Varna-Devnya Economic Center

VARNA-DEVNYA

ECONOMIC CENTER

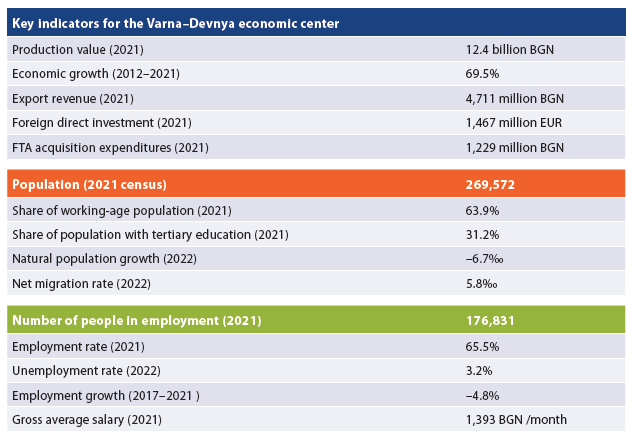

- INTRODUCTION | Key indicators for the Varna–Devnya economic center

- COMPOSITION AND LABOR MIGRATION

The Varna–Devnya center encompasses two cores, while the periphery of the smaller core – the municipality of Devnya – fully overlaps with that of the Varna city municipality. It includes the municipalities of Aksakovo, Avren, Beloslav, Vetrino, Suvorovo, Dolni Chiflik, Dalgopol and Provadia. Unlike most other centers in the country, Varna–Devnya has not expanded its range compared to the previous edition of the study in 2017. The largest flow of daily labor migrants to Varna comes from the municipality of Aksakovo – 3,700 people, or 48% of all workers in the municipality, and more than 1,000 people from Beloslav and Dolni Chiflik each. The largest source of workforce for Devnya is Varna city municipality – 1,700 people commute daily from the district center.

- ECONOMY AND INVESTMENT

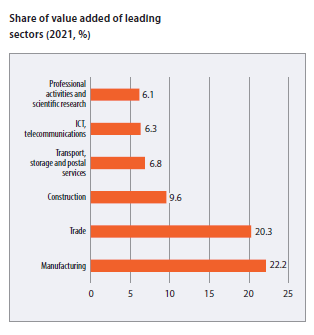

Varna–Devnya is the third largest economic center in the country in terms of production value, with 12.4 billion BGN, or 29,400 BGN per capita in 2021. The value added growth in the last decade is moderate – 69.5%. Concentration of value added in the cores is high, with Varna municipality generating 80%, Devnya 13%, and Aksakovo in third place with only 3.7%. The industry profile is relatively balanced, with manufacturing as the leading sector generating 22% of value added, followed by trade (20%), construction (9.6%), transportation and warehousing (6.8%) and ICT (6.3%). While in Devnya almost all of the value added is generated by industry, in the smaller peripheral municipalities (Vetrino, Avren, Dolni Chiflik) the leading role is played by agriculture, and services are concentrated in Varna municipality. Among the largest employers are the St. Marina University Hospital with 1,800 employees, Electrodistribution– North with 1,700 employees, the Discordia transport company with 1,400 employees, and PPD Bulgaria with 1,300 employees. The leader in terms of revenue for 2021 is the fertilizer producer Agropolychim in Devnya with 730 million BGN.

Varna–Devnya is the third largest economic center in the country in terms of production value, with 12.4 billion BGN, or 29,400 BGN per capita in 2021. The value added growth in the last decade is moderate – 69.5%. Concentration of value added in the cores is high, with Varna municipality generating 80%, Devnya 13%, and Aksakovo in third place with only 3.7%. The industry profile is relatively balanced, with manufacturing as the leading sector generating 22% of value added, followed by trade (20%), construction (9.6%), transportation and warehousing (6.8%) and ICT (6.3%). While in Devnya almost all of the value added is generated by industry, in the smaller peripheral municipalities (Vetrino, Avren, Dolni Chiflik) the leading role is played by agriculture, and services are concentrated in Varna municipality. Among the largest employers are the St. Marina University Hospital with 1,800 employees, Electrodistribution– North with 1,700 employees, the Discordia transport company with 1,400 employees, and PPD Bulgaria with 1,300 employees. The leader in terms of revenue for 2021 is the fertilizer producer Agropolychim in Devnya with 730 million BGN.

The Varna–Devnya center has a high level of FDI, which by the end of 2021 reached 1.47 billion EUR. Just over half – 740 million EUR – was in the municipality of Devnya, which ranks it first in FDI per capita in the country with 87,000 EUR. Of the remaining 714 million EUR, most are focused in Varna municipality. Foreign investment is concentrated in industry (55%), real estate operations (19%), and trade, transport and tourism (13%). The distribution of FTA acquisition expenditures in 2021 was similar, with 47% of the total 1.2 billion BGN investment in Varna, 24% in Devnya, 17% in Aksakovo, and 10% in Beloslav. In this investment indicator, too, the leading role is played by industry (26%), followed by trade, transport and tourism (17.9%) and construction (17.7%). Export earnings in the non-financial sector amount to 4.7 billion BGN, of which 3.7 billion BGN are in Varna and 904 million BGN in Devnya. Labor productivity in the Varna–Devnya center is 24,200 BGN value added per employee per year – the highest after that of the Zagore center.

