Sevlievo-Gabrovo Economic Centre

SEVLIEVO-GABROVO ECONOMIC CENTER

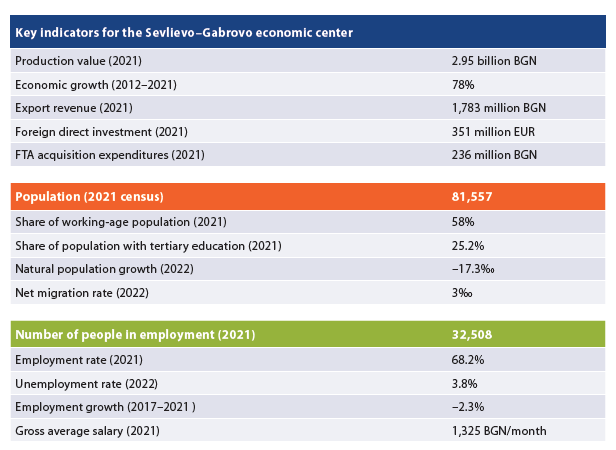

- INTRODUCTION | Key indicators for the Sevlievo–Gabrovo economic center

- COMPOSITION AND LABOR MIGRATION

Sevlievo–Gabrovo is an unusual economic center: it consists of two cores, neither of which has peripheral municipalities. This is due to the strong but geographically limited economies of the two adjacent municipalities. It is important to note, however, that there already are municipalities approaching the threshold of daily labor migration: 8% of employed people in Dryanovo commute to Gabrovo every day, while 9.8% of those in Apriltsi commute to Sevlievo, which is why they could be added to the periphery of Gabrovo and Sevlievo and represented in a future edition of the study. Between the two cores there is also strong interaction, with 5.7% of employees, or 1,300 people commuting daily from Gabrovo to Sevlievo for work.

- ECONOMY AND INVESTMENT

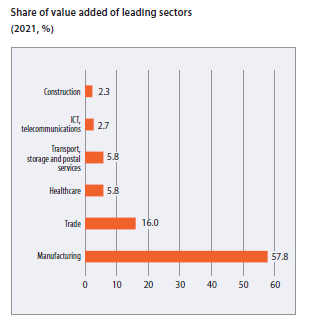

In 2021, the production value of Sevlievo–Gabrovo was 2.95 billion BGN, comparable to that of much larger centers in both territory and population, such as Veliko Tarnovo and Pazardzhik. For this reason, relative to the number of inhabitants, the production value of the center is high – 36,200 BGN per person, close to that of centers with highly developed industry such as Plovdiv and Zagore. The growth of value added between 2012 and 2021 is also significant – 78%. The economy of the center is evenly distributed between the two cores: in 2021 Sevlievo generated 53% of the total value added, and Gabrovo generated 47%. Activity is highly concentrated in manufacturing which generates 58% of value added. Other larger sectors include trade with 16%, as well as healthcare and transportation, warehousing and postal services, with 5.8% each. The economy of Gabrovo municipality is slightly more balanced, but here manufacturing also accounts for 49%. The local economy is dominated by a few large industrial enterprises – the sanitary ware manufacturer Ideal Standard–Vidima with almost 3,300 employees, the plastic products manufacturer Hamberger with 1,100 employees, and the Parallel furniture company with 843 employees in Sevlievo, as well as the Dzalli garment company with over 1,000 workers in Gabrovo. The economic center has attracted 351 million EUR of FDI by the end of 2021. Per capita, the amount of foreign capital is 4,300 EUR per person, with more FDI reported only in the Burgas – Nessebar center and the one around Sofia. Most of the foreign investment – 288 million EUR – was made in Sevlievo. Current investment in the two municipalities in the previous year was relatively low, with expenditures for the acquisition of fixed assets amounting to 236 million BGN in 2021, half of them in industry. Due to its particular economic structure, Sevlievo–Gabrovo is the most export-oriented economic center after that of the capital, with 22,200 BGN of export revenue per capita in 2021. The nominal volume of exports is 1.8 billion BGN. The center also has relatively high labor productivity, with value added per employee reaching 18,700 BGN.

