Open Letter for Tax Decentralization sent to Prime Minister Boyko Borisov

Open Letter for Tax Decentralization sent to Prime Minister Boyko Borisov

12 November 2019

TO

BOYKO BORISOV

PRIME MINISTER

COPY TO:

TOMISLAV DONCHEV

DEPUTY PRIME MINISTER

VLADISLAV GORANOV

MINISTER OF FINANCE

Open Letter

In relation to

The necessity of remising part of the revenue from personal income taxation to municipalities

Dear Mr. Borisov

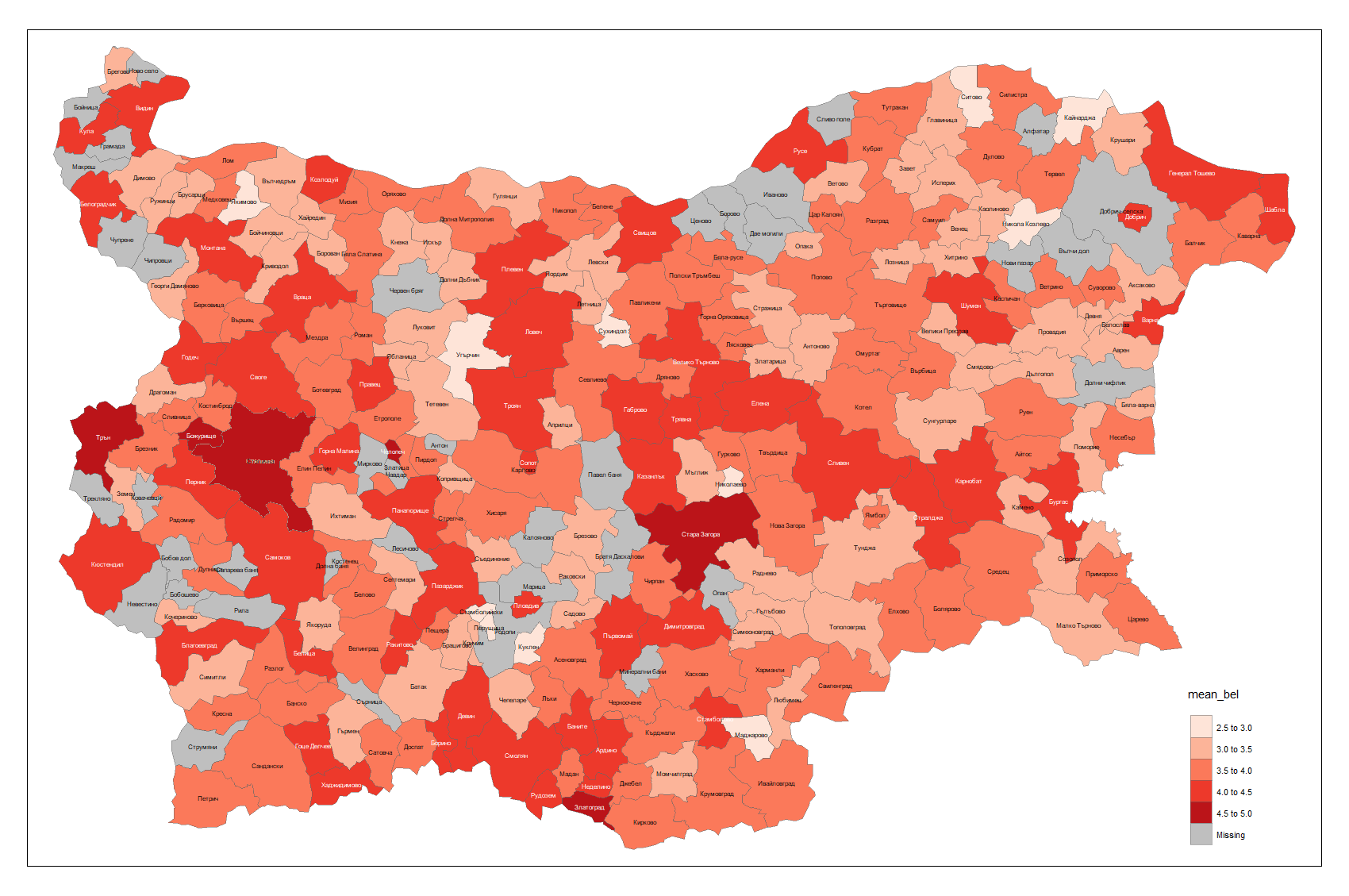

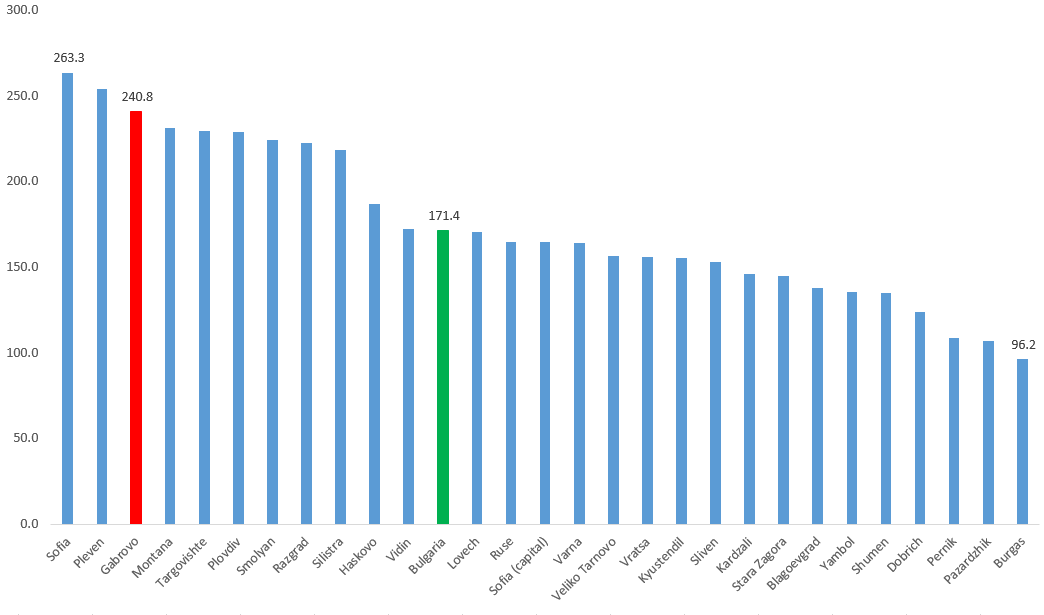

We believe that a consensus exists as to the goal of achieving rapid regional development in Bulgaria and the continuous rise in the living standards of Bulgarian citizens, regardless of their location. During your recent travels around the country you must have noticed both the large discrepancy between the wealth of different municipalities, and the severe dependency of localities on constant financial transfers from the central government. Inevitably, the following question arises: Why do all municipalities, even regional centers with nearly no unemployment, regularly find themselves faced with financial troubles and are unable to independently influence the public environment and the lives of their own citizens?

With this letter, we would like to direct your attention to this exceptionally important tax reform whose essence is the remising of part of personal income taxation revenues to the budgets of municipalities. This reform goes beyond the financial framework of the budget and concerns a wider set of issues, including the very functioning of democracy in Bulgaria. A hospital in a regional center that lacks necessary equipment is not merely a budget matter, but a large problem for the entire health system of the country. A social housing that is on the brink of closure in a small municipality equally is not just a fiscal issue. Insufficient local budget for the provision of local transport undermines regional development and deters access to work, social and health services. Resources’ availability in regions, or lack thereof, impacts each aspect of our lives.

