Pazardzhik Economic Centre

PAZARDZHIK ECONOMIC CENTER

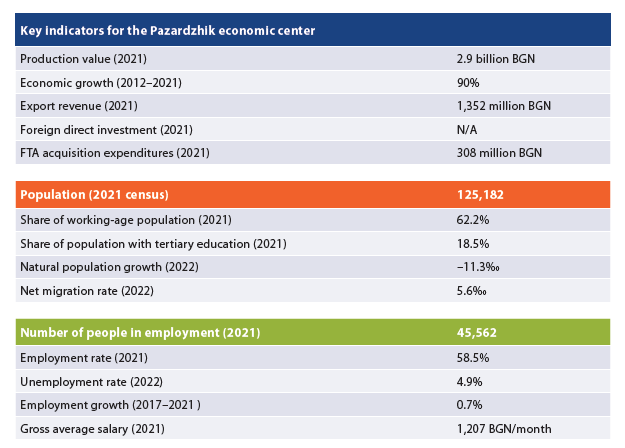

- INTRODUCTION | Key indicators for the Pazardzhik economic center

- COMPOSITION AND LABOR MIGRATION

The Pazardzhik center consists of the municipality of Pazardzhik as its economic core and the municipalities of Septemvri, Lesichovo and Belovo as its periphery. In line with the general trend and compared to the previous edition of the study (2017), the center has expanded and Belovo is now part of the periphery. The largest number of workers commute to the core from Septemvri – 1.5 thousand people, and work in Pazardzhik is most important for the local labor market in Lesichovo, where it generates 23% of all employment.

- ECONOMY AND INVESTMENT

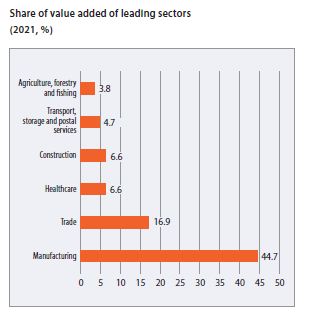

Production in the centre in 2021 is estimated at 2.9 billion BGN, or an average of 8,300 BGN per capita, which is one of the lowest in the country. However, the Pazardzhik center is experiencing significant economic growth, with a 90% increase in value added within a decade. As regards the concentration of economic activity, 85% of all value added in the center is generated in Pazardzhik and another 13% in Septemvri. The local economy is driven by manufacturing, which generates 45% of value added, followed by trade with 17%, and healthcare and construction with 6.6% each. This specialization is even more pronounced in the municipality of Septemvri, where manufacturing contributes more than ¾ of the total value added. The largest local employers are the auto parts manufacturer Kostal with over 1,500 employees and 813 million BGN in revenues in 2021, Kolovag in Septemvri with 1,300 employees and 209 million BGN in revenues, as well as the General Hospital in Pazardzhik and the cardboard and packaging manufacturer D.S. Smith.

Production in the centre in 2021 is estimated at 2.9 billion BGN, or an average of 8,300 BGN per capita, which is one of the lowest in the country. However, the Pazardzhik center is experiencing significant economic growth, with a 90% increase in value added within a decade. As regards the concentration of economic activity, 85% of all value added in the center is generated in Pazardzhik and another 13% in Septemvri. The local economy is driven by manufacturing, which generates 45% of value added, followed by trade with 17%, and healthcare and construction with 6.6% each. This specialization is even more pronounced in the municipality of Septemvri, where manufacturing contributes more than ¾ of the total value added. The largest local employers are the auto parts manufacturer Kostal with over 1,500 employees and 813 million BGN in revenues in 2021, Kolovag in Septemvri with 1,300 employees and 209 million BGN in revenues, as well as the General Hospital in Pazardzhik and the cardboard and packaging manufacturer D.S. Smith.

Due to the confidentiality rules of the National Statistical Institute, comprehensive data on the amount of FDI in the economic centre are not available. However, as the industry in Pazardzhik municipality alone has attracted foreign investment worth 121 million EUR, and Septemvri municipality – a total of 13 million EUR in all sectors, it can be concluded that almost all FDI in the center is concentrated in the economic core, and almost exclusively in the manufacturing industry. The structure of investment in FTA in 2021 also leads to the same conclusion, with 276 million BGN of the total 308 million spent on the purchase of machinery, land and buildings in Pazardzhik municipality and another 25 million BGN in Septemvri. Expenditures on the acquisition of fixed assets were the highest in industrial enterprises with 155 million BGN, as well as in trade, transport and tourism with a total of 45 million BGN.

