Ruse-Targovishte-Razgrad Economic Centre

RUSE-TARGOVISHTE-RAZGRAD

ECONOMIC CENTER

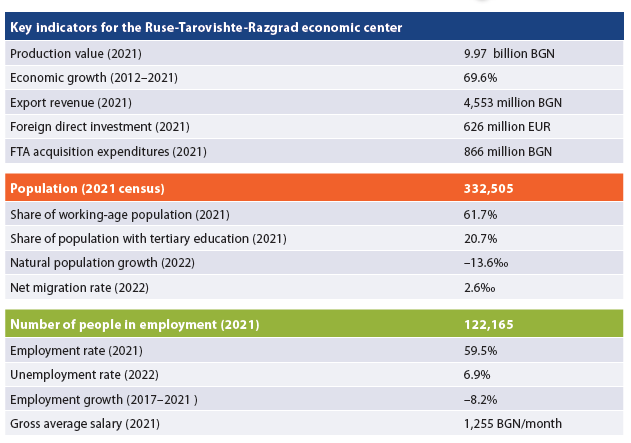

- INTRODUCTION | Key indicators for the Ruse-Tarovishte-Razgrad economic center

- COMPOSITION AND LABOR MIGRATION

The Ruse–Targovishte–Razgrad center incorporates three cores and their intertwined peripheries, with the municipality of Loznitsa falling within the peripheries of the Targovishte and Razgrad cores, and the municipality of Tsar Kaloyan – within the peripheries of Ruse and Razgrad. A total of 12 small municipalities fall within the periphery of the three cores. The most active labor migration to Ruse is from the municipality of Ivanovo, where 1,229 workers commute daily, or 50% of all people in employment in the municipality. A total of 37% of all employees in the municipality of Loznitsa commute daily to work in one of the nearby large cities of Targovishte and Razgrad. Compared to the previous edition of this study (2017), Ruse has added Borovo, Tsar Kaloyan and Kubrat to its periphery; Targovishte has added Omurtag and Antonovo; and for Razgrad this is the first time it meets the criteria for qualifying as an economic core.

- ECONOMY AND INVESTMENT

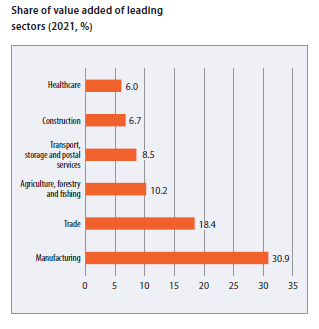

In 2021, the total production value of the 15 municipalities in the economic center was 9.97 billion BGN or 30,000 BGN on average per capita. Between 2012 and 2021, value added growth was 70%, which is relatively low compared to the leaders. Value added is concentrated in the economic cores, with 54% in Ruse municipality, 17% in Targovishte, and 12% in Razgrad. Of the peripheral municipalities, Slivo Pole and Vetovo have the largest economic footprint, as they are dominated by the industry around Ruse and create 7% and 3% of the total value added respectively. The leading sector is manufacturing with 31% of the value added, followed by trade with 18%, while agriculture ranks third with 10%. It is important to note that in the smaller municipalities agriculture plays a significantly larger role. The leading companies are in different industrial sectors, with the largest employers being the glass company Pashabahche with 1,700 employees in Targovishte, Vitte Automotive with 1,100 in Ruse, and the food company Pilko in Razgrad with 858 workers. The leader in terms of revenue for 2021 is Ruse’s Astra Bioplant with 3.36 billion BGN.

In 2021, the total production value of the 15 municipalities in the economic center was 9.97 billion BGN or 30,000 BGN on average per capita. Between 2012 and 2021, value added growth was 70%, which is relatively low compared to the leaders. Value added is concentrated in the economic cores, with 54% in Ruse municipality, 17% in Targovishte, and 12% in Razgrad. Of the peripheral municipalities, Slivo Pole and Vetovo have the largest economic footprint, as they are dominated by the industry around Ruse and create 7% and 3% of the total value added respectively. The leading sector is manufacturing with 31% of the value added, followed by trade with 18%, while agriculture ranks third with 10%. It is important to note that in the smaller municipalities agriculture plays a significantly larger role. The leading companies are in different industrial sectors, with the largest employers being the glass company Pashabahche with 1,700 employees in Targovishte, Vitte Automotive with 1,100 in Ruse, and the food company Pilko in Razgrad with 858 workers. The leader in terms of revenue for 2021 is Ruse’s Astra Bioplant with 3.36 billion BGN.