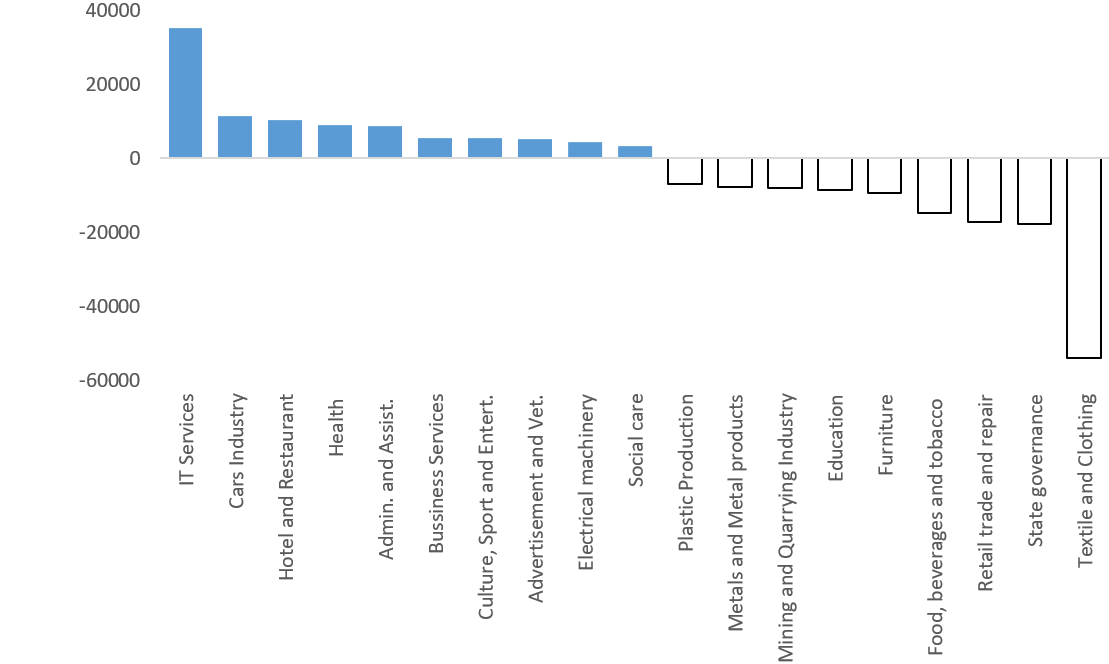

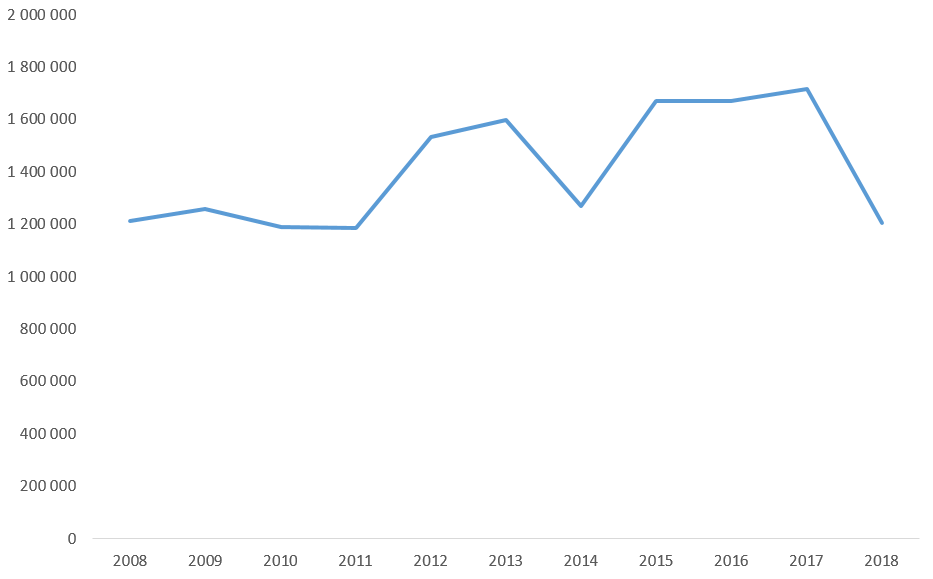

In 2018, regional level spending in Bulgaria reached 7.2 billion leva. Almost 5 billion of that amount are not regional resources – about 4 billion leva are transfers from the central government and roughly 1 billion is EU funding. The remaining 2.3 billion are municipalities’ own income, only 1 billion of which comes from taxes. In practice, of 7 leva spent at the regional level only 1 is revenue from local taxes. All the rest comes from state transfers, EU subsidies and non-tax revenue. This breakdown clearly illustrates the vast structural problem that faces local budgets in Bulgaria – municipalities have no adequate own resource and are entirely dependent on transfers (from the central government) and subsidies (from the EU taxpayer).

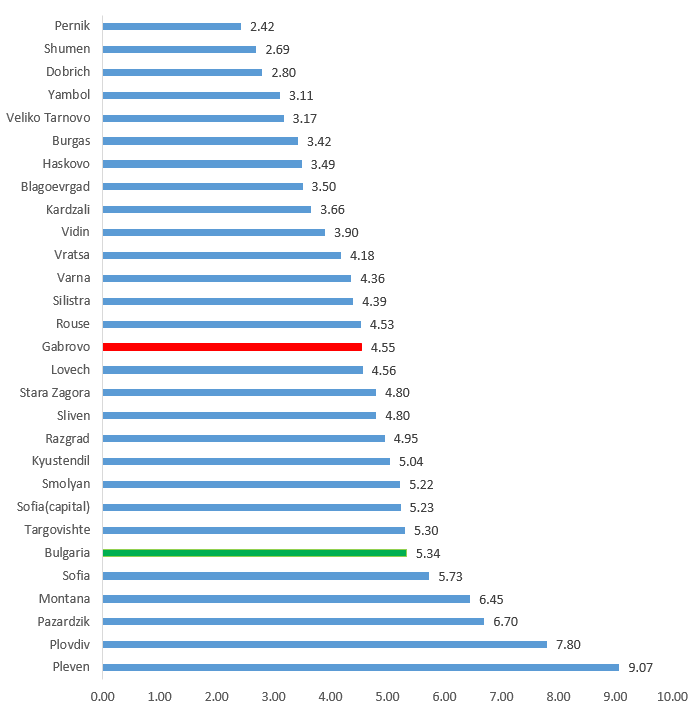

The want for sufficient own resources prevents municipalities from pursuing reasonable independent policies and makes them largely unresponsive to the needs and priorities of their populations. The problem is legally founded – the lack of free public resource is not the result of local governments’ failure. Revenues from taxation of incomes, profits and consumption which are generated at the local level are almost exclusively handed over to the central government. There are some exceptions but they are insignificant – patent taxes, levies on tourism, etc. Municipalities collect their own revenues, primarily through property taxes, which are highly insufficient for their needs, even when measures for improved tax collection have been enacted. Paradoxically, in the recent years of stable economic growth and budget surpluses, municipalities still suffer from lack of resources and expect governmental aid.

