What is the Industry Profile of Bulgarian Districts

NSI published the regional GDP data for 2017.

Peter Ganev

Last week, the National statistics institute published the data on the regional gross domestic product (GDP) for 2017. These data allow us to map economic processes on the regional level, even though with a one-year lag. Traditionally, news on regional GDP focus on the differences between the regions. As usual, in 2017 Sofia is far ahead of the pack in terms of GDP per capita with 30 295 leva, and Silistra ranks last with only 6 687 leva. The details on the industry structure of the regions, however, are often left behind. In this article we focus on precisely this, though the gross value added (GVA) of the different industries on the regional level.

The overall structure of the country’s economy is pretty clear – services form 67% of it, industry – 28%, and agriculture is only 5%, and this distribution has been pretty stable. In the past five years (2013-2017) industry has gained only one percentage point, resulting from small decreases both in the shares of services and agriculture. What are, however, the distinct profiles of the separate regions, and which are the industry and agricultural regions in Bulgaria? In order to answer this question, we the shares of the primary industries in gross value added on the regional level. Separately, we shall review the value added by industry per capita in the regions, in order to assess whether the separate economic sectors are creating real value, or they just have higher shares as a result of the weak development of the other spheres of economic activity. It is important to note that the data are weighed relative to the population of the regions, as otherwise larger regions will always have a significant lead.

What industries are prevalent in the regions of Bulgaria?

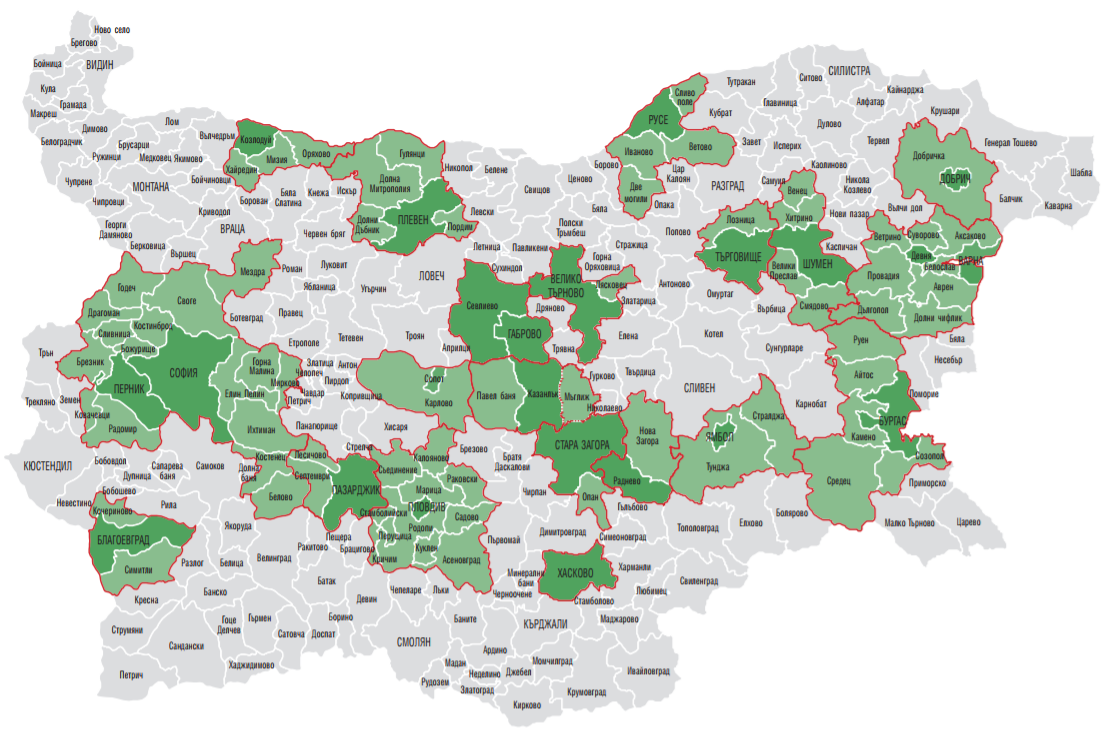

Industrial regions – Stara Zagora, Sofa (district), Vratsa and Gabrovo

Data on the regions where industry is prevalent are absolutely clear. The four regions are the only ones where industry creates at least half of the gross value added – 66% in Stara Zagora, 61% in Sofia (district) and about 50% in Vratsa and Gabrovo. It is interesting that in all of those regions industry has increased its share in value added, by 5-6 percentage points in the past five years. Should we look at not only the share, but the nominal value added by industry per capita, those very same regions take the top four spots, and in the same order – 9985 leva per capital in Stara Zagora, 8177 leva in Sofia (region), 5305 leva in Gabrovo and 5300 in Vratsa.

