Sliven-Yambol Economic Centre

SLIVEN-YAMBOL

ECONOMIC CENTER

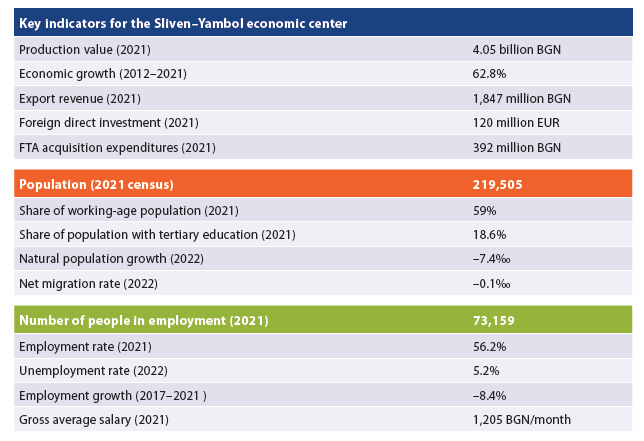

- INTRODUCTION | Key indicators for the Sliven–Yambol economic center

- COMPOSITION AND LABOR MIGRATION

The Sliven–Yambol centre consists of two cores – the municipalities of Sliven and Yambol, as well as three small peripheral municipalities – Tvarditsa, Tundzha and Straldzha. The municipality of Tundzha is the one most closely linked to its core, with 2,200 people, or 36% of those employed commuting to Yambol every day – a consequence of the administrative division that separates the urban center from the agricultural lands and villages around it. Sliven is a new economic core for this edition of the study, with only the municipality of Tvarditsa in its periphery. Judging by labor migration, the municipality of Elhovo is relatively close (7.1% of the employed commute daily to work in Yambol) to joining the territory of the economic center.

- ECONOMY AND INVESTMENT

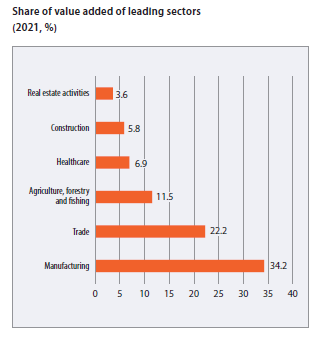

The total production value of the five municipalities in the Sliven–Yambol center in 2021 was 4 billion BGN, or 18,500 BGN per capita. Value added in the center is divided in relatively equal proportions between the two cores, with Sliven generating 47%, Yambol 44%, Tundzha 5%, and Straldzha 3%. In terms of distribution by sector, manufacturing leads with 34%, followed by trade with 22%, and agriculture ranks third with 12%. Agriculture is particularly important in the peripheral municipalities of Yambol, where it contributes half of the value added. The leading employer in the center is Yazaki Bulgaria, which employed over 5,000 people in 2021, followed by textile manufacturer E. Miroglio with 2,300 employees, and the timber company Southeast State Enterprise with 1,500 people. The leader in terms of revenues is Papas Olio with 573 million BGN.

The total production value of the five municipalities in the Sliven–Yambol center in 2021 was 4 billion BGN, or 18,500 BGN per capita. Value added in the center is divided in relatively equal proportions between the two cores, with Sliven generating 47%, Yambol 44%, Tundzha 5%, and Straldzha 3%. In terms of distribution by sector, manufacturing leads with 34%, followed by trade with 22%, and agriculture ranks third with 12%. Agriculture is particularly important in the peripheral municipalities of Yambol, where it contributes half of the value added. The leading employer in the center is Yazaki Bulgaria, which employed over 5,000 people in 2021, followed by textile manufacturer E. Miroglio with 2,300 employees, and the timber company Southeast State Enterprise with 1,500 people. The leader in terms of revenues is Papas Olio with 573 million BGN.

FDI in the center amounts to 120 million EUR, divided between the two cores – 80 million BGN in Sliven and 40 million BGN in Yambol, and concentrated almost exclusively in manufacturing. The distribution of investment in the five municipalities in the last reported year is significantly different, with Yambol municipality leading with 42%, and Sliven accounting for another 40% of FTA acquisition expenditures. For 2021, the total value of these expenditures stands at 392 million BGN, of which 105 million are in commerce, transport and tourism, 84 million in agriculture, and 63 million in industry. Relative to the number of inhabitants, the Sliven–Yambol center has the lowest investment activity after the Haskovo center, with FDI of only 1,784 BGN/person on average. Enterprises are strongly export-oriented, with export revenues of 1.85 billion BGN in 2021. Labor productivity is also relatively high, reaching 18,000 BGN of value added on average per employee in the non-financial sector.

