Plovdiv-Maritsa-Rakovski Еconomic Centre

PLOVDIV-MARITSA-RAKOVSKI

ECONOMIC CENTER

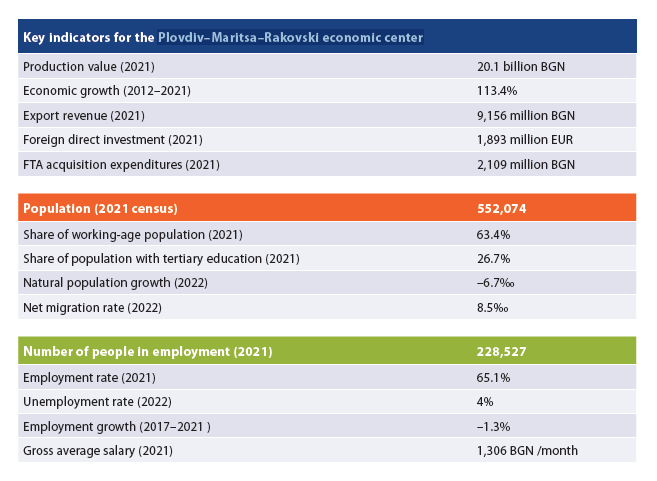

- INTRODUCTION | Key indicators for the Plovdiv–Maritsa–Rakovski economic center

- COMPOSITION AND LABOR MIGRATION

The economic centre consists of three cores – the municipalities of Plovdiv, Maritsa and Rakovski, and a broad periphery, which includes 11 other municipalities. All the peripheral municipalities are labor force donors to Plovdiv, while the municipality of Brezovo also falls within the periphery of Rakovski. The number of people commuting every day from the periphery to Plovdiv for work exceeds 25,000. The leading position in commuting belongs to Rodopi, where 49% of the employed, or 6,600 people, travel daily to Plovdiv, another 5,200 come from Maritsa, and 4,200 people travel from Asenovgrad. A significant source of labor for the smaller cores is Plovdiv City municipality itself, with 3,200 people travelling to Maritsa municipality each day and another 850 to Rakovski. The municipalities of Hisarya and Parvomay are very close to joining Plovdiv’s periphery, and compared to the previous edition of the survey (2017), the center has expanded by adding the municipalities of Bratsigovo and Brezovo.

- ECONOMY AND INVESTMENT

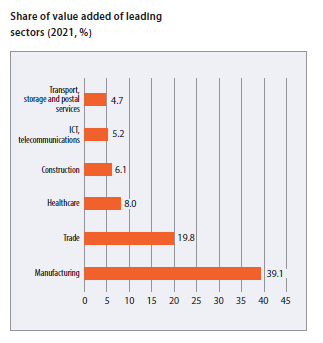

With а production value of 20.1 billion BGN, or 36,400 BGN per capita, Plovdiv–Maritsa–Rakovski was the second largest economic center in the country in 2021. Value added growth during the decade was the fastest among the 16 centers – 113%, mostly as a result of the accelerated development of industrial areas. Value added is concentrated in Plovdiv city municipality (74%), with a significant share also in Maritsa (8.1%), Asenovgrad (3.6%), Rodopi (3.5%) and Rakovski (3.3%). The leading sector is manufacturing with 39% of the value added, followed by trade (20%), healthcare (8%) and construction (6.1%). The largest employer in the center is the St. George’s University Hospital with 2,700 employees, followed by Liebherr-Hausgeräte Maritza with over 2,000 employees, KCM and the transport company PIMC with 1,500 employees each. The leader in terms of revenue for 2021 is Tabaco Trade with 930 million BGN.

With а production value of 20.1 billion BGN, or 36,400 BGN per capita, Plovdiv–Maritsa–Rakovski was the second largest economic center in the country in 2021. Value added growth during the decade was the fastest among the 16 centers – 113%, mostly as a result of the accelerated development of industrial areas. Value added is concentrated in Plovdiv city municipality (74%), with a significant share also in Maritsa (8.1%), Asenovgrad (3.6%), Rodopi (3.5%) and Rakovski (3.3%). The leading sector is manufacturing with 39% of the value added, followed by trade (20%), healthcare (8%) and construction (6.1%). The largest employer in the center is the St. George’s University Hospital with 2,700 employees, followed by Liebherr-Hausgeräte Maritza with over 2,000 employees, KCM and the transport company PIMC with 1,500 employees each. The leader in terms of revenue for 2021 is Tabaco Trade with 930 million BGN.

The amount of accumulated FDI in 2021 reached 1.89 billion EUR, of which 75% is in Plovdiv, 14% in Maritsa, and 6.1% in Rakovski. Foreign capital is concentrated in industry (67%), real estate operations (14%) and trade, transport and tourism (9.8%).

Expenditures for the acquisition of FTA in 2021 are relatively more evenly distributed: out of a total 2.1 billion BGN, 36% are in manufacturing, 24% in trade, transport and tourism, 12% in real estate operations, and 9.9% in construction. In this indicator of investment activity, the leader is again Plovdiv city municipality with 68%, followed by Maritsa with 8% and Rakovski, Rodopi and Asenovgrad with 4.6% each. Enterprises in the center generate the second highest export revenue in the country – over 9 billion BGN, or 16,700 BGN per capita. Labor productivity has reached 18,300 BGN value added per employee in the non-financial sector per year, which is relatively high.