The reason behind this industry focus of those regions is no surprise either. They all have major industrial companies - the large electrical producers of Radnevo and Galabovo in Stara Zagora, Kozlodui NPP in Vratsa, as well as some larger mining companies in the Srednogorie (Pirdop and Chelopech, for instance) in Sofia (district). Gabrovo is the only example of an industrial region that lacks a major energy or mining company, the regional centre has a longstanding industrial traditions (and is known as the “Bulgarian Manchester” for a reason), and the large factories in Sevlievo are also in the region.

Services regions – Sofia (capital), Varna and Burgas

Defining the regions with a pronounced services profile is not such a simple task. Only the capital city of Sofia is obvious, as services have a significantly higher value added (22 575 leva per capita) and a grand total of 86% of the gross value added in the region. Varna is second, but the share of services is 69%, the nominal value of GVA – 8320 leva per capita. Burgas is also at the top of the list, but far behind the others – the share of services is 64% (still high, but close to that of Pleven and Veliko Tarnovo), but the gross value added per capita is 6790 leva, which puts it far ahead of the rest of the regions, excluding Varna and the capital city.

Services-focused regions actually also contain the largest regional centres in the country – only Plovdiv is missing, but we will cover its case separately. The economies of Sofia and those of Varna and Burgas are, however, very different. More than 10% of all employees in Sofia are in ICTs (as of 2017), and this is the high-tech part of the service sector, which pushes wages higher. In Varna and Burgas this sector is not as widespread, and only 1-2% of all employees work in ICTs. In the same time, tourism plays a very important role in the economies of the two regions, as 14% of the employees in Burgas and 9% in Varna work in hotels and restaurants, while the share of this sectors of services is only 4% in Sofia as of 2017. In other words, while the service economy of Sofia is more focused on high tech, Varna and Burgas still haver more pronounced traditional sectors.

More agrarian regions – many and getting poorer

Finding the agricultural regions is likely the hardest task, because they are more and relatively poor. The poor development of the other sectors sometimes makes the share of agriculture seem as if it is of importance for the regional economy. In spite of this, the following regions have the highest shares of agriculture relative to the other parts of the country - Silistra (23%), Vidin (18%), Montana (16%), Razgrad (16%), Dobrich (16%), Kardzhali (15%), Targovishte (14%), Shumen (13%) and Yambol (13%).In these regions, the gross value added per capita of agriculture is also the highest, about 1000 – 1300 leva.

It is evident that the regions where agriculture generates more than 10% of gross value added are also at the lower end of the spectrum in terms of wealth, and are among the lowest in GDP per capita. The reason behind this is that the value added in agriculture remains quite low – even in the region where GVA per capita in agriculture is the highest (Silistra, 1327 leva per capita), it is still three times lower compared to the country average for industry (3522 leva) and sic times lower than the country average for services (8281 leva). Silistra and Vidin are also the only regions where value added per capita in the industry is so low, that it is lower than agriculture in those particular regions.

What are the dynamics and where is Plovdiv?

The common regional dynamics in the past 5 years shows that the increases in the share of industry in value added are in the regions with the most pronounced industrial focus. The regions dominated by services, with the exception of the capital, also show some increases in the share of industry, mostly in Burgas and less so in Varna, but in those regions services create more value added in general. In the relatively agricultural regions, with the exception of northwestern Vidin and Montana, the share of agriculture is dropping. The case of Vratsa, where there is a giant leap in industry at the expense of both services and agriculture, is quite curious. This is a consequence of the good financial results of NPP Kozlodui – 100 million leva more income in 2017.

The exclusion of Plovdiv from the regions with well-defined profiles is a consequence of the diversity of the region’s economy, with combines powerful industry and services, which, as we have seen, are inevitably in the lead in the regions with the largest cities. Based on the value added of industry and services Plovdiv sits right behind the abovementioned regions in both categories – 5946 leva per capita in services and 4 143 leva per capita in industry. After a more defined growth of services in the past few years, the ratio in Plovdiv has settled at 56-57% services and 40% industry in the overall value added. Similar developments can be seen in Ruse, which ranks close to Plovdiv in terms of value added per capita in industry and services, and has a pretty similar sectoral structure.

For the seventh year in a row, the Institute for Market Economics presents the study “Regional profiles: Indicators for Development” – the only comprehensive yearbook on Bulgarian regional development. The Regional profiles, as the study is better known, has become an indisputable trademark of the IME.

For the seventh year in a row, the Institute for Market Economics presents the study “Regional profiles: Indicators for Development” – the only comprehensive yearbook on Bulgarian regional development. The Regional profiles, as the study is better known, has become an indisputable trademark of the IME.