What Do You Know About the Infrastructural Development of Bulgaria

The condition of the road network is slowly improving.

The condition of the road network is slowly improving.

Burgas and Sofia (capital) are the only districts in which the annual average population has increased in 2013.

Public events, dedicated to the third edition.

After the official presentation of the study "Regional Profiles: Indicators of Development 2014" on November 11the, the IME organised several public events. The English edition of the study was presented on December 3rd and all analysis are now available in both Bulgarian and English.

For a third consequtive year the study "Regional Profiles: Indicators of Development" was subject to widespread media interest.

Sofia, December 3rd 2014

The IME presented the English version of the study “Regional Profiles: Indicators of Development 2014” on December 3rd 2014. The event was attended by representatives of foreign embassies and chambers of commerce and industry.

Desislava Nikolova, Petar Ganev, Yavor Aleksiev

Sofia, Decmber 1st 2014

On December 1st 2014 the Institute for Market Economics organized a round table discussion, as part of the project “Regional Profiles: Indicators of Development”. The discussion was attended by experts from public administration and NGOs, academics and professionals in the fields of regional development and statistics.

Svetla Kostadinova, Desislava Nikolova, Petar Ganev, Yavor Aleksiev

The Bulgarian edition of the study was presented on November 11th, 2014.

The third edition of the study "Regional Profiles, Indicators of Development" will be presented on a special press conference on November 11th, 2014 at 11.00 AM.

The event will be held at the BTA.

The article will be available in English on October 23th, 2014.

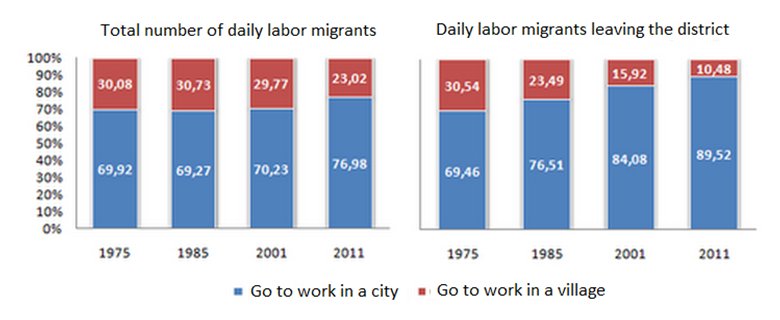

Daily labor migrants are one of the most important groups in contemporary labor markets, as they illustrate labor market flexibility and to some extent - the mobility of labor resources. These are people who live in one place, but they leave its borders daily to go to work in another. The total number of Bulgarians who travel every day to work is 400.3 thousand people in 2011, which means that about 14% of the workers in the country are with such status. Of them 104.3 thousand people leave not just the boundaries of the settlement in which they live, but also those of the entire district.

Daily labor migrants generally earn their money in one place, but they spend it in another. This way they contribute to the development of their own city (or town, village) and to the diminishing (or at least the slower deepening) of the differences between regions. An increasing share of daily labor migrants in the labor force is often interpreted as an indicator of increasing labor mobility of the population, and in the long term - the overall competition for work force in the labor market. Labor migration data is provided by the Population census in 1975, 1985, 2001 and 2011.

Several trends can be distinguished:

The proportion of daily labor migrants in 1975 and in 2011 is practically the same - 14% of all employees. At the same time, between 1975 and 2011 there is an increase in the proportion of daily labor migrants who leave the boarders of the district in which they live. In the period between 1975 and 2001 that proportion increased slightly from 10.2% to 11.5%. Between 2001 and 2011 this share reached a little over 26 percent, which is evidence of a rapidly increasing labor mobility between regions during the last two censuses.

It is worth taking a look at the distribution of employees depending on whether their work destination is a city or a village. Somewhat opposite to the intuitive perceptions in regard to labor market development a significant part of the traveling workers continue to find employment in villages throughout the whole period between 1975 and 2001. The first significant increase in the share of those employed in cities is not observed until 2011.

Figure 1: Proportion of daily labor migrants depending on the kind of location in which they work (1975-2011), %

Source: NSI, IME

The reason for this is the already mentioned increase in the proportion of migrants between different districts. The majority of those migrants traditionally leave their district to go to work in a city, which is located outside its boundries.

