Could Local Tax Policies Encourage Any Change?

The IME conducted 4 individual studies from April 2012 to April 2015 regarding the levels of local taxes and fees.

Yavor Aleksiev

The IME conducted 4 individual studies from April 2012 to April 2015 regarding the levels of local taxes and fees. For this purpose, every municipality received inquiries under the APIA during the spring of every year.

Five types of taxes and fees are included into the scope of the study:

- The Immovable property tax for legal entities (‰),

- The vehicle tax (commercial and passenger vehicles, 74 kW to 110 kW),

- The annual license tax for retailers (up to 100 sq. m of retail space – for most favourable location of the site) (BGN/sq. m),

- The annual waste collection charge for properties of legal entities (‰),

- The local tax on the transfer of property (‰).

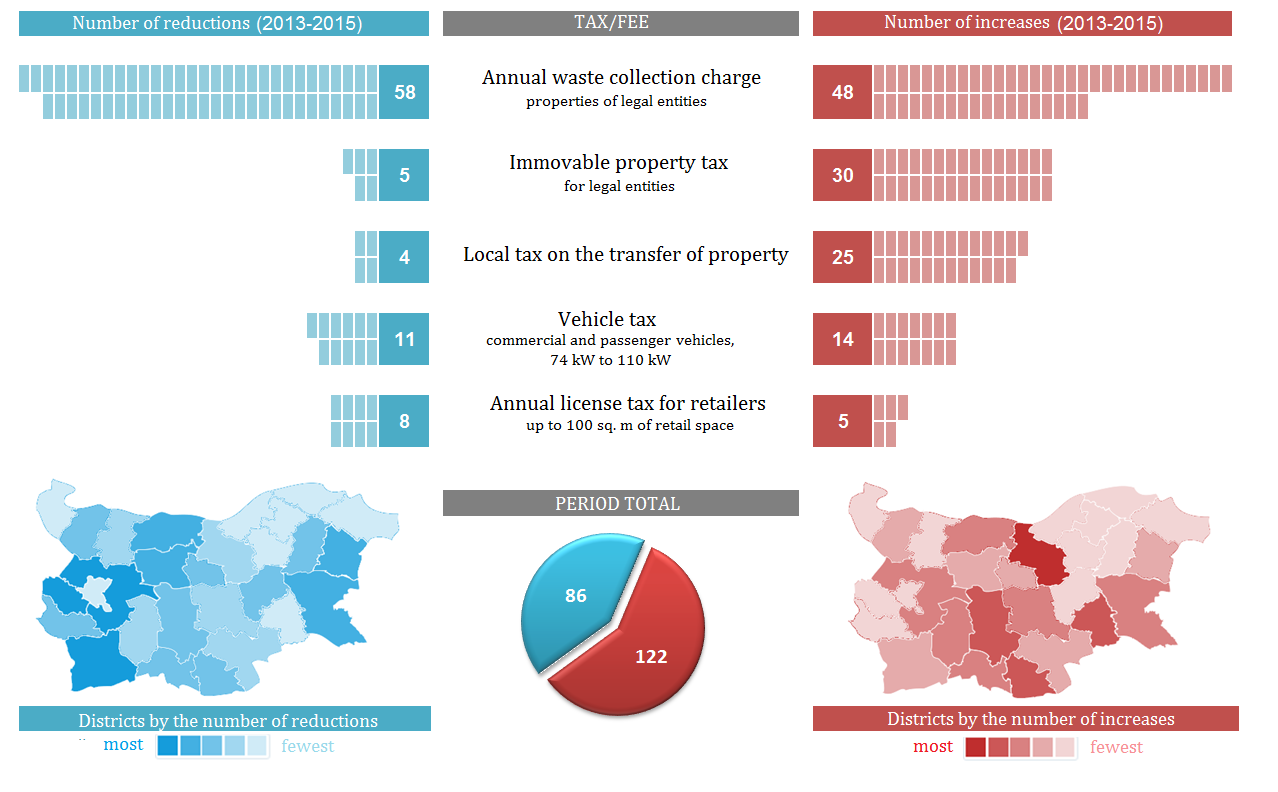

