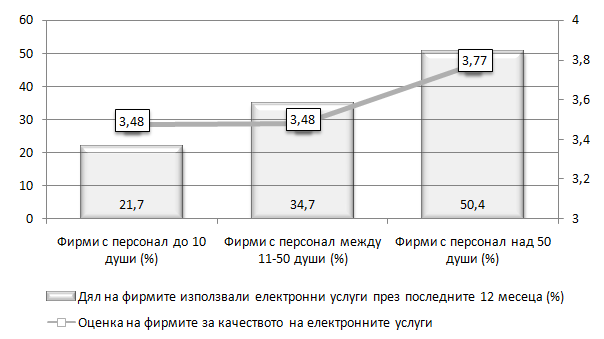

Electronic services are used by 21.7% of the companies with up to 10 employees and 34.7% of the companies employing between 11 and 50 people. Large companies are the ones that most often use e-services provided by the local administration - in the last 12 months preceding the survey 50.4 % of them did so. Small and medium businesses evaluate their quality as “rather high” (3.48/5.00). The assessment of the large companies is even higher- 3.77/5.00.

Source: IME, „Regional profiles: Indicators of Development 2013“

[1] The study will be presented on 14th November 2013. Along with the socio-economical development of the 28 districts in the country, the study includes several thematic analysis in various topics such as labor market development and trends in local tax policies.

The results of an IME business survey, carried out in the build-up to the study “Regional Profiles: Indicators of Development 2013” (to be published in November), indicate rather negative trends for the development of domestic labor markets in the next 12 months.

It appears that the Bulgarian economy has finally started to create jobs. In the second quarter of 2013 the number of employed people was 26,5 thousand higher compared to the same period last year. Meanwhile, slowing economic growth could have a reverse effect on this much awaited positive trend. The results of an IME business survey, carried out in the build-up to the study “Regional Profiles: Indicators of Development 2013” (to be published in November), indicate rather negative trends for the development of domestic labor markets in the next 12 months.

According to the data published this month by the National Statistical Institute (NSI), the increased number of employees in seasonal industries (agriculture, hotels and restaurants etc.) during the second quarter and the growth is significantly higher than the observed growth during the previous couple of years. In comparison to 2012, there are 13 thousand newly created jobs in agriculture and 14 thousand in “Hotels and Restaurants” .Therefore, it is hard to make a definite conclusion whether these new jobs in recent months are due to general improvements in the economy or just temporary effects as a result of a strong summer season.

The dynamics of the number of employed for the first two quarters in different regions of the country also point to rather strong seasonal trends. For the period April-May 2013 most openings have been created in districts with traditionally high occupation during the summer months. Compared with the first quarter of the year, the average number of employees under labor contract during the second quarter increased by 16,8% in Burgas, 7,8 % in Varna and 8,8 % in Dobrich. Other districts with good performance this year are Targovishte and Shumen. However, the increase in the number of employees there is only 2-3%. In 2012 these rates were 13,9% in Burgas, 7,0% in Varna and 5,7% in Dobrich.

In spite of the positive signs of growing employment, businesses are not quite as optimistic about the situation on the labor market in the country for this year and next.

For the purposes of the upcoming second edition of the study “Regional profiles: Indicators of Development”, in May 2013 IME conducted a survey among 1680 companies nationwide. One its goals, was to examine the expectations of businesses regarding the dynamics of the number of employees in the period June 2013-June 2014. The results are shown in the graph below, by visualizing the expectations of business representatives about increasing or decreasing the number of their employees. Results above 3 show expectations of hiring more staff. Result below 3 point to negative tendencies.

Business expectations regarding the number of employed (June 2013 - June 2014)

Source: IME, „Regional profiles: Indicators of Development 2013“

Note: The data is from May 2013.

Businesses expect that the number of employees will increase in the following 10 districts: Burgas, Targovishte, Pazardzhik, Pernik, Plovdiv, Blagoevgrad, Yambol, Dobrich, Sliven and Kardzhali. Oddly enough, only Dobrich and Targovishte are part of Northern Bulgaria. There is no expected change in the number of employees in Kyustendil and Stara Zagora and in all other districts this number is expected to fall.

It seems more than clear that an exact assessment of labor market conditions in Bulgaria could be made at the end of the third quarter, when most of the seasonal workers will be dismissed. The question is whether the momentum in the labor market and perhaps in the economy in general will be sufficient to keep employment high in comparison to previous year. The successful summer season makes evaluations based on the dynamics of previous years uncertain. Employment numbers may be positive but so far business expectations remain subdued.

Raising the minimum thresholds makes the labor of more than half of the employed in poorer districts more expensive.

Raising the minimum thresholds makes the labor of more than half of the employed in poorer districts more expensive.

Talks on changes in the social security system have started again, against the background of continuing protests in the country and the news of a possible budget revision. We have been hearing all kinds of extravagant and even unconstitutional suggestions, such as the proposal to “take away” money from the private pension funds, but yet again little attention is being paid to the influence of minimum insurance thresholds on employment levels in the country. Let’s not forget that neglecting this topic is an invariable criticism in the reports and statements of the EC[1] and the IMF[2]. We now have access to more data, which clearly show the size of the problem and have not been publicly available until now.

In the past year we published an analysis of the effects of social security and regulatory burdens on the labour force in the country. For the first time, using detailed data, we can prove that one out of every four people is insured on or close to the minimum threshold. Now, thanks to the work done by our colleagues from National Social Security Institute, we have 2012 data and a breakdown by regions[3]. It has been pointed out analytically more than once that this problem is mainly on regional level, but never before have had access to detailed regional data. And the statistics are more than alarming.