Labor migration between districts

Although in most areas the number of employees who travel daily as a share of the total number of employed people remains stable, there are some areas in which changes are observed. The most significant changes are precisely between the Census in 2001 and Census in 2011, when the share of daily labor migrants working outside their own district increased in all regions, despite the overall decline in labor migrants in some regions.

|

|

Increase of daily labor migrants (number of people) |

|||

|

Overall increase in the numner of the employed |

Increase of DLM |

DLM, working in the same districts |

DLM, working in another districts |

|

|

Country total |

236 810 |

71561 |

4 996 |

66 575 |

|

Blagoevgrad |

5 282 |

2807 |

1 128 |

1 679 |

|

Burgas |

18 276 |

5435 |

4 470 |

965 |

|

Varna |

37 695 |

2494 |

442 |

2 052 |

|

Veliko Turnovo |

44 |

4597 |

2 794 |

1 813 |

|

Vidin |

-5 000 |

-30 |

-447 |

417 |

|

Vratsa |

-4 670 |

1847 |

-581 |

2 428 |

|

Gabrovo |

-4 732 |

442 |

-434 |

876 |

|

Dobrich |

4 553 |

2323 |

7 |

2 316 |

|

Kurdzhali |

-12 224 |

197 |

-1 866 |

2 063 |

|

Kyustendil |

-2 077 |

-2151 |

-4 371 |

2 220 |

|

Lovech |

-2 369 |

1706 |

-20 |

1 726 |

|

Montana |

-12 530 |

2710 |

665 |

2 045 |

|

Pazardzhik |

8 135 |

6306 |

652 |

5 654 |

|

Pernik |

5 990 |

4194 |

-1 613 |

5 807 |

|

Pleven |

-6 391 |

2951 |

330 |

2 621 |

|

Plovdiv |

33 701 |

11565 |

8 350 |

3 215 |

|

Razgrad |

-10 440 |

2433 |

438 |

1 995 |

|

Ruse |

4 178 |

2854 |

1 815 |

1 039 |

|

Silistra |

-3 727 |

395 |

-903 |

1 298 |

|

Sliven |

-3 107 |

3009 |

882 |

2 127 |

|

Smolyan |

-2 187 |

1512 |

-475 |

1 987 |

|

Sofia |

9 726 |

6098 |

21 |

6 077 |

|

Sofia (cap.) |

157 797 |

-4114 |

-11 125 |

7 011 |

|

Stara Zagora |

15 426 |

2880 |

1 138 |

1 742 |

|

Targovishte |

1 254 |

2538 |

1 337 |

1 201 |

|

Haskovo |

3 530 |

1971 |

189 |

1 782 |

|

Shumen |

442 |

2249 |

802 |

1 447 |

|

Yambol |

205 |

2343 |

1 371 |

972 |

Source: NSI, IME

In absolute terms the largest increase is in Sofia (capital). While in 2001 only 627 people worked outside the district, their number reached 7 011 people in 2011. At the same time, the share of daily labor migrants from the capital (1.22%) remains low.

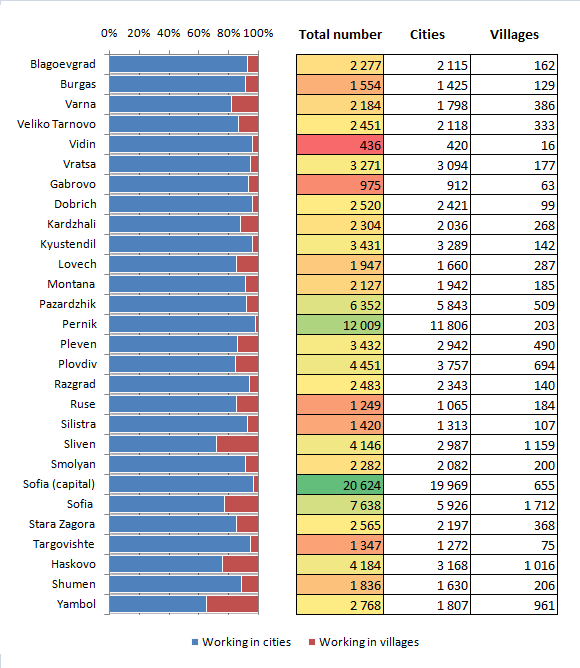

Figure 2: Number of daily labor migrants working in other district in 2011

Source: NSI, IME

As in 2001 the largest number of workers in 2011 leaving the limits of the district they live in were from Sofia and Pernik - respectively 20.6 and 12.0 thousand. This movement is due to the fact that the capital city has a strong attraction as the leading business center in the country and respectively - the proximity of the Sofia and Pernik districts to it. The lowest number of daily labor migrants were registered in Vidin - only 436 people.

