Veliko Tarnovo Economic Centre

VELIKO TARNOVO ECONOMIC CENTER

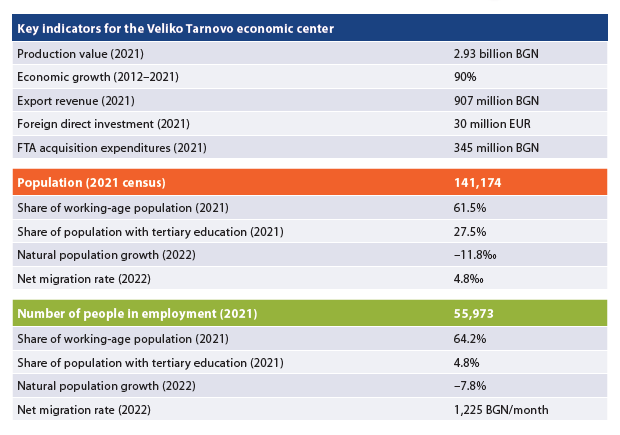

- INTRODUCTION | Key indicators for the Veliko Tarnovo economic center

- COMPOSITION AND LABOR MIGRATION

The Veliko Tarnovo economic center consists of five municipalities – Veliko Tarnovo is the core, and Zlataritsa, Lyaskovets, Gorna Oryahovitsa and Polski Trambesh are its periphery, from which more than 3,000 people commute daily for work. Over half of them – 1,800 people – come from Gorna Oryahovitsa. Daily migration to the core from Zlataritsa, where 20% of all employees work in Veliko Tarnovo, is of the greatest importance among the labor markets in the periphery. The center has expanded considerably in recent years: previously only Lyaskovets was part of its periphery. The municipality of Dryanovo is also close to inclusion, with 7% of employees commuting to Veliko Tarnovo as of 2021.

- ECONOMY AND INVESTMENT

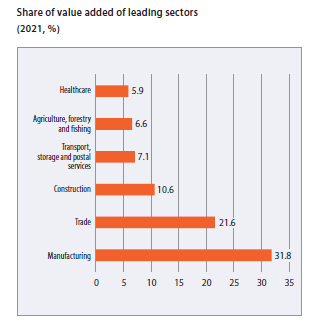

In 2021, the production value of the Veliko Tarnovo center reached 2.93 billion BGN, or an average of 21,000 BGN per capita in the municipalities included in the center. The center has one of the fastest growing economies in the country, with value added increasing by 90% over the last 10 years, slower only compared to the centers around Plovdiv, Sofia and Kardzhali. In contrast to most centers, Veliko Tarnovo’s economic activity is not very concentrated, with 65% of value added being generated in the core, another 20% in Gorna Oryahovitsa and a further 11% in Lyaskovets. The leading economic sector is manufacturing with 32% of value added, followed by trade (22%), construction (11%) and transport (7%). The deconcentrated nature of the economy is also evident in the distribution of the largest employers – the Arkus weapons factory in Lyaskovets employs 1,600 people, the strong confectionery industry is distributed between Prestige–96 in the core, Sugar Plants in Gorna Oryahovitsa and Grestcommerce in Lyaskovets. Extrapak and Megaport also play a major role, as well as the Apollo–95 textile factory. On the whole, there are numerous industrial enterprises in the center, each with high revenues and several hundred jobs.

In 2021, the production value of the Veliko Tarnovo center reached 2.93 billion BGN, or an average of 21,000 BGN per capita in the municipalities included in the center. The center has one of the fastest growing economies in the country, with value added increasing by 90% over the last 10 years, slower only compared to the centers around Plovdiv, Sofia and Kardzhali. In contrast to most centers, Veliko Tarnovo’s economic activity is not very concentrated, with 65% of value added being generated in the core, another 20% in Gorna Oryahovitsa and a further 11% in Lyaskovets. The leading economic sector is manufacturing with 32% of value added, followed by trade (22%), construction (11%) and transport (7%). The deconcentrated nature of the economy is also evident in the distribution of the largest employers – the Arkus weapons factory in Lyaskovets employs 1,600 people, the strong confectionery industry is distributed between Prestige–96 in the core, Sugar Plants in Gorna Oryahovitsa and Grestcommerce in Lyaskovets. Extrapak and Megaport also play a major role, as well as the Apollo–95 textile factory. On the whole, there are numerous industrial enterprises in the center, each with high revenues and several hundred jobs.