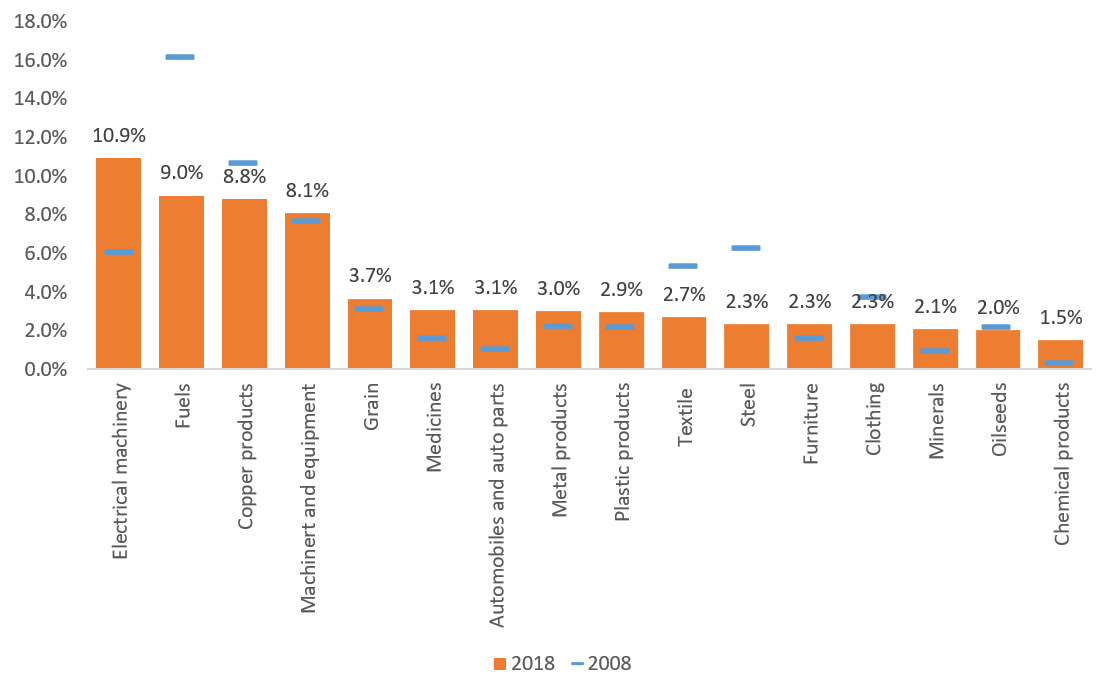

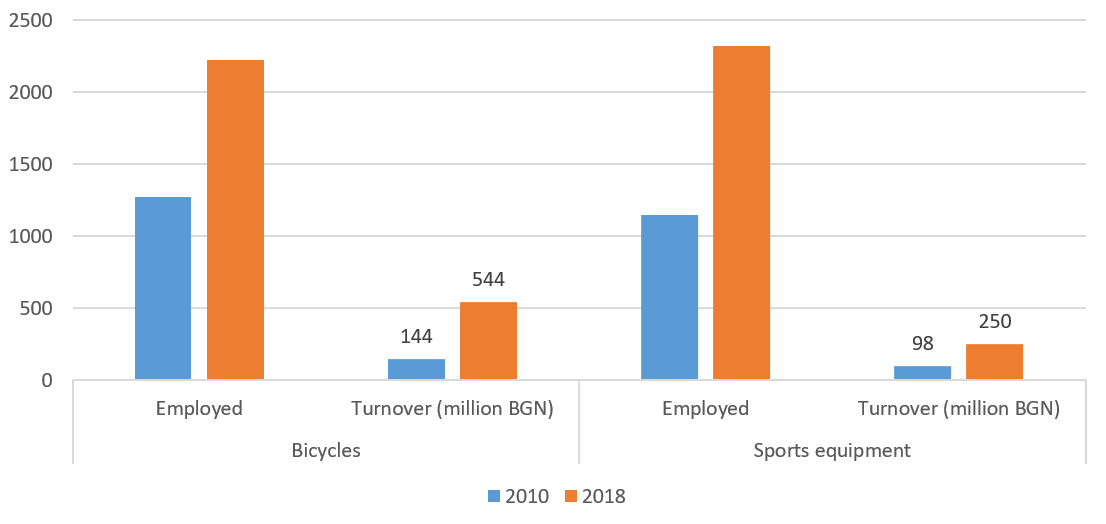

We believe that the moment has come for municipalities in Bulgaria to receive a share of the generated tax revenues from the economic activity of their own citizens. Discussions throughout the last 10 years have convinced us that the most effective means for solving this issue is for parts of tax incomes’ revenues to be ceded to municipalities. Thus, regional budgets will be way more connected to the condition of the local economy, the number of employed and their wages – What is a better stimulus for local governments to work to attract further investments and jobs?

