Is The Quality of Local Government E-Services Improving?

More than 50% of municipalities only provide e-services from the first and second levels.

Yavor Aleksiev

It is widely accepted that the development of e-services and the restriction of direct contacts between businesses and the administration is one of the most effective ways to reduce both corruption and administrative burden on business. Contemporary electronic interaction reduces the risk of lost documents, delayed permits and off the table pressure from administration on business or vice versa. Although successive governments have (at least seemingly) made attempts to accelerate the adoption of e-government at national and local level, the results remain unsatisfactory, especially considering the money spent for this purpose.

For the purposes of the third annual edition of the study “Regional Profiles: Indicators of Development” the IME carried out two separate surveys, which included questions regarding the quality and scope of e-services, offered at the local level:

A sociological survey among businesses that took place in May 2014 and included 1680 companies from the entire country. Among various questions regarding the effect of various business environment factors on the local level, the survey included questions that evaluate the performance of local administrations and the scope and quality of e-services.

A survey among municipalities, which started in March 2014 and ended in May 2014. Local municipalities were sent a list of questions, according to the stipulations of the Public Information Procurement Act, and provided information about the levels of key local taxes and fees, as well as their level of implementation of “one-stop-shops” and the scope of e-services they provide. In 2013 we received answers from 226 municipalities, and in 2014 – from 28 more, which brought the total number of municipalities to 254.

The overall impression is that although municipalities state higher levels of readiness for “one-stop-shop” and e-services, progress is slow, and businesses usually only take opportunity of the simplest and most straight-forward ways of online communication. This may be the explanation behind the lack of clear statistical correlation between the scope of e-services, offered by municipalities, and businesses’ assessment of their quality.

E-services

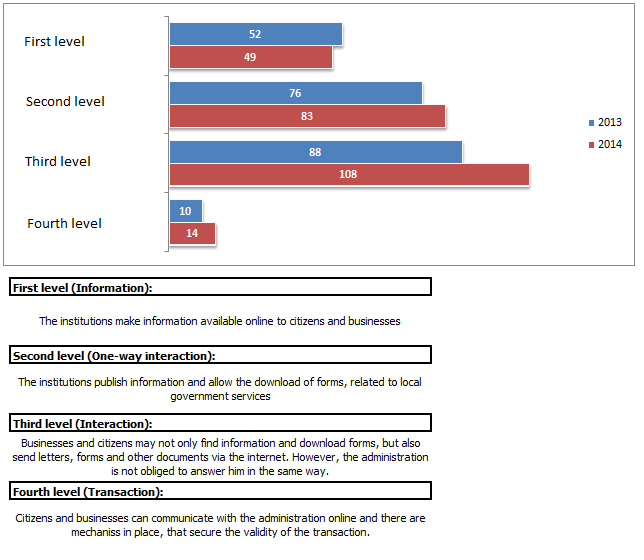

In 2013 and 2014 the highest relative share of municipalities describe the e-services they offer as being of the third level (Interaction). This means that business customers may not only find information and download forms, but also send letters, forms and other documents via the internet; however, the administration is not obliged to answer him in the same way. Despite that, in both years more than 50% of municipalities only provide e-services from the first and second levels (56.6% in 2013 and 51.9% in 2014). This means that in most cases municipalities only have a website that businesses can use in order to receive information that has already been uploaded, or download some of the forms and documents they need, without having to physically visit the municipality.

Only 10 municipalities in 2013 and 14 municipalities in 2014 declare that they provide the highest level of e-services. A curious fact is that some of those that stated they provide e-services of the highest level in 2013 actually revised their estimations lower in 2014 (e.g. Petrich and Dobrich-city). This leads to the conclusion that some employees in the administration answer the questions incorrectly.

Graph 1: Development of e-services at the local level (municipalities’ self-assessment), number of municipalities

Source: IME survey among municipalities, 2014

One-stop-shops

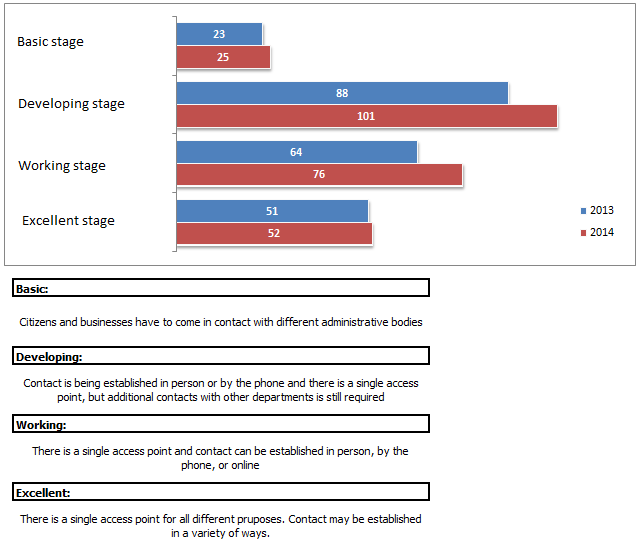

Similar tendencies can be observed with regard to municipalities’ readiness of implementation of one-stop-shops. In 2013 and 2014 this type of administrative service is in its “basic”, or “developing” stage in respectively 49.1% and 49.6% of municipalities. This suggests that businesses have to come in contact with different administrative bodies or in the best case (in the “developing” stage) – to establish the initial contact at a single access point, but afterwards still have to visit structures and departments.\

The number of municipalities, which declare “excellent” readiness for the implementation of one-stop-shops, are 51 in 2013 and 52 in 2014. This means that these municipalities have a single access point for all different purposes and contact may be established in a variety of ways, including online.