- LABOR MARKET

According to the Employment Agency, in 2022 the unemployment rate in the Plovdiv–Maritsa–Rakovski center was 4%, but there are significant differences between the municipalities within it – from 2.5% in Plovdiv and 3.1% in Maritsa, to 11.3% in Bratsigovo and Kritchim and 14.5% in Brezovo. The local labor market is very dynamic, which is confirmed by the low share of people registered for more than a year in the employment offices of the Employment Agency – it is relatively high only in Rakovski (2.1% of the population aged 15–64) and Brezovo (3.2%), while in Plovdiv it is only 0.06%. The share of the unemployed among the population aged 15–29 reaches 5.4% in Rakovski and 5% in Brezovo.

According to the 2021 census data, the employment rate is relatively higher – 65.1%, ranging between 69.2% in Plovdiv and 48.5% in Krichim. The total number of employed people is 229,000, of which 144,000 are in Plovdiv, 22,000 in Asenovgrad, and 13,000 in Rodopi. During the last 5 years, employment in the center has been shrinking, with the number of employees decreasing by 1.3% compared to 2017. The employment structure closely follows that of value added, with 38% of employees in manufacturing, 19% in trade, and 6.9% each in transport and healthcare.

Between 2017 and 2021, the growth of the average salary for the center was 49% and reached 1,306 BGN gross per month; at the municipal level, the highest salaries in 2021 were in Kuklen (1,549 BGN per month) and Maritsa (1,514 BGN per month). The highest salaries in Plovdiv are in the fast-growing ICT sector (3,262 BGN per month), as well as in healthcare (2,335 BGN per month), while in the smaller cores, it is the manufacturing sector that offers higher remuneration.

- HUMAN RESOURCES AND WORKFORCE

Between the latest two censuses, the population of the center decreased by 6.3% to a total of 552,000 people, with only the center around Sofia registering a smaller decline. The proportion of the working age population is high at 63.4%, concentrated in Plovdiv City municipality with 208,000 people in this age group. The rest of the labor supply is mainly in Asenovgrad – 36,000 people of working age, another 20,000 in Rodopi and Maritsa each, and 16,000 in Rakovski. The share of elderly population in the center is not particularly high, with people aged 65 and above accounting for 21.8% and demographic replacement indicators pointing to relatively slow ageing processes.

Between the latest two censuses, the population of the center decreased by 6.3% to a total of 552,000 people, with only the center around Sofia registering a smaller decline. The proportion of the working age population is high at 63.4%, concentrated in Plovdiv City municipality with 208,000 people in this age group. The rest of the labor supply is mainly in Asenovgrad – 36,000 people of working age, another 20,000 in Rodopi and Maritsa each, and 16,000 in Rakovski. The share of elderly population in the center is not particularly high, with people aged 65 and above accounting for 21.8% and demographic replacement indicators pointing to relatively slow ageing processes.

Plovdiv–Maritsa–Rakovski has the second highest net migration rate in the country after the Kardzhali center – 8.5‰ in 2022. It is important to note that almost all its constituent municipalities have increased their population as a result of migration processes; only Saedinenie and Kuklen have a negative net migration rate (–5‰ each); all others have positive net migration, most visible in Bratsigovo (19.6‰) and Plovdiv (12.2‰). The natural population growth is negative (–6.7‰), but it is one of the most favorable among the 16 economic centers of the country. There are, however, significant differences between the individual municipalities, with natural growth rates ranging from –4.2‰ in Plovdiv and –5‰ in Rakovski to –22.4‰ in Kaloyanovo and –20.8‰ in Brezovo.

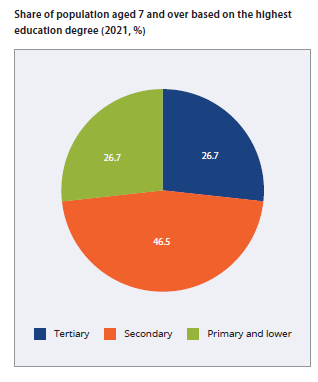

The educational structure of the center is relatively favorable, with university graduates and people with primary and lower education among the population aged 7 and older having an equal share of 26.7% in 2021. However, the share of illiterate people is relatively high – 1.5% in the center overall, but 6.5% in Perushtitsa and 3.9% in Rakovski. Unlike most large cities, Plovdiv has a high proportion of illiterate people as well – 1.2%. Students’ results in the center are also relatively low – the average grade in the matriculation exam in BLL is Average 3.48, the third lowest average grade in the country. Seventh-graders in the center perform better, but their results are far from those in the centers around Sofia and Varna.

Latest news

Sofia for another year breaks away from other regions in economic development 16.02.2026

In 2024, Sofia continues to stand out more and more clearly in its economic development from the other...

Bansko on the eve of the Winter Games 09.02.2026

Today is the official opening of the 25th Winter Olympic Games in Milano Cortina. Two decades after the...