Blagoevgrad Economic Centre

BLAGOEVGRAD ECONOMIC CENTER

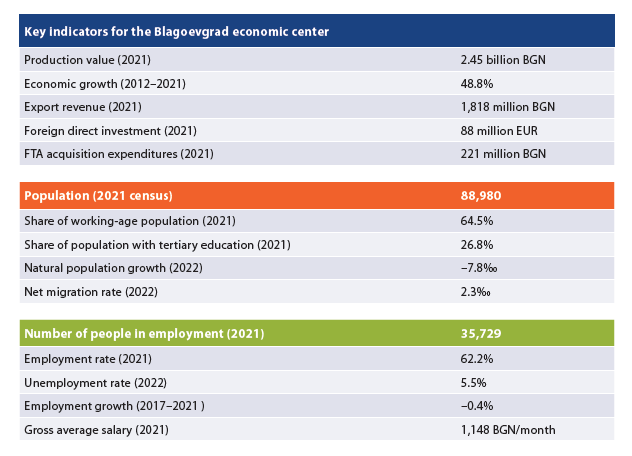

- INTRODUCTION | Key indicators for the Blagoevgrad economic center

- COMPOSITION AND LABOR MIGRATION

The Blagoevgrad economic center consists of four municipalities – the core municipality of Blagoevgrad and the peripheral municipalities of Kocherinovo, Simitli and Rila. Compared to the previous edition of the study (2017), the municipality of Rila is a new addition to the periphery of the Blagoevgrad center. From its peripheral municipalities, the core attracts 1,700 workers per day, 1,029 of them from Simitli. Work in Blagoevgrad, on the other hand, is of utmost importance for the labor market of Kocherinovo, where 36% of employees commute daily to their jobs in the core. Of the surrounding municipalities, Kresna comes closest to being included in the center’s periphery, with a little over 6% commuting daily to work in Blagoevgrad. It is interesting to note that the centre is located on the territory of two administrative districts, Kocherinovo and Rila being municipalities in Kyustendil district.

- ECONOMY AND INVESTMENT

In 2021, the total value of production in the Blagoevgrad center reached 2.45 billion BGN, or an average of 27,500 BGN per capita. Despite the small size of the local economy in absolute terms, if population size is taken into account, its performance is better than that of most other centers. However, Blagoevgrad has the lowest growth rate of all economic centers in the country – only 49% over the last 10 years. This mostly reflects the problems facing the local industry in recent years – from the closure of the cigarette manufacturer to the shortage of workers in the garment sector.

In 2021, the total value of production in the Blagoevgrad center reached 2.45 billion BGN, or an average of 27,500 BGN per capita. Despite the small size of the local economy in absolute terms, if population size is taken into account, its performance is better than that of most other centers. However, Blagoevgrad has the lowest growth rate of all economic centers in the country – only 49% over the last 10 years. This mostly reflects the problems facing the local industry in recent years – from the closure of the cigarette manufacturer to the shortage of workers in the garment sector.

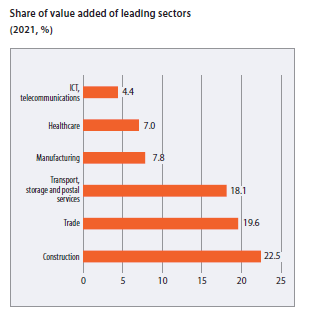

The concentration of production in the center’s core is comparable to that of other centers, as it generates 90% of the total value added, while Simitli contributes another 7.6%. The structure of the center’s economy is somewhat unusual, with construction being the largest sector as of 2021, accounting for 23% of total value added, followed by trade with 20%, and transport, warehousing and postal services with a total of 18%. Manufacturing (7.8%) and healthcare (7%) are also relatively large in size. Simitli has a distinctly different economic profile, with industrial enterprises playing a major role and generating as much as 41% of value added. Labor productivity in the non-financial sector in the center is relatively low – only 16,100 BGN of value added on average per employee.

It is noteworthy that some of the largest employers in the center are public enterprises – the South- Western State Enterprise, which employs more than 1,500 people, and the general hospital with 500 people. The companies with the highest revenues are those in commerce. Thanks to its important role, the Blagoevgrad center has significant export revenues – 1.82 billion BGN in 2021, and the average value of 21,000 BGN per capita puts the center in third place in the country after the broad center around the capital and Sevlievo–Gabrovo.