Against this backdrop, FDI in the center is one of the lowest among all the centers in the country – its cumulative value by the end of 2021 stood at only 30 million EUR, of which 22 million EUR in Veliko Tarnovo and another 5 million EUR in Gorna Oryahovitsa. However, overall investment activity is high, with 345 million BGN of FTA acquisition expenditures in 2021 – 66% in the core and 19% in Gorna Oryahovitsa. Expenditure on the purchase of machinery, land and buildings in trade, transport and tourism totaled 106 million BGN, while enterprises in the industry sector invested a further 71 million BGN, and those in agriculture – another 58 million BGN.

The center is among the less export-oriented ones, with export revenue in 2021 amounting to 907 million BGN, or 6,700 BGN per capita. Labor productivity is relatively low – the average value added per employee per year is 16,500 BGN.

- LABOR MARKET

In 2022, the unemployment rate in the economic center reached 4.8%, which is close to the national average. The share of the unemployed among the workforce is significantly higher in Zlataritsa (17%) and Polski Trambesh (11%). These municipalities also have a significant share of long-term unemployed people, 3.6% and 3% respectively, while in the other municipalities this problem is practically non-existent. According to 2021 census data, the employment rate is 64% – the fifth highest among all the 16 centers in the country, and the number of employed persons is 56,000 in total. The employment rate in the Veliko Tarnovo municipality is significantly higher – 69%. Most of the employed are in the core – 33,300 people, and in Gorna Oryahovitsa – 14,400 people.

However, against the backdrop of a growing economy, over the last 5 years the Veliko Tarnovo center has seen a significant contraction of the labor market, with the number of employed persons decreasing by 8%, mostly under pressure from demographic processes. The sector with the most employees – 35% of the total number of employed persons – is manufacturing, followed by trade with 23%, construction with 8%, and transport and storage with 7% of employees.

The 2021 average salary for the center as a whole was higher by 51% than it was in 2017 and reached 1,225 BGN gross per month, which is very close to the national average. Salary levels are relatively evenly distributed across economic activities, with the highest ones in the ICT sector in Gorna Oryahovitsa – 3,429 BGN per month, though with a very small number of employees, and in healthcare in Veliko Tarnovo – 2,028 BGN per month in 2021.

- HUMAN RESOURCES AND WORKFORCE

Over the last 10 years, the population of the economic center declined by 16% to 167,000, which is a relatively rapid rate compared to the 16 centers. The share of the working age population (15–64 years) is also among the lower ones – 62%, or 87,000 people, including 49,000 in Veliko Tarnovo and 23,000 in Gorna Oryahovitsa. The indicators of aging are also unfavorable: with 26% of the population over the age of 65, Veliko Tarnovo ranks third after Sevlievo–Gabrovo and Pleven among all the economic centers. The demographic replacement rate also portends rapid age structure deterioration.

Over the last 10 years, the population of the economic center declined by 16% to 167,000, which is a relatively rapid rate compared to the 16 centers. The share of the working age population (15–64 years) is also among the lower ones – 62%, or 87,000 people, including 49,000 in Veliko Tarnovo and 23,000 in Gorna Oryahovitsa. The indicators of aging are also unfavorable: with 26% of the population over the age of 65, Veliko Tarnovo ranks third after Sevlievo–Gabrovo and Pleven among all the economic centers. The demographic replacement rate also portends rapid age structure deterioration.

The center attracts migrants, the net migration rate averaging 4.8‰ in 2022. This holds true not only for the core but also for all peripheral municipalities. However, the population decline is a consequence of a low birth rate and high mortality, with a natural growth rate of –11.8‰ in 2022 – a relatively good level compared to the rest of northern Bulgaria. However, the natural growth rate is significantly lower in Lyaskovets (–21‰) and in Polski Trambesh (–18‰).

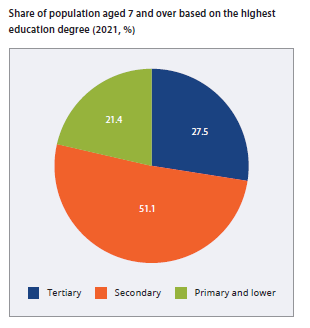

One of the main advantages of Veliko Tarnovo is the very good educational structure of the population. According to the census data, 27.5% of the population aged 7 and above have university degrees, while only the centers around Sofia and Varna perform better on this indicator. At the same time, the share of the population with primary and lower education is among the lowest – 21.4%, and illiteracy is also very low – 0.6% of the population aged 9 and older.

The good educational structure is also linked to good performance of the students in the centre, with an average score of 3.78 on the 2022 state matriculation exam in BLL, and an average score of 35 out of 100 on the NEA in mathematics after grade 7. Students in the municipality of Veliko Tarnovo predictably perform significantly better.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....