In the period 2001-2011 the number of employees in the whole economy increased from 2.59 to 2.83 million people (236.8 thousand more), while the number of daily labor migrants between districts increased from 37.7 to 104.3 thousand people (or 66.6 thousand people). This means that for the period between 2011 and 2001 , 28 out of every 100 additional working places went to migrant workers. In some regions, the growth in the number of labor migrants is almost equal to the total decline in the number of people employed. For example, in Smolyan a simultaneous decrease in the number of employed by 2 187 people and a growth of labor migrants by 1 987 people was observed. Thus the daily labor migration contributed to the maintenance of household labor income and the overall rate of employment in smaller areas, offsetting diminishing job opportunities in that region. In some areas, the increase in the number of labor migrants was even higher than the overall growth of the number of employees. For example, in Shumen there was an increase in the total number of employees by 442 people and an increase in daily labor migrants by 1 447 people. This means that some of the people who previously worked in that district started working outside its borders, but did not change their residence.

In the major economic centers of the country the situation is completely different. Despite the increasing number of daily labor migrants, only 4 out of every 100 new jobs in Sofia (capital) in 2011 compared to 2001 went to migrant workers leaving the district. Similar ratios are observed in Burgas (5/100), Varna (5,100), Plovdiv (10/100) and Stara Zagora (11/100).

In all areas of Northwestern Bulgaria the increase of the number of daily labor migrants to other areas was not sufficient to offset the overall decline in the number of employed people. Part of the explanation of that process can be the territorial remoteness of districts such as Montana and Vidin from the strong economic centers in the country – i.e. those that attract additional labor force. Weak infrastructure development (compared to other regions of the country) probably also has a negative effect on labor mobility.

Further increase in the intensity of daily labor migration is essential for sustaining the economic vitality of some of the remotest and poorest areas of the country. The number of daily labor migrants’ dynamics between the censuses in 2001 and in 2011 shows that labor migration between districts is on the rise. This is a trend which will help natural cohesion, or at least - the slower deepening of differences between regions.

MRF gains from the "ethnicity" factor, BSP gains from "age", and CEDB - from "employment".

After the previous parliamentary elections held in 2013 we examined the relationship between three major socio-economic factors (ethnicity, age, and occupation) and the results of the leading parties in the different districts of the country[1]. The results from the parliamentary elections held this month confirm some observations from last year – MRFMRF takes advantage of the “ethnicity” factor, BSP takes advantage of the “age” factor, CEDBCEDB takes advantage of the “employment” factor.

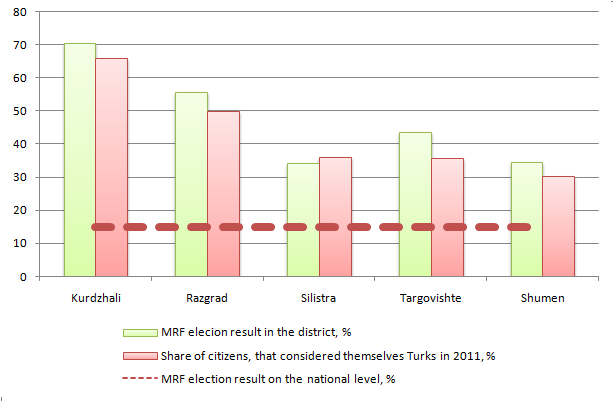

MRF takes advantage of the “ethnicity” factor

The distribution of votes in 2014 among districts has once again been significantly affected by the ethnic origin of the local population. In areas where the proportion of people who declare themselves Turks is over 30%, MRF won between 34.3% (Silistra) and 70.43% (Kardzhali) while nationwide, the party managed to win 14.84% of the votes. In areas with similar socio-economic profile such as Vidin and Kyustendil, in which the share of the Turkish population is smaller, the party gets respectively 6.64% and 1.47% of the votes.

Figure 1: Ethnicity and MRF election result

Source: Sources: CEC, NSI , IME calculations

The distribution of votes by district shows that MRF is the only of the 4 leading parties where there is a strong negative correlation between the share of the urban population and the election result. This means that the smaller the proportion of the urban population in one district is the higher is the MRF election result.

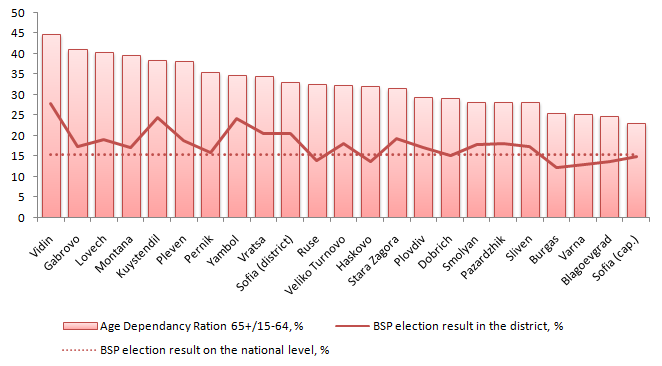

BSP takes advantage of the "age" factor

BSP is the only party which showed a positive correlation between the age structure of the population in most areas[2] and its tendency to vote for a given party. Its best results are achieved in districts[3] where the age dependency ratio of the population over 65 to that aged 15-64 is over 33%. This means that in these areas there are three or fewer people of working age for every person aged over 65 account for.

