Regional Profiles: Indicators of Development 2016

The IME presented the fifth edition of "Regional Profiles: Indicators of Development"

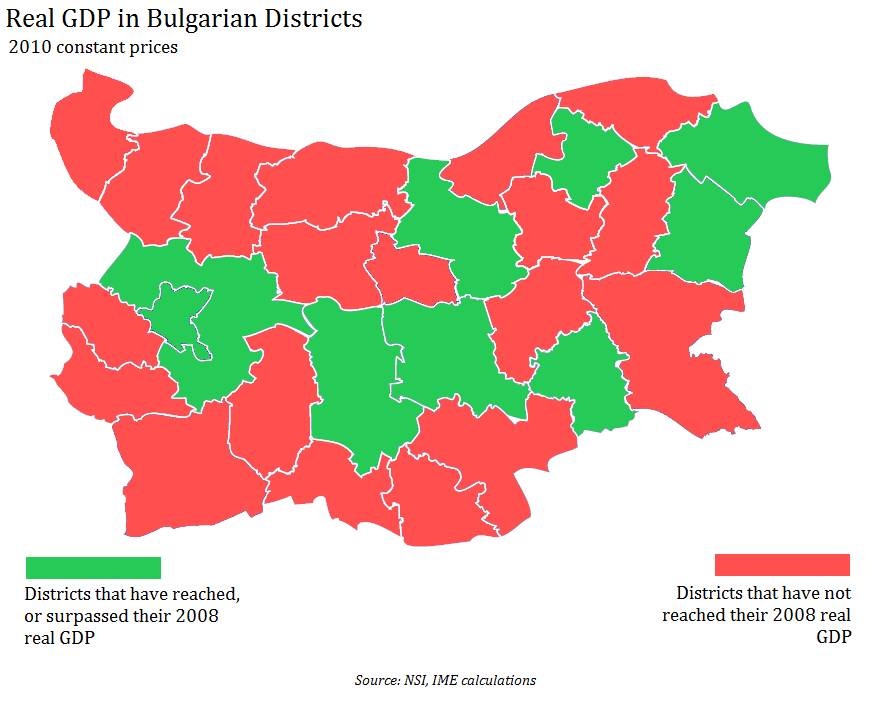

More and more regions in the country have already recovered from the economic crisis. This can be seen in the gross production data as well as the data on investments and employment.

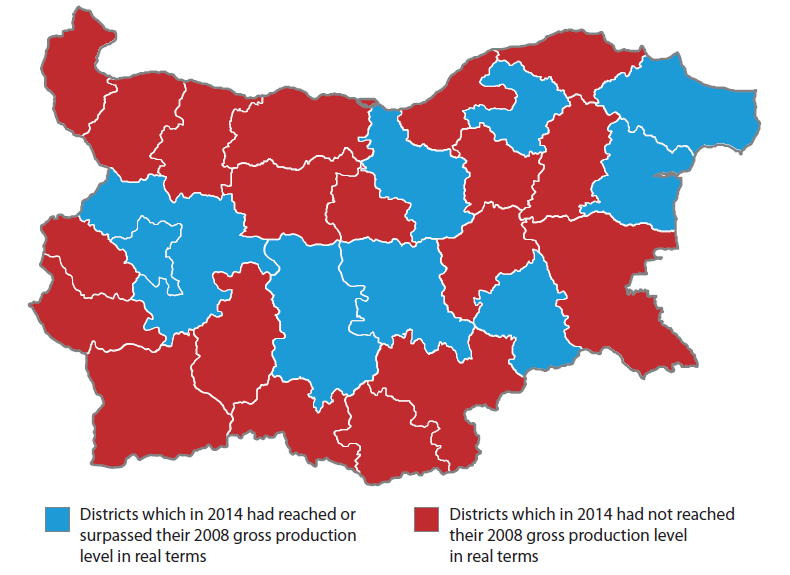

In 2014 the Bulgarian economy finally managed to overcome the consequences of the crisis and the gross domestic product in real terms exceeded its pre-crisis level. The economies of 9 regions already reached the levels of the pre-crisis gross domestic product. In the other 19 regions, however, the real GDP is still lower compared to2008. It seems that all regions in Northwestern Bulgaria are yet to overcome the impact of the crisis on their economies. Meanwhile, the economies of North-central and Northeastern Bulgaria are already approaching their pre-crisis production levels. Despite the fact that in South-central Bulgaria the recovery from the crisis has not finished yet, Plovdiv is an enormous exception and already reports real aggregated production nearly 9 per cent higher than the pre-crisis rate. This is due to the considerable investments in several rapid-growing sectors such as the outsourcing industry and production of car parts, which the district attracted over the last years.

