The regional results on the last matriculation exam highlight the stagnation of the education system

The grades are have become a better expression of the actual abilities of students.

Adrian Nikolov

When it announced the 2017 matriculation results, the Ministry of Education highlighted the decrease of failed students compared to the previous year. Truly, there is something to write home about - the number of the failed students in 2017 has dropped from 4189 to 3887. In general, this decrease amounts up to 1% of the total number students. However, this downward trend is only compared to last year outcome. In reality, 2017 marks the second worst performance in the record of matriculation exams in Bulgaria.

Much less attention was payed to the slight fall in the average exam results – from Good 4.17 to Good 4.13. Despite the fact that this is a continuation of a relatively stable trend towards a decrease in the average results in the past years, a decrease of four points is not as much a sign of decreasing quality of education as it is of the higher difficulty of the particular exam and a confirmation of the lack of significant improvements in quality. The weak performance of the students could also be explained with improvements in mechanisms sanctioning cheaters – in other words the newer grades represent the real capabilities of the students much better compared to years ago.

Aggregated data point to even more curious trends on the local level, because of this we will investigate those trends on the basis of data provided by the Ministry of Education on the district level level.

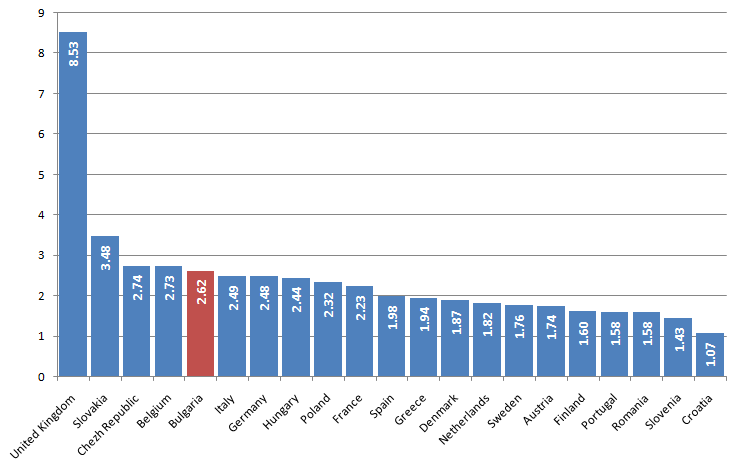

The map shows the “fail” grades in the districts as percentage from the total number students who sat the exam. The uneven distribution of the quality of education is obvious here, and it cannot be captured in the national average. For example in the capital a mere 2% have failed, while in Yambol and Kardjali one fifth were unable to pass the exam. A positive example is Smolyan, where the results have improved significantly over the years as a result of long-term policies aimed at improving the quality of education.

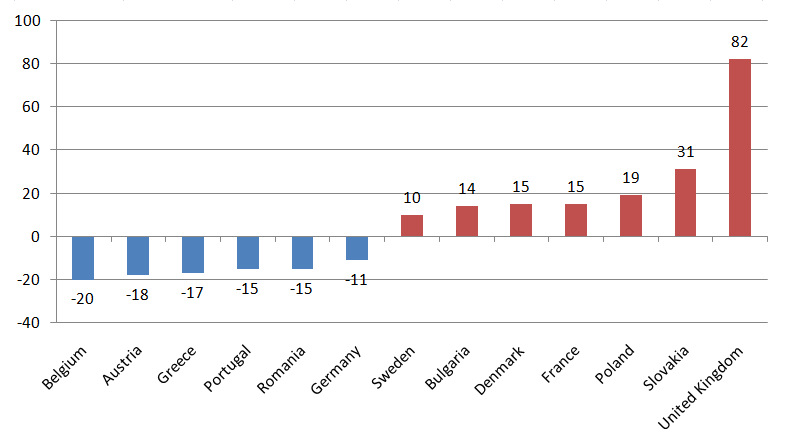

The dynamics of failed grades on the matriculation exam come as a clear result from the improvements in cheating control - in regions like Kurdjali, for instance, where there were only 3% failed students in 2014, but in the following three years their number has grown more the six times. A similar trend, but with smaller variance can be observed in Yambol, Pazadjik, Silistra and Sofia regions. An interesting outlier is Montana, where the share of failed grades has halved within a year. The regions with traditionally high results and high quality education– Sofia-city, Plovdiv, Varna, Burgas do not mark any significant shifts in the past years.

Shifts in the average grades follow closely the failed grade trends. However, there is some evidence of deepening inequality in the quality of education between the diffrent regions – the leaders improve their performance while the worse performers show a trend towards decreasing results. Generally, new data point to stagnation and lack of any significant change within the school education system.

District-level results from the latest matriculation exams do not point only to negative conclusions – the dynamics of the failed grades, for example hint that the current form of examination is getting better to achieving a realistic representation of the actual quality of the district educational systems. They also underline the need for reform of the system of financing and the school network, without which the inequality of education quality will continue to widen.