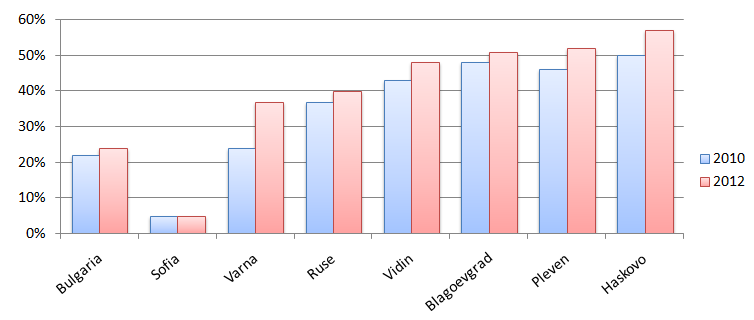

As expected, such a problem is more or less non-existent in Sofia – only 5% of those working in the capital are insured on or close to the minimum social insurance income. In other words, wages in Sofia are relatively high and raising the minimum insurance thresholds does have a serious influence. But the situation in the country is different. In Haskovo for example, almost 60% of all workers are insured on or close to the minimum. This means that raising the minimum thresholds automatically makes the labour of more than half of the employed in Haskovo more expensive, which inevitably pushes employment down.

Insured on or close to the minimum threshold (% of the insured by regions, 2010 – 2012)

Source: NSSI

*Data of the NSSI for the 16 economic activities for the period 2010 – 2012 have been used, which encompasses almost 1 million insured persons. We assumed insured persons on or close to the minimum to be all those, who are insured on or close to the threshold – with a tolerance range of 10% above the administratively specified threshold.

The same is true for other regions as well – in Blagoevgrad, Vidin, and Pleven 50% of the workers are insured close to the minimum. In Ruse and Varna, 40% are close to the minimum. In other words, if we exclude Sofia, minimum insurance thresholds play a crucial role in the country, because every change in them automatically influences at least half of the employed. Even more, in the past several years, the impact of the minimum thresholds is increasing. Varna was hit the hardest – in 2010 25% were close to the minimum thresholds, while in 2012 these were already close to 40%.

All of this is not quite surprising and just confirms the arguments already expressed. The system of minimum insurance thresholds has immense influence in the countryside, which is neglected in view of Sofia. The blind raising of minimum thresholds in times of crisis and decreasing employment has made it so that more than half of the employed in the country (excluding Sofia) are insured on or close to the minimum and every increase in these thresholds automatically depresses employment levels in many regions. This is one of the explanations behind the problems on the labour market and the lack of new jobs, which is also confirmed by international observers and institutions and the detailed regional data. Inexplicable is the desire of the institutions to comment on all kinds of topics, including unconstitutional ones, but persistently avoid all criticism against the system of minimum insurance thresholds and its effects on employment.

[1] The position of the EC (here): “… To reevaluate the minimum insurance thresholds, in order to make sure that the system does not raise the cost of hiring low-skilled workers too much…”

[2] The position of the IMF (here): “… The effect of the higher minimum wages and minimum social security threshold on employment must also be evaluated…”

[3] Data of the NSSI for the 16 economic activities for the period 2010 – 2012 have been used, which encompasses almost 1 million insured persons. We assumed insured persons on or close to the minimum to be all those, who are insured on or close to the threshold – with a tolerance of 10% above the administratively specified threshold.

�

The project "Regional Profiles: Indicators of Development" is carried out with the support of the America for Bulgaria Foundation.

During the second part of our trip we visited the regions of Vratsa, Pleven, Lovech, Gabrovo, Veliko Tarnovo, Targivishte, Shumen, Razgrad, Ruse, Silistra, Dobrich and Varna.

Petar Ganev

In mid-June 2013 for a second year in a row IME embarked on а tour of the 28 districts in Bulgaria as a part of the upcoming second edition of the study “Regional Profiles: Indicators of Development”. By holding meetings with representatives of non-governmental organizations, business associations and regional authorities, IME’s team aims to acquire direct impressions of the socio-economic environment in each district.

During the second part of our trip we visited the regions of Vratsa, Pleven, Lovech, Gabrovo, Veliko Tarnovo, Targivishte, Shumen, Razgrad, Ruse, Silistra, Dobrich and Varna. We will use our observations from these visits for the completion of each region’s profile in the upcoming second edition of our study. Some of the underlying socio-economic trends that we observed in the regions of Northern Bulgaria are:

IME would like to extend its gratitude to all of our partners and especially the representatives of the Bulgarian Chamber of Commerce and Industry (BCCI) for their cooperation in the organization of local meetings and workshops.

The project "Regional Profiles: Indicators of Development" is carried out with the support of the America for Bulgaria Foundation.

Sofia for another year breaks away from other regions in economic development 16.02.2026

In 2024, Sofia continues to stand out more and more clearly in its economic development from the other...

Bansko on the eve of the Winter Games 09.02.2026

Today is the official opening of the 25th Winter Olympic Games in Milano Cortina. Two decades after the...

Disability pensions are affected by demographics, but also by unemployment by region 06.02.2026

NSSI data show that there are over half a million people receiving disability pensions. However, the regional...

Economic and social development of the districts over the last decade 12.01.2026

The IME Regional Profiles study has been tracking the economic and social development of regions in Bulgaria...