General Comment

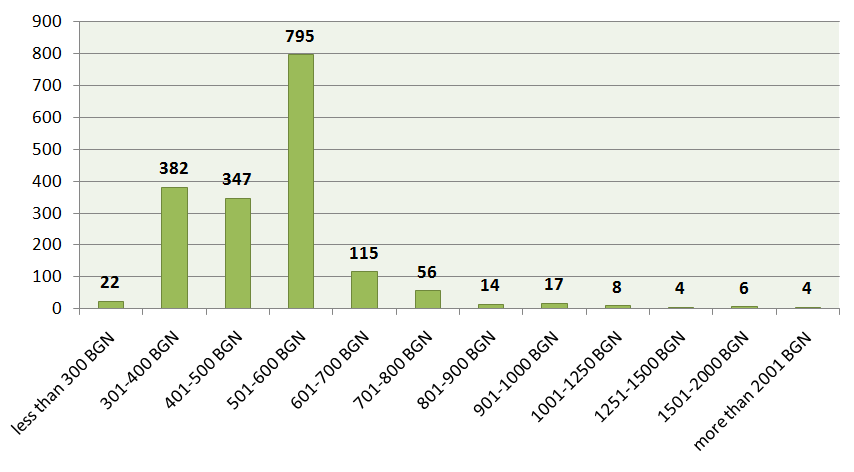

There have been no significant changes in the size of local taxes and fees in recent years. Changes regarding the annual license tax for retailers have been the most uncommon, and the most frequently atered fee is the annual waste collection charge for properties of legal entities. With regard to the entire period 2013–2015, the waste collection charge was decreased more times (58) than it was increased (48).

We have observed 86 instances of decreases and 122 instances of increases of the local taxes and fees under consideration . Most probably the actual amendments (in both directions) have been more than the ones registered by our team, but provided there is no official database to enhance the analysis, we present to your attention the results of our study of the information gathered under the APIA.

