Kardzhali Economic Centre

KARDZHALI ECONOMIC CENTER

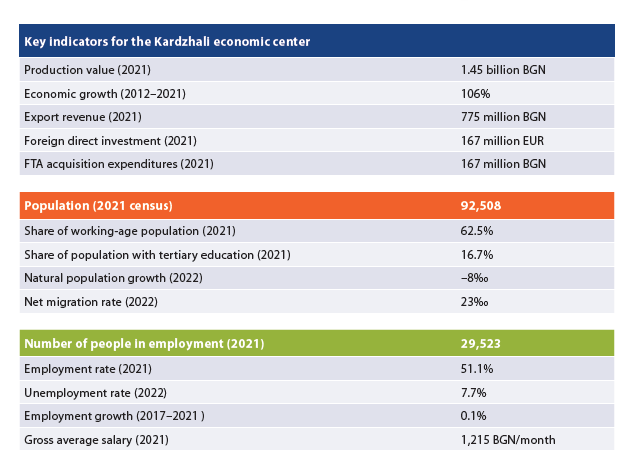

- INTRODUCTION | Key indicators for the Kardzhali economic center

- COMPOSITION AND LABOR MIGRATION

The Kardzhali center has the smallest local economy in Bulgaria. It comprises the district capital Kardzhali as its core and three smaller peripheral municipalities: Momchilgrad, Chernoochene and Dzhebel. The core receives a total of 1,300 daily labor migrants from its periphery, and these processes are most important for the economy of Momchilgrad, where 17% of the employed work in the municipality of Kardzhali. Two more municipalities, Kirovo and Ardino, are very close to the 10% labour migrant number criterion, which means that in the near future they are also likely to become part of the center. Kardzhali is an economic center new to the 2023 edition, meeting the criteria for employment density and labor migration, though not for production value.

- ECONOMY AND INVESTMENT

Kardzhali is the smallest economic center in the country, with a combined production value for the four municipalities of 1.45 billion BGN in 2021. Economic growth over the last decade is 106%, which ranks the Kardzhali center third on this indicator after those around the capital and Plovdiv. The local economy is characterized by the lowest labor productivity of all the economic centers in the country, with an average of 13,500 BGN of value added per employee in the non-financial sector.

Kardzhali is the smallest economic center in the country, with a combined production value for the four municipalities of 1.45 billion BGN in 2021. Economic growth over the last decade is 106%, which ranks the Kardzhali center third on this indicator after those around the capital and Plovdiv. The local economy is characterized by the lowest labor productivity of all the economic centers in the country, with an average of 13,500 BGN of value added per employee in the non-financial sector.

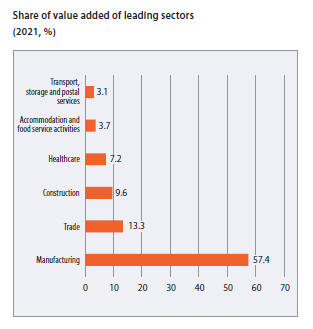

In 2021 manufacturing was the leading sector for the center’s economy, generating 48% of value added in the four municipalities. Trade provided 11% of value added, construction – 8%, and healthcare – 6%. In terms of distribution among the municipalities, the core municipality of Kardzhali accounts for 75% of the local economy, while Dzhebel carries more weight among the peripheral municipalities. The economy of the centre is dominated by several large enterprises – the manufacturer of rubber products for the automotive industry Teklas Bulgaria, which employs almost 3,000 people, the Kardzhali general hospital, the GORUBSO mining company and Kyashif, a producer of hydraulic cylinders. These large enterprises make up a significant part of the profile and distribution of labor migration within the center.