- LABOR MARKET

After the increase in 2020, the unemployment rate in Sliven–Yambol shrank to 5.2% of the population aged 15–64 in 2022. There are large differences between municipalities in the center in terms of unemployment, ranging from 3.1% in Yambol to 18% in Tvarditsa. Unemployment appears to be transitory, with only Tvarditsa reporting a significant 2.3%

share of unemployed persons with more than one year of registration in the labor offices. In this municipality there is also a higher share of youth unemployment – 4.2% of the population aged 15–29, but in the other municipalities this share is insignificant. At the same time, the employment rate according to the 2021 census is the third lowest among all economic centers in the study – 56.2%, which indicates a significant number of inactive persons in the local labor market. The total number of employed persons is 73,000; 37,000 are in Sliven and 25,000 are in Yambol.

Over the last 5 years, employment in the center has been shrinking significantly, with the number of employees dropping by 8.4% compared to 2017, while only the Burgas–Nessebar center has seen a faster decline. The leading sector in terms of employment is manufacturing with 41%, followed by trade with 21%, agriculture with 9% and construction with 6%. During the same period, there was a relatively high growth of the average gross monthly salary – by 54% up to 1,205 BGN. However, the highest average salary was not in any of the cores, but in the municipality of Tundzha – 1,256 BGN per month. Among economic activities, the highest pay is in health care – 1,967 BGN in Sliven and 2,065 BGN in Yambol.

- HUMAN RESOURCES AND WORKFORCE

Between the last two censuses, the population of the center declined by 12% to 220,000 – a relatively small decline compared to other parts of the country. The bulk of the population in the center is in the municipality of Sliven – 125,000 people, and another 74,000 people live in Yambol. Although the share of elderly population (65 years and older) is relatively high at 23.4%, demographic replacement indicators reveal relatively slow aging compared to other centers. However, the proportion of the working age population is also low at 59%, or 130,000 people.

Between the last two censuses, the population of the center declined by 12% to 220,000 – a relatively small decline compared to other parts of the country. The bulk of the population in the center is in the municipality of Sliven – 125,000 people, and another 74,000 people live in Yambol. Although the share of elderly population (65 years and older) is relatively high at 23.4%, demographic replacement indicators reveal relatively slow aging compared to other centers. However, the proportion of the working age population is also low at 59%, or 130,000 people.

Unlike all other economic centers except Kozloduy, Sliven–Yambol is losing population as a result of migration processes. In 2022, the net migration rate was –0.1‰, whereas in previous years the indicator was more negative, especially in the two cores. In contrast, natural population growth is relatively high (–7.4‰). Tvarditsa is one of the 4 municipalities in the country where the balance of births and deaths is positive, at 2.9‰ for 2022; however, in Tundzha the decline reached –19‰.

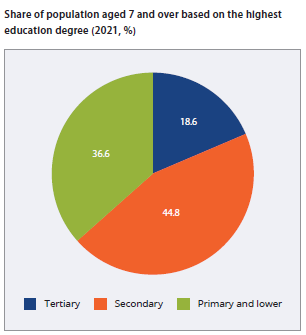

A significant obstacle to the further development of the center is the educational profile of the workforce. According to the census data, only 18.6% of the total population aged 7 years and older has a university degree, and 36.6% have primary or lower education (43% in Tundzha, 59% in Tvarditsa). Also noteworthy is the very high illiteracy rate – 4.3% for the center as a whole (4.8% in Sliven municipality and a whole 11% in Tvarditsa). This is a reflection of the relatively poor outcomes of the local school system, as students in these municipalities did not score very high on either the matriculation exam in BLL, Good 3.77, or the NEA national external assessment in mathematics at the end of 7th grade – 41.4 points out of a possible 100.

Latest news

Math talents on the edge of the map 30.06.2025

If you think that mathematics can only be taught and learned well in mathematics high schools or elite...

The municipalities need more own resources and a share of revenues from personal income taxation 26.06.2025

IME analysis shows opportunities for expanding municipalities' financial autonomy. The budget expenditures...