- LABOR MARKET

In 2022, the average unemployment rate for the center according to the Employment Agency data was 3.2%: it was lower only in the center around the capital. While unemployment is almost absent in Varna (2.1%), neighboring Beloslav (2.1%), and Aksakovo (2.8%), the rate remains relatively high in some of the smaller municipalities, most notably in Dalgopol (12%) and Avren (9.2%). These are also the municipalities with significant long-term unemployment, where persons registered in the labor offices for more than a year account for 5% of the population aged 15–64 in Dalgopol, 2.9% in Avren and 2.3% in Suvorovo, compared to only 0.02% in Varna city municipality. Most municipalities in the center do not have particularly high youth unemployment, with Avren having the highest share (3.8%) of unemployed among the population aged 15–29.

Employment in the center is high at 65.5% for the population in the 15–64 age group, according to 2021 census data, but ranges from 69% in Varna and 65% in Beloslav to 42% in Dalgopol and 49% in Dolni Chiflik. The total number of employed persons is 177,000, of which 143,000 are in Varna. Employment in Varna–Devnya is shrinking, with a 4.8% decline in the number of employees compared to 2017. The sectoral distribution of employment is relatively even, with trade as the leader (23%), followed by manufacturing (17%) and construction (11%).

Salaries in the Varna–Devnya center have grown relatively slowly in the period from 2017 to 2021 – by 46%, reaching an average of 1,393 BGN gross per month. Again, the differences between municipalities are significant, with markedly higher average salaries in Devnya (1,947 BGN per month) and Beloslav (1,514 BGN per month). At the sectoral level, the highest salaries are in the energy sector in Devnya (3,946 BGN per month), ICT services in Varna (2,535 BGN per month), and manufacturing in Devnya (2,488 BGN per month).

- HUMAN RESOURCES AND WORKFORCE

Despite its location in Northern Bulgaria, Varna– Devnya is among the centers with a relatively low decline of the population, which has decreased by 8.7% to 422,000 people in a decade. The share of working-age population is one of the highest in the country at 63.9%, second only to the center around the capital. The working-age population is concentrated in Varna city municipality – 207,000 people, also in Aksakovo (12,000) and Provadia (11,000). At the same time, the share of elderly population is relatively low – 21.2%, and here again Varna–Devnya ranks second in the country; the demographic replacement indicators show relatively slow ageing processes compared to most other parts of Bulgaria.

Despite its location in Northern Bulgaria, Varna– Devnya is among the centers with a relatively low decline of the population, which has decreased by 8.7% to 422,000 people in a decade. The share of working-age population is one of the highest in the country at 63.9%, second only to the center around the capital. The working-age population is concentrated in Varna city municipality – 207,000 people, also in Aksakovo (12,000) and Provadia (11,000). At the same time, the share of elderly population is relatively low – 21.2%, and here again Varna–Devnya ranks second in the country; the demographic replacement indicators show relatively slow ageing processes compared to most other parts of Bulgaria.

Varna–Devnya is the most attractive economic center in northern Bulgaria in terms of migration, with a net migration rate of 5.8‰ in 2022. However, not all of its municipalities attract population, with Aksakovo, Beloslav, Suvorovo, Provadia and Dalgopol suffering a net loss of inhabitants from migration processes. Compared to the rest of the country, the natural growth of –6.7‰ for the center as a whole is not particularly negative, the municipality of Varna being the single one with –4.9‰.

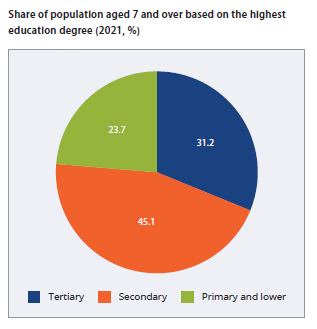

The center has a rather favorable educational structure, with 31.2% of the population aged 7 years and above having a university degree, and only 23.7% having primary or lower education. In Varna, the share of university graduates is significantly higher – 37.4%. The illiteracy rate in the center as a whole is 0.9%, although it is distinctly higher in the small municipalities – Dolni Chiflik (3.6%), Dalgopol (3.1%), and Provadia (2.9%). Varna–Devnya has both the second highest average score in the matriculation exam in BLL among all 16 centers – Good 3.99, and the highest average score on the NEA in mathematics at the end of grade 7 – 43.3 out of 100 points.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....