Burgas-Nessebar Economic Centre

BURGAS-NESSEBAR

ECONOMIC CENTER

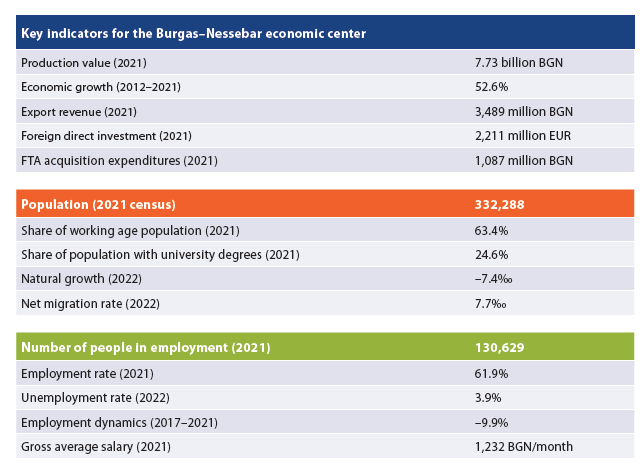

- INTRODUCTION | Key indicators for the Burgas–Nessebar economic center

- COMPOSITION AND LABOR MIGRATION

The Burgas–Nessebar center includes the municipalities of Burgas and Nessebar as economic cores and Kameno, Sredets, Sozopol, Aitos, Ruen and Pomorie as their peripheries. Unlike the previous edition of the study (2017), Nessebar has now met the criteria for a core, and with Pomorie joining, the range of the center has expanded. Burgas municipality attracts daily more than 6,400 workers from its peripheral municipalities, while Nessebar attracts 2,900. Employment in Burgas is of greatest importance for the labor market in Kameno, where 35% of employees commute every day, while the source of most incoming workers is Aytos – 1,500 people. For Nessebar, this role is played by Pomorie: from Pomorie 1,700 people, or 18% of all employees, commute to work in the core every day.

- ECONOMY AND INVESTMENT

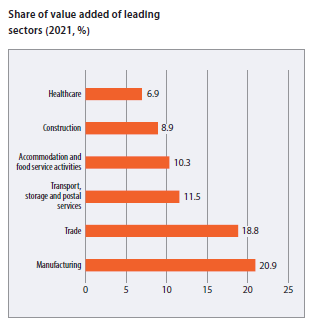

The total production value of the Burgas–Nessebar constituent municipalities was 7.73 billion BGN in 2021, or 23,200 BGN per capita. The growth of value added has been 53% throughout the last decade – the lowest after that of the Blagoevgrad center. However, it should be borne in mind that 2021 was particularly difficult for tourism, the key industry for the local economy. Value added is concentrated in the municipality of Burgas, which generates 75% of the value created in the center; another 10% are in Nessebar, and 4% each in Sredets and Pomorie. In terms of sectors, the economy is balanced – the leading role is played by process industries (21%) and commerce (19%), but transport and warehousing (12%), tourism (10%), construction (9%) and healthcare (7%) also have significant shares. It should be noted that in a “normal” year, without COVID-19, tourism would have a significantly higher share, especially in the periphery. Among the leading employers are Lukoil Neftochim with 1,300 workers, which was also the revenue leader in 2021, Water Supply and Sewerage with 1,300 people, as well as Nursan Automotive and Yana Textile with over 1,000 employees each.

The total production value of the Burgas–Nessebar constituent municipalities was 7.73 billion BGN in 2021, or 23,200 BGN per capita. The growth of value added has been 53% throughout the last decade – the lowest after that of the Blagoevgrad center. However, it should be borne in mind that 2021 was particularly difficult for tourism, the key industry for the local economy. Value added is concentrated in the municipality of Burgas, which generates 75% of the value created in the center; another 10% are in Nessebar, and 4% each in Sredets and Pomorie. In terms of sectors, the economy is balanced – the leading role is played by process industries (21%) and commerce (19%), but transport and warehousing (12%), tourism (10%), construction (9%) and healthcare (7%) also have significant shares. It should be noted that in a “normal” year, without COVID-19, tourism would have a significantly higher share, especially in the periphery. Among the leading employers are Lukoil Neftochim with 1,300 workers, which was also the revenue leader in 2021, Water Supply and Sewerage with 1,300 people, as well as Nursan Automotive and Yana Textile with over 1,000 employees each.