Given the relatively small size of the local economy, the Kardzhali centre attracts a relatively large amount of foreign investment, which reached 167 million EUR by the end of 2021, or 1,802 EUR per capita. 164 million EUR, which is almost all of the foreign investment in the center, is concentrated in the center’s core. Expenditure on FTA acquisition, which reflects the ongoing investment activity of the enterprises, amounted to 167 million EUR in 2021, of which 41% was made in the center’s industrial sector, 14% – in construction and 13% – in trade, transport and tourism. A large part of the investment expenditures – 134 million BGN – is focused in the municipality of Kardzhali, and another 15 mil lion BGN – in Dzhebel. The centre is one of the less export-oriented ones considered in this study: the volume of export revenues reached 775 million BGN in 2021, concentrated almost exclusively in process industries.

- LABOR MARKET

The labor market of the Kardzhali economic center gives out mixed signals. On the one hand, the average unemployment rate, as measured by the Employment Agency in 2022, remains high at 7.7% amid a general recovery, and in Dzhebel it has topped 16%. After its peak during the COVID pandemic, unemployment has been trending downwards. Unemployment problems in the region are more of a structural nature and not so much a consequence of the 2020 crisis. Also, the peripheral municipalities are characterized by a high share of long-term unemployment: over 20,000 people in the center are economically inactive. The employment rate of the population aged 15–64 is relatively low at 51% – the only centre with a lower rate is Kozloduy.

At the same time, over the last 5 years, the center has seen a slight increase of 0.1% (up to 24,300 persons) in the number of those employed in a labor or service contract, at a time when most other centers have been losing employees. The economic core absorbs almost all workers, with 19,000 people employed in 2021. Average salaries in the centre also grew substantially in this period (54%), to an average gross salary of 1,215 BGN per month, slightly higher in Dzhebel (1,295 BGN). The sectors offering the highest salaries in the center are healthcare in Kardzhali (1,897 BGN per month) and Momchilgrad (1,819 BGN per month), as well as culture, sports and entertainment in Kardzhali (1,879 BGN per month).

- HUMAN RESOURCES AND WORKFORCE

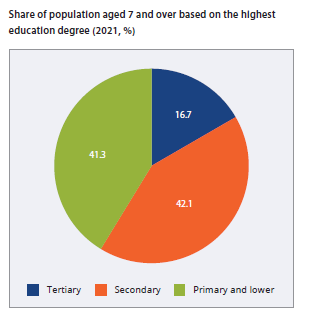

The educational structure of the population in the Kardzhali center according to the 2021 census is particularly unfavorable. Its municipalities have the lowest share of population aged 7 and above with university degrees – only 16.7%; at the same time, the share of those with primary and lower education reaches as much as 41%, and 2.6% are illiterate. The distribution in small peripheral municipalities is even more unfavorable.

The educational structure of the population in the Kardzhali center according to the 2021 census is particularly unfavorable. Its municipalities have the lowest share of population aged 7 and above with university degrees – only 16.7%; at the same time, the share of those with primary and lower education reaches as much as 41%, and 2.6% are illiterate. The distribution in small peripheral municipalities is even more unfavorable.

Against this backdrop, student performance in the four municipalities is close to the national average and far exceeds that of other smaller economic centers. It is noteworthy that these results are relatively consistent between the core and the periphery, except for the matriculation exam in BLL, where school leavers from Kardzhali achieved an average score of Good 3.83.

Among the strengths of the Kardzhali center are the positive demographic indicators compared to most parts of the country. Within the decade between the two censuses, the total population dropped by 9% to 92,500 people – a dynamic comparable to that of the economically strongest centers. The proportion of the economic center’s working age population is also relatively high at 62.5%, and the proportion of the retirement age population is more than 24%, which is also relatively favorable.

Demographic developments point to the center maintaining its good performance in the medium term. Kardzhali has the highest net migration rate of all economic centers in the country: 23‰, mainly due to stable migration from Turkey. Its main destinations are the district capital and Dzhebel. The natural growth rate of –8‰ is also relatively high, especially compared to less developed parts of the country.

Latest news

All municipal projects can start this year – here's how 04.03.2026

Is it possible for all municipal projects in the state budget – worth a total of over 4 billion euros –...

Regional inequalities are growing 02.03.2026

Deep regional inequality remains one of the most persistent challenges to Bulgaria's economic development....