As of the end of 2021, the cumulative FDI stands at 88 million EUR, or 991 EUR per capita. Almost all foreign capital in the center is concentrated in the municipality of Blagoevgrad – over 86 million EUR, while the remaining 2 million are in the municipality of Simitli. Over half of it (45 million EUR) is in trade, transport and tourism, while the remaining 36 million is in industry. In 2021, enterprises made investment expenditures of over 221 million BGN for the acquisition of land, buildings and machinery, of which 193 million BGN were in Blagoevgrad and 20 million BGN in Simitli. Investment activity is focused on industry – 62 million BGN of expenditures for the acquisition of fixed assets, as well as the sectors of construction and trade, transport and tourism with 52 million BGN each.

- LABOR MARKET

Although unemployment rose sharply during the course of the Covid pandemic, reaching some of the highest levels in the country, by 2022 unemployment in the centre had already fallen to 5.5%. There are no significant differences between municipalities in the overall unemployment rate, but the periphery faces problems with long-term unemployment: in Simitli the share of the unemployed registered for over a year is 3.3%, and in Rila – 1%. The share of inactive persons is relatively high, reaching 39% in Simitli in 2021 and 38% in Rila. The employment rate is close to the average for all centers – about 62% for the population aged 15–64, and the total number of persons in employment according to the 2021 census is 35,700 persons, among them 28,900 in Blagoevgrad municipality, and another 4,600 in Simitli.

The size of the labor market has remained virtually unchanged over the past 5 years, with employment down 0.4% compared to 2017. However, in the Blagoevgrad center, the structure of employment differs significantly from that of value added, with most employees – 23% – concentrated in manufacturing, 18% in trade and 16% in construction.

Despite the weaker economic dynamics, over the last 5 years salaries in the centre have increased by 51% to 1,148 BGN (gross) on average per month. However, there are great differences between the municipalities, as the average salary in Blagoevgrad is 1,214 BGN on average per month, while in Kocherinovo it is only 791 BGN. Among the sectors with significantly higher salaries are healthcare with 2,163 BGN and culture, sport and entertainment with 2,137 BGN in the city of Blagoevgrad.

- HUMAN RESOURCES AND WORKFORCE

Between the two censuses, the center lost 11% of its population, and the total number of people living in the four municipalities reached about 89,000 in 2021. Blagoevgrad’s demographics are among the best in the 16 centers, with a 64.5% share of the working-age population aged 15 to 64 – lower only than that in the centers around the capital and Varna. Of that working-age population, 45,000 people are concentrated in the municipality of Blagoevgrad and another 8,600 are in Simitli. The share of the population aged 65 and above is very low at 21.4%, placing the centre among the slowest ageing ones in the country. The universities in the core, which attract a significant number of young people, as well as the proximity and good infrastructural connectedness with the capital, undoubtedly play a role in these positive trends.

Between the two censuses, the center lost 11% of its population, and the total number of people living in the four municipalities reached about 89,000 in 2021. Blagoevgrad’s demographics are among the best in the 16 centers, with a 64.5% share of the working-age population aged 15 to 64 – lower only than that in the centers around the capital and Varna. Of that working-age population, 45,000 people are concentrated in the municipality of Blagoevgrad and another 8,600 are in Simitli. The share of the population aged 65 and above is very low at 21.4%, placing the centre among the slowest ageing ones in the country. The universities in the core, which attract a significant number of young people, as well as the proximity and good infrastructural connectedness with the capital, undoubtedly play a role in these positive trends.

In 2022, the natural growth rate for the center as a whole was –7.8‰, although the ratio between mortality and the birth rate was significantly more negative in the periphery: up to –29‰ in Kocherinovo, and up to –23‰ in Rila. The center gains population from migration processes, with a total net migration rate of 2.3‰, while in the city of Blagoevgrad it reaches 4.4‰.

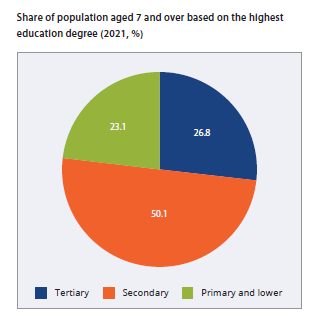

Among the strengths of the Blagoevgrad center is the educational structure of the population – according to census data, 27% of the population aged 7 and older have university degrees, and only 23% have primary or lower education. The centre also has the lowest illiteracy rate in the country – 0.5% of the population aged 9 and above, similar to the centre around the capital and Sevlievo–Gabrovo. Student achievement is also good – with an average score of Good 3.90 on the matriculation exam in BLL and 36.4 points in mathematics at the end of 7th grade, the centre ranks among the leaders in the country.

Latest news

Math talents on the edge of the map 30.06.2025

If you think that mathematics can only be taught and learned well in mathematics high schools or elite...

The municipalities need more own resources and a share of revenues from personal income taxation 26.06.2025

IME analysis shows opportunities for expanding municipalities' financial autonomy. The budget expenditures...