The economic center’s FDI is moderately high – 626 million EUR cumulative at the end of 2021; of these, 355 million EUR are in the municipality of Ruse, and another 267 million EUR in Targovishte, though the total figure presented here does not include the municipality of Razgrad, for which data are confidential. Almost all foreign investment is concentrated in manufacturing. Expenditure on acquisition of FTA in 2021 reached 866 million BGN, distributed mainly between the manufactruring (35%), trade, transport and tourism (23%), and agriculture (17%). The municipality of Ruse accounts for 49% of all expenditure on the purchase of machinery, land and buildings in the whole center, another 15% is in Targovishte, and 14% in Razgrad. Export revenues in 2021 exceeded 4.5 billion BGN, or 13,800 BGN per capita, which puts the center in the export-oriented group. Labor productivity ranks fifth among the 16 centers, with 21,400 BGN of value added per employee.

- LABOR MARKET

In 2022, the center still had the relatively high unemployment rate of 6.9% compared to the rest of the country, according to the Employment Agency data. However, average figures blur very large differences between municipalities, with the share of unemployed persons ranging from 3.2% of the working age population in Ruse municipality to 25% in Samuil municipality and 22% in Antonovo municipality. Razgrad and Targovishte have similar rates, 4.6% and 4.7% respectively. In some places there are also conspicuous problems with long-term unemployment – while in Ruse the share of the unemployed who have been registered at the labor offices for more than a year is only 0.3%, it exceeds 1% in Targovishte, 10% in Vetovo and 12% in Samuil. In some places the share of unemployed young people is also significant – 7% of the population aged 15 to 29 in Vetovo and Sitovo, while in the core areas the share is more significant in Razgrad (1.6%).

The employment rate in the age group from 15 to 64 is 59.5%, but here, too, there are large differences between one municipality and another – from 67.8% in Ruse to 32.3% in Antonovo. The largest number of employed persons is concentrated in the three cores – 59,000 in Ruse, 17,600 in Targovishte and 17,100 in Razgrad. Employment in the center has been shrinking relatively fast, with the number of employees declining by 8.2% over the last 5 years. The employment structure follows the general structure of the center’s economy, with manufacturing (39%) and trade (18%) in the lead.

Over the last 5 years, the average salary in the center has increased by 51% to 1,255 BGN on average per month – between 1,438 BGN in Razgrad and 921 BGN in Tsar Kaloyan. Healthcare offers the highest salaries in all three economic cores, with an average of 2,404 BGN per month in Ruse, 1,977 BGN per month in Razgrad and 1,929 BGN per month in Targovishte.

- HUMAN RESOURCES AND WORKFORCE

Like the other centers in northern Bulgaria, Ruse– Targovishte–Razgrad is rapidly losing population, with a 17.6% drop to 333,000 people between the last two censuses. It also has one of the highest shares of elderly population, with 25.5% of the total population being aged 65 and above in 2021 for the center as a whole and as high as 39.6% in Ivanovo. Demographic replacement indicators point to relatively rapid ageing processes. At the same time, the share of the working-age population is among the highest – 61.7% on average for the center. The working-age population is concentrated in the cores – 88,000 people in Ruse, 30,000 people in Targovishte and 27,000 people in Razgrad.

Like the other centers in northern Bulgaria, Ruse– Targovishte–Razgrad is rapidly losing population, with a 17.6% drop to 333,000 people between the last two censuses. It also has one of the highest shares of elderly population, with 25.5% of the total population being aged 65 and above in 2021 for the center as a whole and as high as 39.6% in Ivanovo. Demographic replacement indicators point to relatively rapid ageing processes. At the same time, the share of the working-age population is among the highest – 61.7% on average for the center. The working-age population is concentrated in the cores – 88,000 people in Ruse, 30,000 people in Targovishte and 27,000 people in Razgrad.

The population shrinkage is mainly the result of the strongly negative natural growth, which reached –13.6‰ on average for the center in 2022, ranging from –10‰ in Targovishte to –33.5‰ in Ivanovo. The center as a whole reports positive migration with a net migration rate of 2.6‰, and the most attractive municipalities are some of the smaller ones – Samuil (11‰), Vetovo (6.7‰) and Loznica (6.2‰).

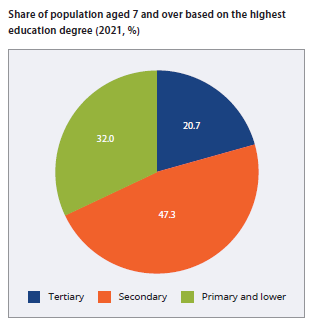

The educational structure of the center is relatively unfavorable, with 20.7% of the population aged 7 years and older having higher education, 32% having primary education and below, while the share of illiterates is 1.1%. The share of university graduates is significantly higher in Ruse municipality (28.2%), while illiteracy is a more pronounced problem in the smaller municipalities of Samuil (4.6%) and Borovo (4.4%). Students’ results are not very high either, with the average score in the 2022 state matriculation exam in BLL being Good 3.58, and the average score at the NEA in mathematics at the end of grade 7 being only 32.7 out of 100.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....