Figure 2: Age dependency and election result BSP

Source: NSI, CEC, IME calculations

BSP achieved its strongest result in Vidin, winning 27.93 percent of the vote. At the same time, although the relationship between the age of the population in different districts and its propensity to vote for BSP remains strong, the party failed to win in any of those nine areas. At the previous parliamentary elections, the party won in eight of them.

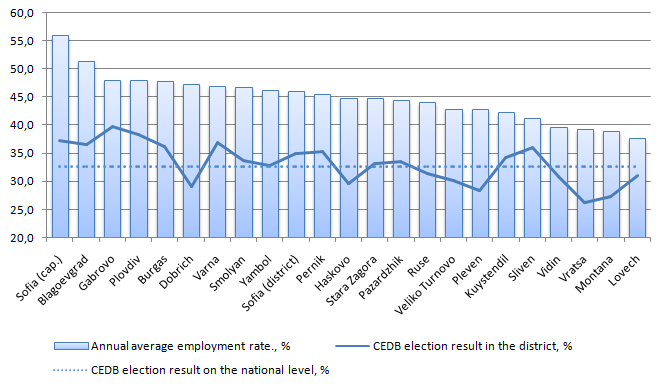

CEDBCEDB takes advantage of the “employment” factor

CEDB is the only party where electoral support exhibits a positive correlation with district employment rates.[4] This relationship is negativ only for BSP the results of RB and MRF show no distinctive connection with employment.

Figure 3: Employment and election result of CEDB

Source: NSI, CEC, IME calculations

CEDB’s results also show the most clearly expressed positive relationship between the share of urban population in different regions and the result of the party - in more urbanized areas CEDB wins a larger share of the vote.

The Reform bloc

The results of RB at the parliamentary elections in different districts revealed no clear relationship (positive or negative) between the votes received and the reviewed socio-economic indicators characterizing ethnicity, settlement, age structure and labor market situation.

[1] The figures represent a conditional comparison of viarious socio-economic indicators and election results in different administrative regions. These are under no circumstances to be considered as proof of the electoral moods of citizens based on their ethnic origin, age or socio-economic status; rather, these depict common tendencies in the shaping of political preferences of groups of people living in a different social, economic, political and cultural context.

[2] The five regions where MRF’s electoral dominance can be primarily attributed to the ethnicity factor have been excluded from the comparison between the age dependency ratio and the results of BSP.

[3] Vidin, Vratsa, Gabrovo, Kyustendil, Lovech, Montana, Pernik, Pleven and Yambol.

[4] The five regions where MRF’s electoral dominance can be primarily attributed to the ethnicity factor have been excluded from the comparison between the employment rate and CEDB’s results.

The concentration of a significant part of the employed population in the country in some areas is a process that will likely continue in the future, given the overall demographic and socio-economic processes taking place in the country.

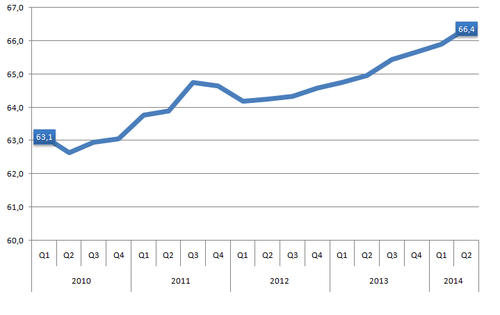

The upcoming third edition of the study "Regional Profiles: Indicators of Development" includes an in-depth overview of the labor market recovery in the country. The analysis of the dynamics of the number of employees by statistical regions highlighted some interesting trends in the redistribution of workforce between the different districts within them.

In three of the six statistical regions in Bulgaria there is a district that is a traditional leader in terms of employment. These are the Northeast region (Varna), the Southeast region (Sofia-capitol) and the South Central region (Plovdiv). From the starting point for the analysis of the labor market recovery (the first quarter of 2010), these districts continue to account for a large part of the employees in their respective regions.