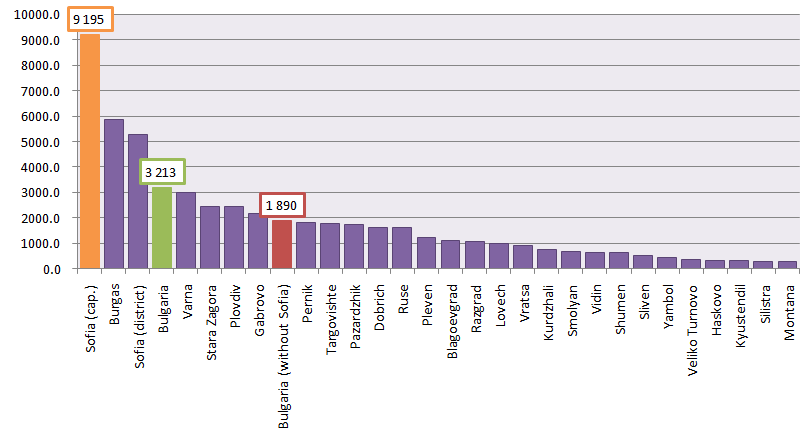

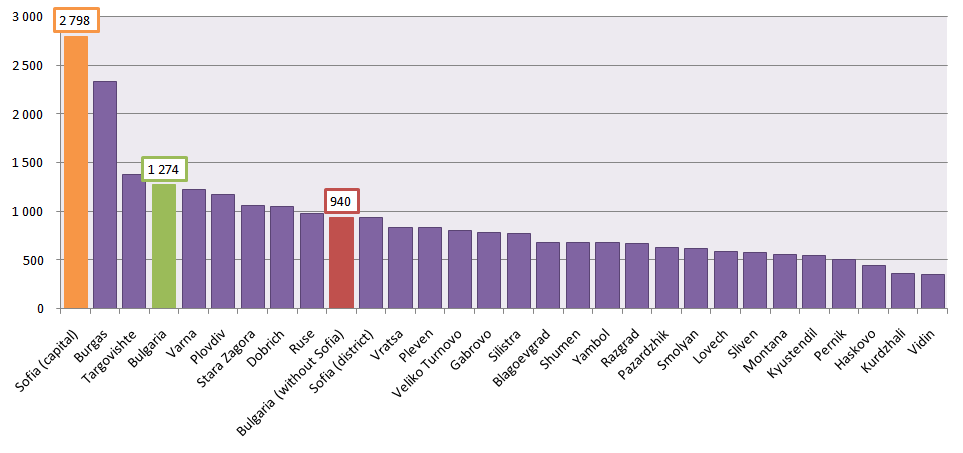

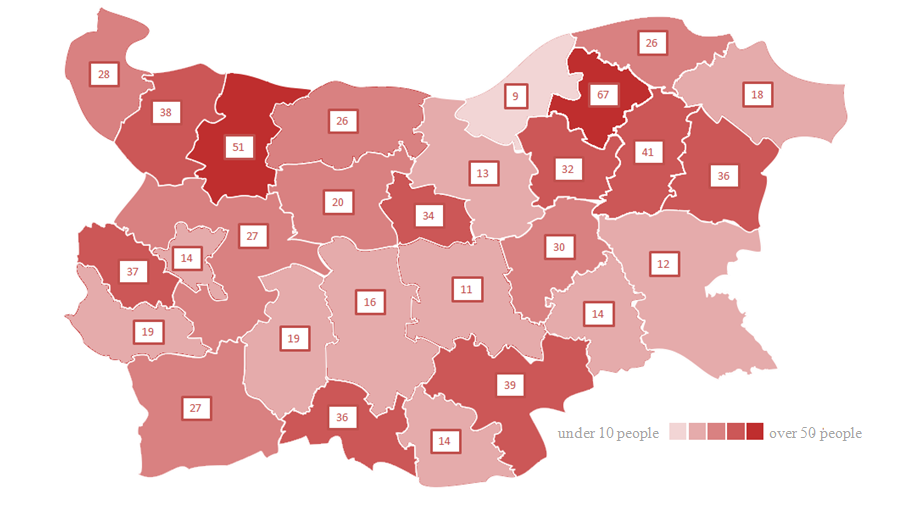

Number of instances of increasing and decreasing local taxes and fees from 2013 to 2015

Source: IME on the basis of inquiries to municipalities under the APIA

It is notable that:

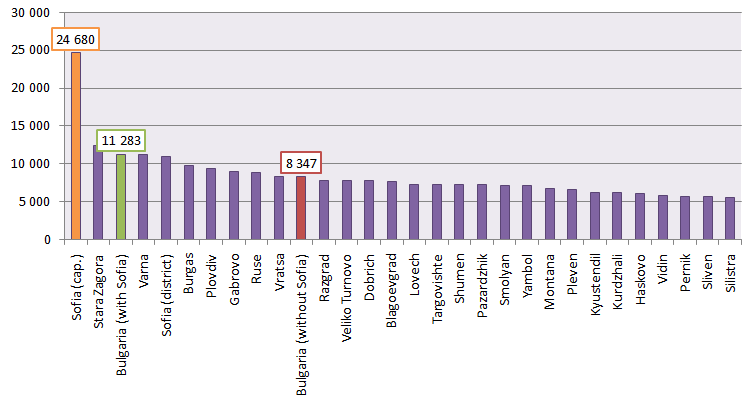

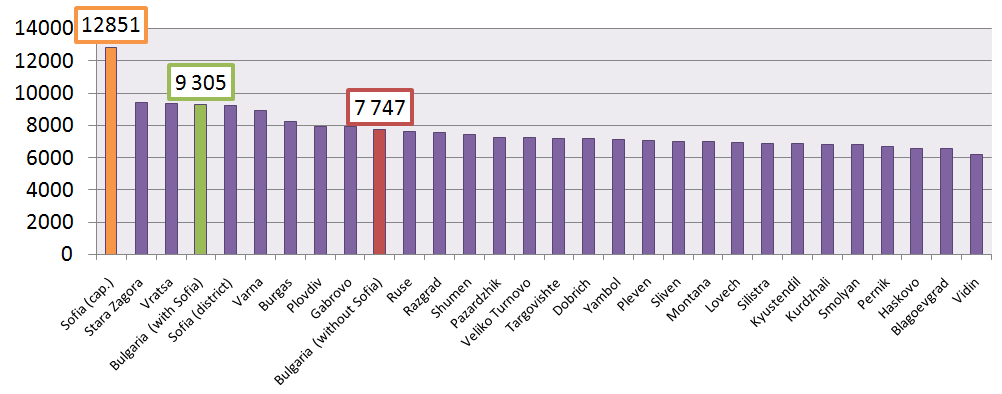

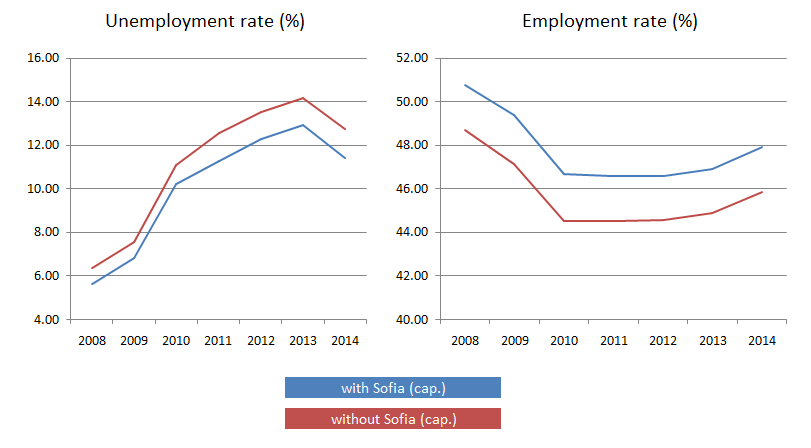

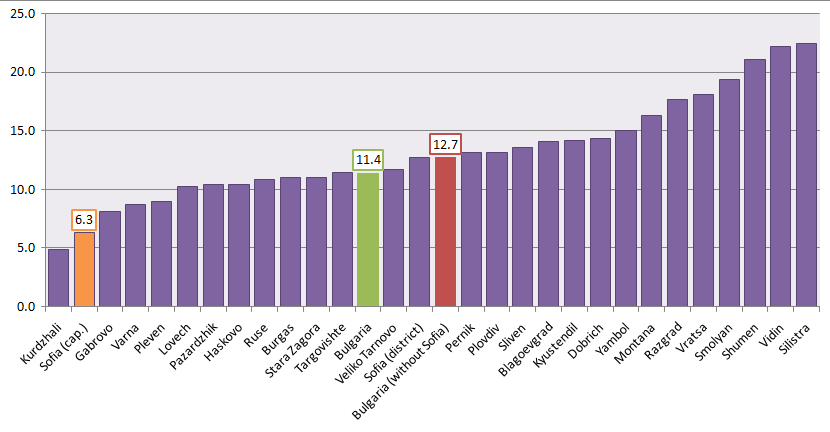

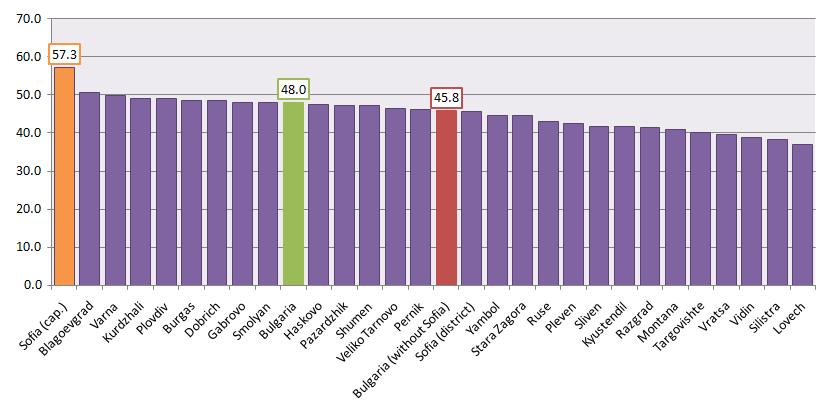

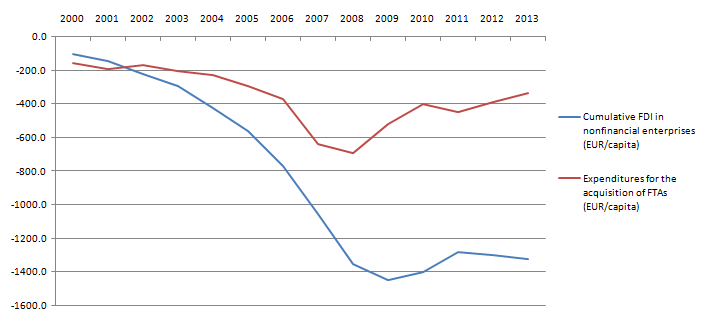

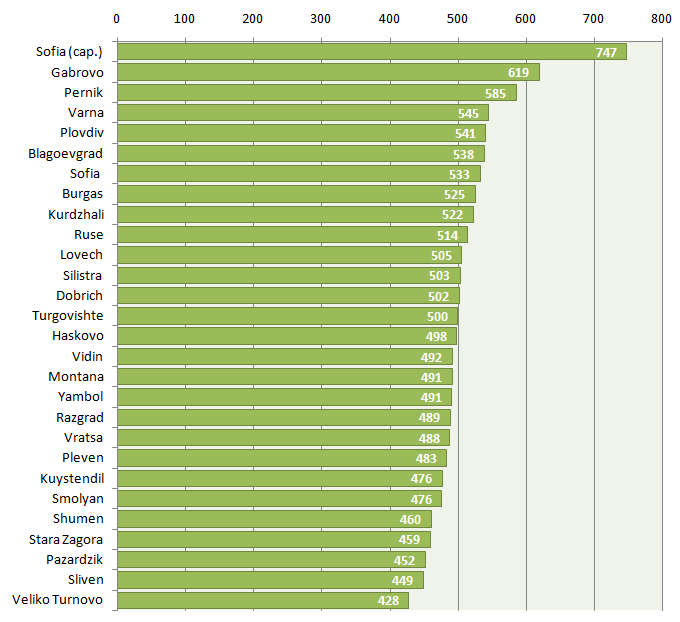

- The levels of local taxes and fees are largely a result of the availability, or the lack, of investments and functioning businesses. The levels of local taxes and fees remain relatively high in the biggest economic centres, and relatively low in the low developed ones.

- Neither high taxes and fees discourage investors from starting businesses, and the people from migrating to districts possessing relatively high tax burden, nor low taxes and fees manage to attract entrepreneurs and immigrants in the less developed districts.

It is clear that the factors defining any decision for starting a business, or migrating to a municipality/district, are rather related to the size of the local market, the quality of infrastructure, the availability of workers, job opportunities, the social environment, etc.

In other words, there is no observable tax competition between municipalities. This is not surprising in view of the fact that the main part of the tax burden, for any company, is actually towards the central government (via labor and corporate taxes, social security contributions and indirect taxation), and not to the municipalities. No matter how much a municipality tries to decrease the size of the taxes and fees collected by it, it is hard for it to achieve such an effect on the overall tax burden that is able to offset other flaws of the local investment environment (for instance, the small size of the local market, the remoteness of the region, or the poor infrastructural development of the district).

The proposal for granting more tax powers to municipalities, which was revoked several weeks ago (the ability to collect 2% income tax in addition to the already collected one) could theoretically spur tax competition, but it would also increase the overall tax burden on the economy.

Increasing the financial independence, accompanied by a territorial and administrative reform, constitutes a strategy whereby the depressed districts could regain their attractiveness for people and businesses. In order to achieve this, however, it is necessary that the financial decentralisation should not only be discussed, but it should be set forth within the clear framework of the current tax burden. The best method is to gradually grant an increasing share of the revenues that are already collected to municipalities untill achieving a degree of differentiation that would allow the more depressed districts to offer much better business conditions than the more developed ones.