In 2021, the production value of Sevlievo–Gabrovo was 2.95 billion BGN, comparable to that of much larger centers in both territory and population, such as Veliko Tarnovo and Pazardzhik. For this reason, relative to the number of inhabitants, the production value of the center is high – 36,200 BGN per person, close to that of centers with highly developed industry such as Plovdiv and Zagore. The growth of value added between 2012 and 2021 is also significant – 78%. The economy of the center is evenly distributed between the two cores: in 2021 Sevlievo generated 53% of the total value added, and Gabrovo generated 47%. Activity is highly concentrated in manufacturing which generates 58% of value added. Other larger sectors include trade with 16%, as well as healthcare and transportation, warehousing and postal services, with 5.8% each. The economy of Gabrovo municipality is slightly more balanced, but here manufacturing also accounts for 49%. The local economy is dominated by a few large industrial enterprises – the sanitary ware manufacturer Ideal Standard–Vidima with almost 3,300 employees, the plastic products manufacturer Hamberger with 1,100 employees, and the Parallel furniture company with 843 employees in Sevlievo, as well as the Dzalli garment company with over 1,000 workers in Gabrovo. The economic center has attracted 351 million EUR of FDI by the end of 2021. Per capita, the amount of foreign capital is 4,300 EUR per person, with more FDI reported only in the Burgas – Nessebar center and the one around Sofia. Most of the foreign investment – 288 million EUR – was made in Sevlievo. Current investment in the two municipalities in the previous year was relatively low, with expenditures for the acquisition of fixed assets amounting to 236 million BGN in 2021, half of them in industry. Due to its particular economic structure, Sevlievo–Gabrovo is the most export-oriented economic center after that of the capital, with 22,200 BGN of export revenue per capita in 2021. The nominal volume of exports is 1.8 billion BGN. The center also has relatively high labor productivity, with value added per employee reaching 18,700 BGN.

- LABOR MARKET

The strong performance of the local economy has also led to good labor market indicators. In 2022, the unemployment rate registered with the Employment Agency declined to an average of 3.8% for the center, with only minor differences between the two cores. The long-term unemployment rate is very low at 0.43% of the population aged 15–64 in Sevlievo and 0.11% in Gabrovo, giving the currently unemployed a very high chance of re-entering employment. Youth unemployment is also low. At the same time, according to 2021 Census data, Sevlievo– Gabrovo has the second highest employment rate among the 16 economic centers of the country. The total number of employed people is 32,500, with 21,200 of them in Gabrovo municipality.

Over the past 5 years, there has been a slight cooling in the local labor market, with the number of employed persons down by 2.3% compared to 2017. In terms of employment structure, 57% of employees are in manufacturing, 13% in trade, 6.5% in transport, warehousing and postal services, and 4.9% in healthcare. The concentration of industrial enterprises in Sevlievo logically determines the leading position of the manufacturing in employment, as it accounts for about 65% of all employees in the municipal economy.

Salaries in the center have increased by 51% over the last 5 years to a gross average of 1,325 BGN per month, giving Sevlievo–Gabrovo the fourth place among all 16 centers. At the municipal level, Sevlievo offers a significantly higher average income for employees – 1,508 BGN per month, with salaries in manufacturing at 1,679 BGN, and those in healthcare at 1,917 BGN. The highest salaries in the whole economic center are in the growing ICT sector in Gabrovo, with 3,121 BGN per month on average.

- HUMAN RESOURCES AND WORKFORCE

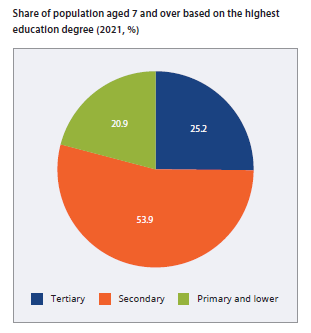

A significant advantage of Sevlievo–Gabrovo is the educational structure of the population. According to census data, ¼ of people aged 7 and above have a university degree, while only 21% have primary or lower education, one of the lowest proportions in the country. The illiteracy rate is 0.5%, and by this indicator the center shares the first place with the one around the capital and with the Blagoevgrad center.

A significant advantage of Sevlievo–Gabrovo is the educational structure of the population. According to census data, ¼ of people aged 7 and above have a university degree, while only 21% have primary or lower education, one of the lowest proportions in the country. The illiteracy rate is 0.5%, and by this indicator the center shares the first place with the one around the capital and with the Blagoevgrad center.

Several of the country’s leading schools are also located in the center. The average score in the matriculation exams in BLL is naturally among the higher ones – Good 3.85, and the average score in the NEA in mathematics at the end of grade 7 is 32.1 out of 100 – one of the most successful performances at the municipal level in the country.

By far the most serious challenge to the medium-term economic development of the center is demography. Between the last two censuses, the population of the two municipalities shrank by a total of 19.5% to 81,600 thousand people. The population decline has been accompanied by rapid changes in its structure, with only 58.4% of residents of working age by 2021 – the lowest proportion among all economic centers. Conversely, the proportion of the population aged 65 and above is the highest at 29.5%, and demographic replacement indicators reveal a further deterioration in the population pyramid, with 245 seniors (over 65) for every 100 children (under 14) in 2021.

These negative developments have been occurring despite positive migration towards the centre. The net migration rate for the centre as a whole in 2022 was 3‰ – higher in Sevlievo, though both municipalities have been attracting population. The more important driving factor, however, is natural population growth which reached –17.3‰ in 2022 – the lowest among all economic centers, with Sevlievo performing slightly better on this indicator (–15‰). The narrowing of the gap between birth rates and death rates seems at this stage to be the most serious challenge facing the two municipalities.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....