As far as investment is concerned, the recovery process is also becoming more and more visible on the regional level. While foreign direct investment stagnated in the recent years, fixed assets expenditures, which are the other key investment indicator, show a more optimistic picture. About 1/3 of the regions already report assets expenditures that exceed the pre-crisis levels. This is mainly due to the increased utilization of EU funds in the 2014-2015 period as a result of the end of the previous programming period and the last possibility to utilize its funds in 2015.

The larger issue, however, is how much do EU funds help to bridge the gap between the average European level of wealth and the Bulgarian ones, on the one hand, and to reduce the inequalities within the country, on the other, i.e. whether there is cohesion, which is the main objective of these funds. The analysis of the Institute for market economics shows that most districts report cohesion in GDP per capita with the average European level since 2007. In Sofia (capital) the GDP per capita is already equal to the EU average – in other words Sofia is already European. The capital city concentrates a growing share of the economic activity in the country (nearly 40% at last count) and creates large income gap between North and South Bulgaria. If Sofia is taken out of the accounts, the GDP per capita wages and income in North and South Bulgaria are almost equal. In the most districts, however, GDP per capita is barely between 20 and 40% of the EU. average.

In the same time there is no a significant statistical relation between the pace of cohesion, on one hand, and the absorption of EU funds, on the another, i.e. the increasing of the wealth in most districts and the “catching up” with the average European level apparently is not a result of EU funding.

Furthermore, cohesion inside the country is not observed - on the contrary, the differences between the regions are growing. This distancing process is particularly intense before 2008. After a drop before 2012 this trend is again observed in the 2013-2014 period.

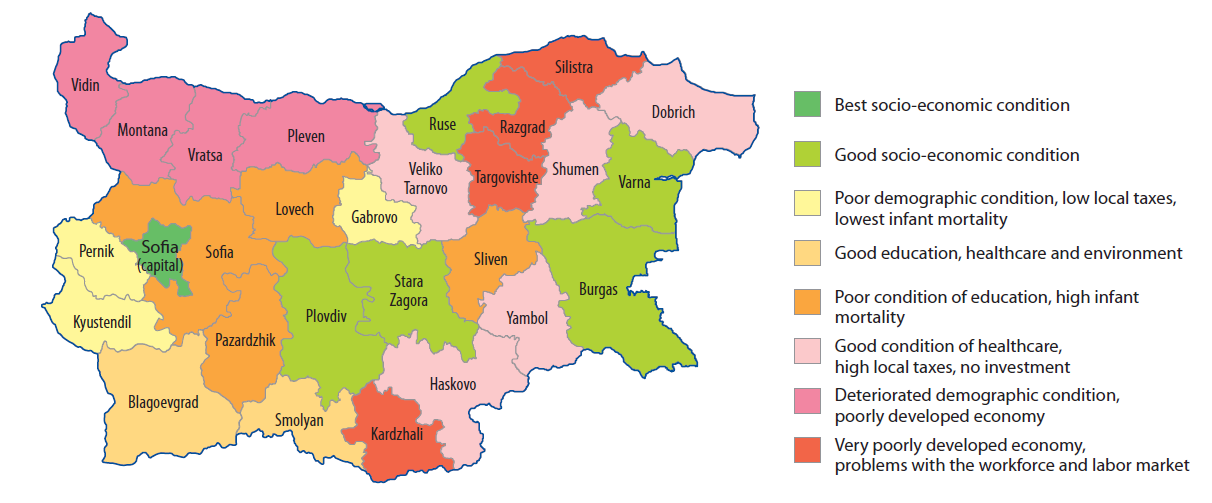

The deepening of the differences in development inside the country is also substantiated by our cluster analysis which groups the regions based on similarities and differences. Only Sofia (capital) has an overall favorable socio-economic profile as once again it sets itself apart as an independent cluster i.e. there is no other district in the country which resembles its conditions and development. In the same time the group of the profiles, characterized with poor socio-economic development is still larger than that of the regions with favorable conditions. This analysis outlines the poor socio-economic conditions of Northwestern Bulgaria, and also ever more clearly the economic problems of the North-central region.

This observations support the conclusion that regional policy in Bulgaria does not bear any fruit. The goals declared in strategies and laws have not been achieved, on the contrary - the differences are deepening, and so are problems. The analysis raises the question if the reliance on utilization of EU funds is the way towards reaching sustainable and strategic development. It becomes more and more clear that the utilization of EU funds is becoming the primary goal of policy in itself, instead of means for its implementation.

The differences in development are especially visible in the labor marker. 2014 and 2015 were particularly good in terms of creation of new jobs in the country. Despite that, 8 regions did not manage to catch on this process in 2015. It is no surprise that many of those regions have serious structural problems – Vratsa, Montana, Silistra, Kurdzhali. Unemployment rates fell in all regions without exception in 2015 but in several regions (including the aforementioned four), this was due to a drop in economic activity, not the creation of new jobs. In these regions part of the unemployed stop actively seeking jobs and leave the workforce.