The economy of the Pazardzhik center is relatively strongly export-oriented, with export revenues of non-financial enterprises amounting to 1.35 billion BGN in 2021, or almost 11,000 BGN per capita. Again, the leading municipalities in this indicator are Pazardzhik and Septemvri. The centre, however, ranks among the lowest in terms of labor productivity with an average of 15,600 BGN of added value per employee per year.

- LABOR MARKET

Following the substantial growth in 2020, unemployment in the centre is now relatively low at 4.9% of working-age population according to the 2022 Employment Agency figures. Although the share of the unemployed is lowest in the core, it no longer exceeds 10% in any of the peripheral municipalities. However, parts of the periphery have visible problems with long-term unemployment, with 6.3% of the working-age population in Lesichovo and 4% in Septemvri registered with the labor offices for over a year, most probably due to low education and inadequate skills. Employment in the economic center is at one of the nation’s lower levels at 59% according to census data, and the total number of employed people is 45,600. Of these, 35,000 are employed in Pazardzhik and another 7,000 in Septemvri. Only the small municipality of Lesichovo has significantly lower employment – just 39% of the population aged 15–64.

The labor market in the Pazardzhik center has seen a slight expansion over the past 5 years, with the number of employees growing by 0.7% from 2017 to 2021. Almost two-thirds of the workforce is concentrated in two sectors – 40% in manufacturing, 21% in trade, and the third largest sector is construction at 7.6%. The labor market in Septemvri is even more concentrated – about 2/3 of jobs are in manufacturing.

Salaries in Pazardzhik have seen the highest growth among all 16 centers over the last 5 years – 61%, but this is mostly a consequence of the low starting value. The average annual gross salary reached 1,207 BGN per month in 2021; it was highest in Septemvri (1,432 BGN) and lowest in Lesichovo (894 BGN). The highest salaries in sectors with relatively large numbers of employees are in healthcare in Pazardzhik municipality – 1,976 BGN per month, and in the process industry of Septemvri – 1,831 BGN per month.

- HUMAN RESOURCES AND WORKFORCE

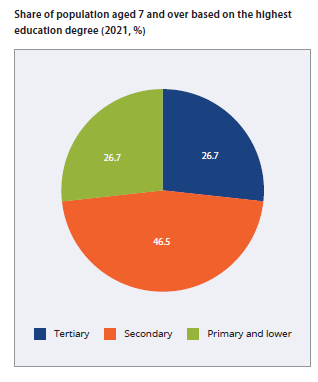

The educational structure of the Pazardzhik center is a serious obstacle to its development. The share of university graduates among the population aged 7 years and older is only 18.5%: it is lower only in the centers of Kardzhali and Kozloduy. This is coupled with a relatively high share of people with primary and lower education – 31%, and a serious illiteracy rate – 1.4%. These indicators are even more negative in the periphery, with 45% of people in Lesichovo having primary education or less, and only 8% having university degrees.

The educational structure of the Pazardzhik center is a serious obstacle to its development. The share of university graduates among the population aged 7 years and older is only 18.5%: it is lower only in the centers of Kardzhali and Kozloduy. This is coupled with a relatively high share of people with primary and lower education – 31%, and a serious illiteracy rate – 1.4%. These indicators are even more negative in the periphery, with 45% of people in Lesichovo having primary education or less, and only 8% having university degrees.

Schools in this economic centre do not perform particularly well on the various external evaluations, with the average score on the 2022 matriculation exam in BLL being Good 3.56, and the average score on the NEA in mathematics at the end of grade 7 being 29 out of a possible 100. These scores are significantly lower in the smaller municipalities.

Pazardzhik’s population is among those with the fastest decline – between the two censuses it has shrunk by 19%, with a larger decline only in Kozloduy and Sevlievo–Gabrovo. The total population in 2021 was 125,000 people, with the share of people of working age at 62%, which is close to the national average. The majority of the employable population is concentrated in the core – 57,000 people, and another 14,000 in September. The current population growth indicators do not give much cause for optimism either – although the net migration rate is positive (5.6‰ in 2022), the natural growth rate is very low (–11.3‰ overall for the centre, up to –20‰ in Belovo). Population ageing is also relatively rapid, with the proportion of people over 65 exceeding 24%.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....