Graph 2: Level of implementation of one-stop-shops (municipalities’ self-assessment), number of municipalities

Source: IME survey among municipalities, 2014

The evaluation of business

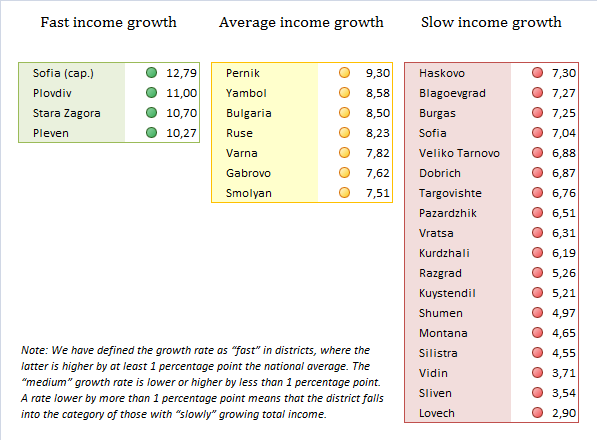

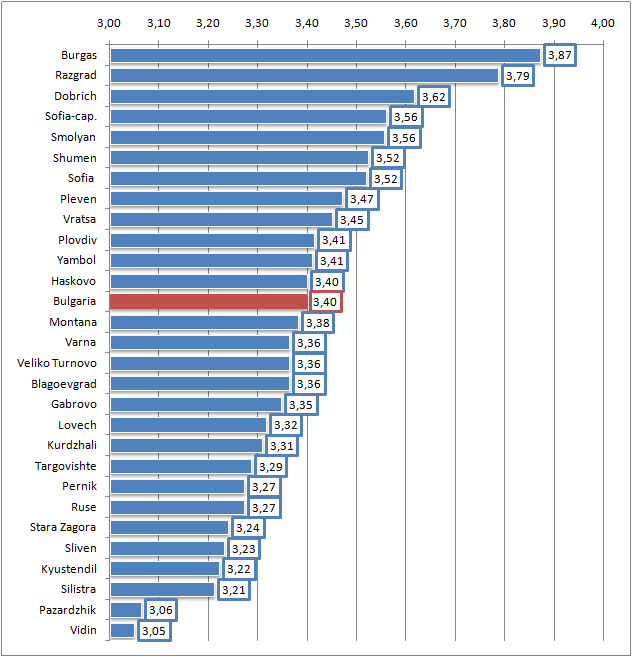

In all three annual surveys among businesses for the purposes of the study “Regional Profiles: Indicators of Development”, businesses have given a positive evaluation of the quality of local e-services. Despite that, average ratings have been decreasing – from 3.90/5.00 in 2012 to 3.54 in 2013 and 3.40 in 2014. The ratings are according to the scale from 1 to 5, where 1 means “very low quality” and 5 means “very high quality”.

It is worth noting that the share of companies that use e-services is gradually increasing – from around 30% in 2012 and 2013 to 38.6% in 2014. This is due mostly to the growing number of small and medium enterprises, which choose online communication and may be part of the explanation behind falling average ratings – e-services are being used by more and different types of enterprises, while their scope and quality is progressing relatively slowly.

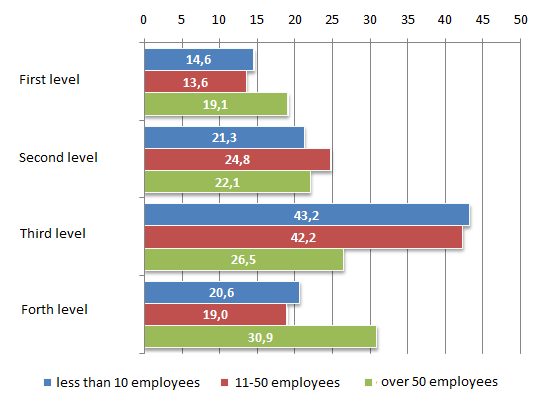

Just like in previous years, there’s a clear correlation between the size of enterprises and the types of e-services they use. For example, micro- and small enterprises usually use services of the second and third levels, while bigger enterprises are inclined to use services of the third and fourth levels.

Graph 3: Types of e-services, used by businesses, %

Source: IME survey among businesses, 2014

Although businesses from all districts rate e-services positively, there’s no clear statistical correlation between the scope of e-services, offered by municipalities, and businesses’ assessment of their quality. In districts such as Varna and Stara Zagora, where many municipalities consider their e-services as highly developed, businesses rate them relatively low and below the country’s average. The district of Burgas receives the highest rating for e-services, despite the fact that only 4 of the 13 municipalities declare a third of fourth level of e-services development.

Graph 4: Businesses’ assessment of the quality of e-services, provided by local administrations; the ratings are according to the scale from 1 to 5, where 1 means “very low quality” and 5 means “very high quality”

Source: IME survey among businesses, 2014

The analysis of the data from IME’s surveys among businesses and municipalities indicate that progress in both the implementation of one-stop-shops and e-services is relatively slow. In many cases businesses don’t take advantage of all new possible ways of communication. This leads to the conclusion that there may be insufficient information about the availability of such services, and their advantages in comparison to traditional ways of communication between local administrations and businesses. There’s also a tendency of falling average ratings in regard to the quality of the e-services that local administrations do actually offer. The latter might be the result of their growing popularity among small enterprises, which usually use e-services of the first and second levels.