In the same time in a number of districts the workforce shortage problem is growing. The lack of suitable candidates with both vocational as well as higher education, in a number of fields limits the growth potential of regional economies. Currently around 1/3 of the industrial enterprises report the lack of workers as a major restraint for their further development, while more than 70 % of the small and medium enterprises claim that the shortage of workforce is the greatest obstacle for their business.

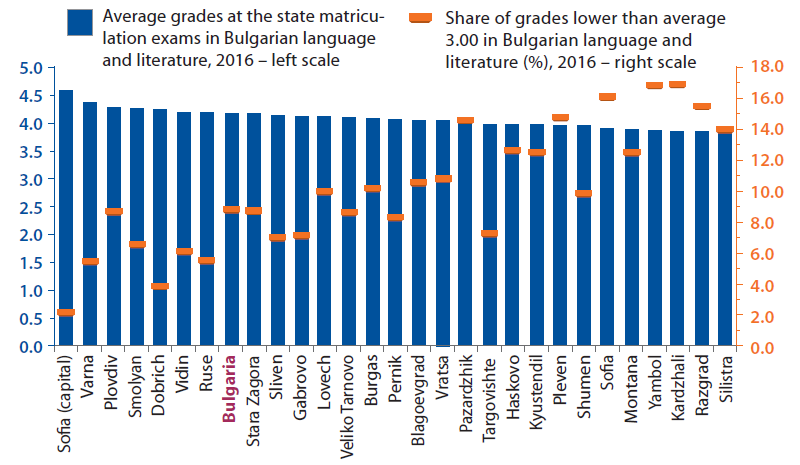

The steady decline of the range and quality of the educational system indicators in most regions deepens the imbalances between supply and demand on the labor market. The share of students leaving school prematurely in the primary and secondary stages of education now reaches a country average of 2,8 % - the highest since 2006. In the same time the average matriculation grade in ‘’Bulgarian language and literature’’ went down to 4,17 in 2016 – the lowest result since the introduction of matriculation exams. The share of “fail” grades is on a record high: almost 9 % of the students could not pass the examination. The least developed regions – Silistra, Razgrad, Kardjali and Montana, for instance – are on the bottom of the rating, which further reduces their chances for catching up in the long-term.

The negative demographic trends in the whole country also continue to put pressure on the labor market. Even the capital is not spared, since its natural growth is on its lowest level since 2007. Currently there are four regions where the people above 65 years old are twice as many as the children (0-14 years old) – Vidin, Gabrovo, Kyustendil and Pernik. Only six regions keep attracting incoming people from other regions – Sofia(district), Sofia (municipality), Burgas, Haskovo, Varna and Plovdiv. Meanwhile, among the biggest ‘’workforce donors’’ are Smolyan, Razgrad, Vidin and Vratsa, which leads to their fast depopulation and even worse perspectives for their future development.

Generally, IME’s regional development analysis shows that in 2014-2015 even more regions were able to overcome the effects of the crisis on investment and the labour market. In the same time, however, about 1/3 of the districts suffer from deep structural problems that hinder them from reaching their pre-crisis levels of production, employment and investment flows, and those districts depopulate fast. This uneven development of the country leads to a shrper increase of the differences between the regions. The intense utilization of European funds in the last two years did not help at all for overcoming those differences. An observation that comes forth is that the European funds utilization has turned into a policy goal in its own right, which substitutes the long-term regional development policy and leads to a permanent dependency of the local budgets from these funds.