At the beginning of 2010 51.0% of the employed in the Northeast region work in Varna, 63.1% of the employed in the South East region work in Sofia (capital) - and 48.8% of the employed in the South Central region work in Plovdiv. Due to the different dynamics of the labor market recovery in each district and region, that share deviates over the years. While in Plovdiv and Varna it remained relatively unchanged compared to the years before the crisis, Sofia (capital) employs an ever growing share of the workforce in the region - as of the second quarter of 2014 more than two thirds of the employees in the Southeast region of the country work there (Figure 1). This trend is getting stronger in the last six quarters (between the first quarter of 2013 and second quarter of 2014) due to the continuing loss of jobs in most of the other districts (most notably Kyustendil and Blagoevgrad) and the faster pace of job creation in the capital city than the one registered in previous years.

Figure 1: Share of the employed in the Southwest region, working in Sofia-cap. (%)

Source: NSI, IME calculations

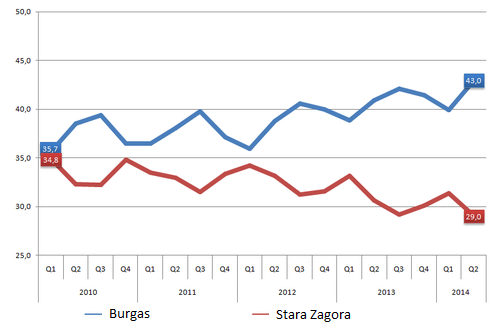

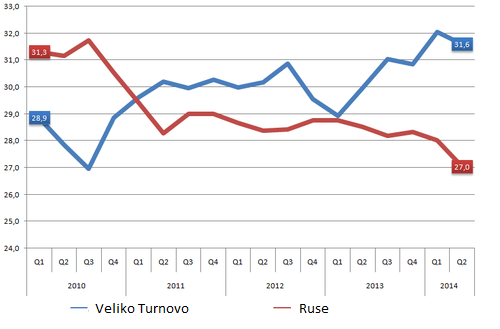

In the other three statistical regions (Northwest, North Central and Southeast) in 2010 there is no distinct leader in employment. However, in two of them there are some interesting trends.

Between the first quarter of 2010 and the second quarter of 2014 Burgas has developed into the evident leader in the number of employees in Southeast region. While the share of people working in Burgas and Stara Zagora in the beginning of the period is approximately equal, the latest data show a serious and growing advantage for Burgas. Currently 43.0% of the people employed in the region work there, compared to only 29.0% for Stara Zagora. This trend is in line with the dynamics of some leading macroeconomic indicators, which show increased investment activity (as well as increased interest from foreign countries) and intensive absorption of EU funds in Burgas.

Figure 2: Share of the employed in the Southeast region, working in Burgas and Stara Zagora (%)

Source: NSI, IME calculations

Between the first quarter of 2010 and the second quarter of 2014 Ruse gradually losses its leading position in terms of number of employees in the North Central region of the country to Veliko Turnovo. This is also the only statistical area in which the district with the greatest number of employees during the first quarter of 2010 retreats at second position. To some extend this trend is due to the similar size of the two districts – in 2013 252 thousand people lived in Veliko Tarnovo and about 230 thousand in Ruse. Despite the continuing loss of jobs the annual average employment rate for Ruse District is still a little higher than the one in VelikoTarnovo in 2013 (i.e. although the number of employees is smaller, their share in the number of local population is bigger), but the dynamics of the employees during the first two quarters of this year shows that this might change before the end of 2014, since the difference in employment rate of the population over the age of 15 of the two districts is barely 1 percentage point – 42,9% for VelikoTarnovo in 2013 and 44,0% for Ruse.

Figure 3: Share of the employed in the North central region, working in Ruse and Veliko Turnovo (%)

Source: NSI, IME calculations

The concentration of a significant part of the employed population in the country in some areas is a process that will likely continue in the future, given the overall demographic and socio-economic processes taking place in the country. The dynamics of the number of employees by districts and statistical regions shows that in South Bulgaria, these trends are more distinctive, especially because of the existence of several strong economic centers, the axis Sofia-Plovdiv-Stara Zagora-Burgas.

Detailed analysis of the labor market in each of the regions and will be made available after the publication of the third annual edition of the study "Regional Profiles: Indicators of development" in November 2014.

Sofia for another year breaks away from other regions in economic development 16.02.2026

In 2024, Sofia continues to stand out more and more clearly in its economic development from the other...

Bansko on the eve of the Winter Games 09.02.2026

Today is the official opening of the 25th Winter Olympic Games in Milano Cortina. Two decades after the...

Disability pensions are affected by demographics, but also by unemployment by region 06.02.2026

NSSI data show that there are over half a million people receiving disability pensions. However, the regional...

Economic and social development of the districts over the last decade 12.01.2026

The IME Regional Profiles study has been tracking the economic and social development of regions in Bulgaria...