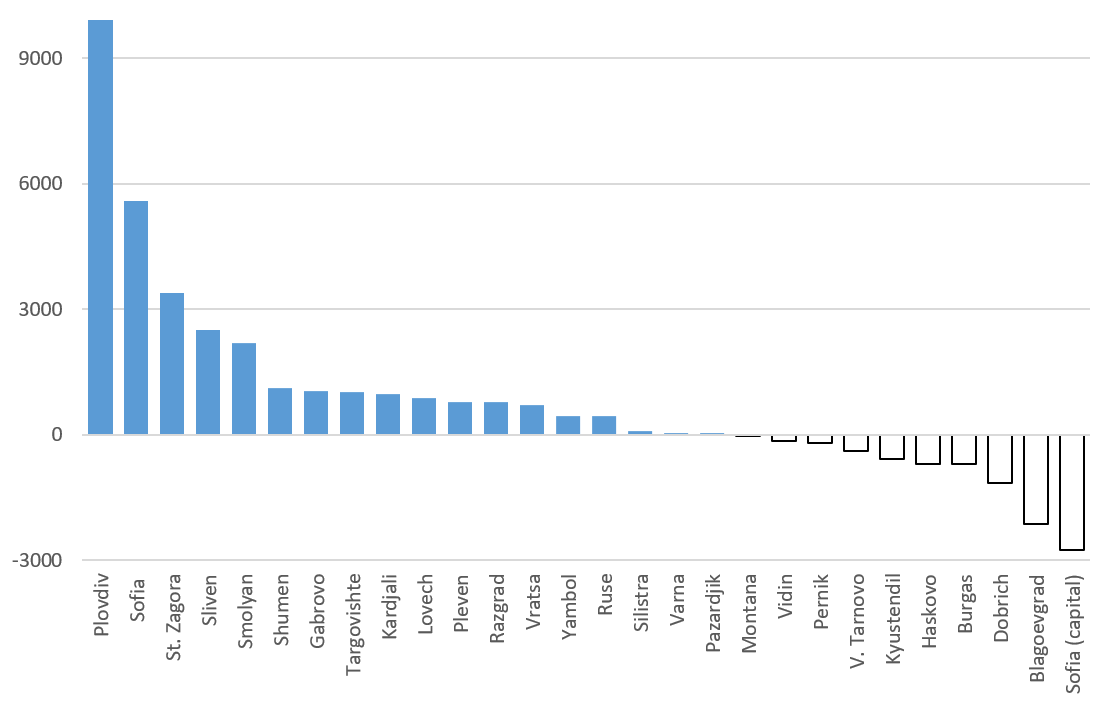

Our proposal, which is well-known and has been widely embraced and shared by a number of other experts, is that 1/5 of the revenues from personal income taxation be automatically handed over to municipalities, as ‘money follow the personal ID’ – when an individual’s permanent address is in a given municipality, 1/5 of their income tax shall stay there. According to our own estimations, this would amount to about 800 million leva which would nearly double municipalities’ own tax revenues without any tax increases – we suggest a restructuring of revenues rather than heavier taxation. Naturally, this would allow for and require changes in the equalizing subsidy and municipalities’ responsibilities that we are prepared to discuss as experts. The goal is clear – that municipalities receive more own resources without anyone losing from the reform.

We are hopeful that fiscal decentralization shall be recognized as a central priority by the government. We find that the reform can be elaborated and supported by all interested parts within half a year and be completely applied with the correspondent legislative changes and the voting of the state budget for 2021. It is no coincidence that we send this letter a week after the local elections in the country. We did not want the question to be politicized and so decided to wait for the cooling of political passions. Presently, there are legitimately elected local governments – let this be the beginning of the change which would allow them to work successfully and in the interest of their citizens.

With respect,

Petar Ganev

Senior Research Fellow, Institute for Market Economics