November 29th, 2016 | 11:00 - 12:00

November 29th, 2016 | 11:00 - 12:00

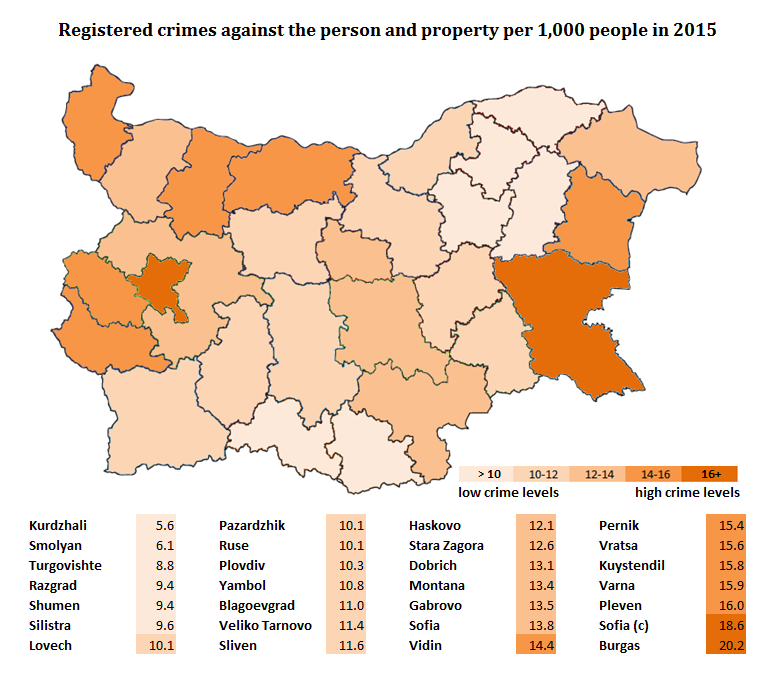

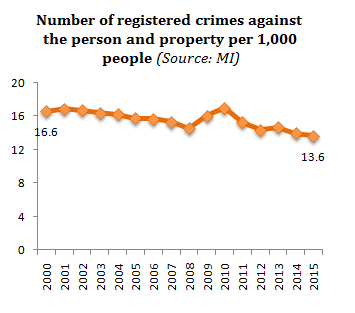

In 2015 the number of registered crimes continued falling and reached 98 thousand in comparison with 135 thousand back in 2000. Crime levels have also decreased in relative terms - from 16.6 per thousand people to 13.6 per thousand people for the 2000-2015 period. This trend was interrupted only during the first years of the crisis (2009 and 2010), during which the number of registered crimes was rising. One possible explanation for the surge in the beginning of the crisis is the quick increase in unemployment and the overall drop in per capita income.

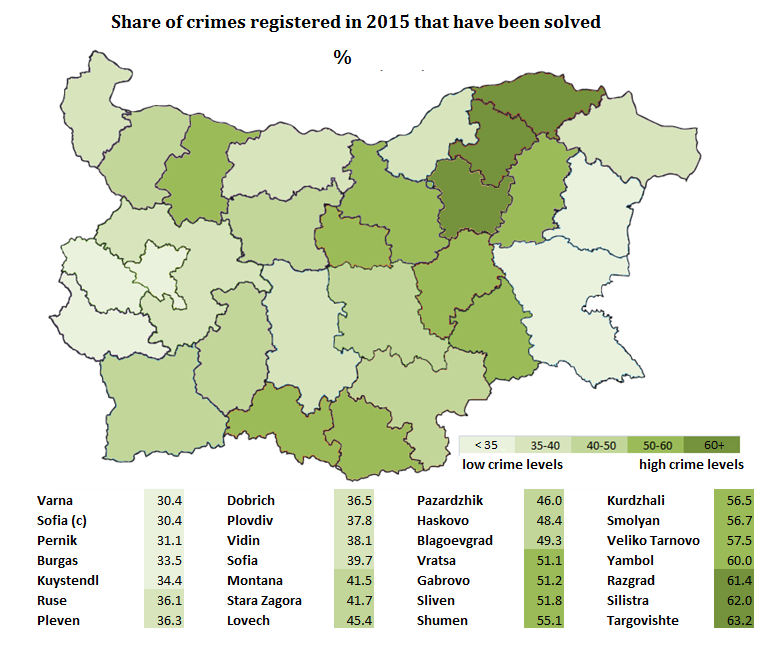

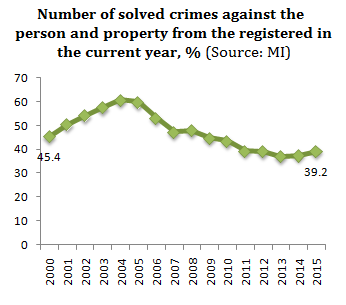

In 2015 the number of registered crimes continued falling and reached 98 thousand in comparison with 135 thousand back in 2000. Crime levels have also decreased in relative terms - from 16.6 per thousand people to 13.6 per thousand people for the 2000-2015 period. This trend was interrupted only during the first years of the crisis (2009 and 2010), during which the number of registered crimes was rising. One possible explanation for the surge in the beginning of the crisis is the quick increase in unemployment and the overall drop in per capita income. This significant decline in the number of solved crimes can be explained with the lack of reform in the Ministry of Interior (MI) and mainly the fact that its huge budget is being spent primarily for salaries and maintenance and not for capital investment. Additional reasons are the sluggishness and the anachronistic characteristics of the system, the possible existence of corruption and unregulated practices between the MI and the judiciary system.

This significant decline in the number of solved crimes can be explained with the lack of reform in the Ministry of Interior (MI) and mainly the fact that its huge budget is being spent primarily for salaries and maintenance and not for capital investment. Additional reasons are the sluggishness and the anachronistic characteristics of the system, the possible existence of corruption and unregulated practices between the MI and the judiciary system.