As of the end of 2021, the total FDI in Burgas–Nessebar amounted to 2.21 billion EUR, or 6,700 EUR per capita, with only the center around the national capital having higher FDI per capita. Foreign capital is concentrated in the two cores, with 93% in Burgas and another 5% in Nessebar. Expenditures for the acquisition of FTA in 2021 approached 1.1 billion BGN, of which 73% were made by enterprises in Burgas, 12% by those located in Nessebar, and 7% in Pomorie. The main driver of fixed asset investment is industry, with 33% concentrated there, as well as commerce, transport and tourism with another 27%. Burgas–Nessebar’s economy is relatively less export-oriented than that in most major centers, with 3.5 billion BGN in export revenues in 2021. Labor productivity is among the highest in the country, with 23,400 BGN of value added per employee.

- LABOR MARKET

Two years after the collapse of tourism and the drastic deterioration of the local labor market, unemployment in Burgas–Nessebar is relatively low – 3.9% on average for the center in 2022; in the city of Burgas it is 2.5%, while only in Sredets municipality it exceeds 10%. The local labor market is very dynamic, long-term unemployed are practically absent, while the share of people registered in the labor offices for over a year is higher than 0.5% only in Sredets municipality. However, the problem of youth unemployment stands out, with the share of the unemployed among the 15–29-year-olds registered in Nessebar municipality exceeding 2% in 2022. According to census data, in 2021 employment in the center was 62%, which is close to the national average. In most small municipalities employment was around 55%; in Nessebar it was 63%, and in Burgas 67%. Employees are concentrated in the municipality of Burgas – 85,000 people, while in Nessebar they are 95,000 and in Pomorie and Aitos – 9,000 each.

In the last 5 years Burgas–Nessebar has been the economic center with the largest decline in employment: the number of employees has decreased by 10% compared to 2017. However, this most probably reflects a temporary state of the labor market, rather than a permanent trend, and comes as a result of shrinking tourism. The distribution of employees is different from the structure of value added, with commerce creating the most jobs (21%), process industry coming second with 19% of employees, and tourism third with 15%.

At 42%, salary growth over the last 5 years has been among the slowest among the country’s economic centers, with only the Zagore center experiencing slower growth. The average salary for Burgas–Nessebar in 2021 was 1,232 BGN gross per month. Significantly higher, however, is the pay in the developing ICT sector of Burgas municipality – 2,490 BGN per month, as well as that in healthcare – 2,291 BGN. In Nessebar, the highest salaries are also in the health sector – 1,912 BGN on average per month.

- HUMAN RESOURCES AND WORKFORCE

Between the last two censuses, the population of Burgas–Nessebar decreased by 7.3% to 332,000 people – a relatively small decline compared to most other centers. Besides, the center has a relatively small share of elderly people, with those over 65 accounting for 21.2% of the population. Only the center around the capital has a lower share of elderly people, but Burgas–Nessebar has slightly more favorable demographic replacement rates, which indicate a slower rate of aging. At the same time, the share of the working-age population in the center averages 63.4% and is concentrated in the municipality of Burgas, with its working age population of over 125,000.

Between the last two censuses, the population of Burgas–Nessebar decreased by 7.3% to 332,000 people – a relatively small decline compared to most other centers. Besides, the center has a relatively small share of elderly people, with those over 65 accounting for 21.2% of the population. Only the center around the capital has a lower share of elderly people, but Burgas–Nessebar has slightly more favorable demographic replacement rates, which indicate a slower rate of aging. At the same time, the share of the working-age population in the center averages 63.4% and is concentrated in the municipality of Burgas, with its working age population of over 125,000.

This center is among the most attractive ones for migrants, with the average net migration growing by 7.7‰ in 2022. Almost all municipalities have positive net migration rates, with the leader Nessebar growing by 64‰ in a year. At the same time, at –7.4‰ the natural growth is among the best in the country, though notably less favorable in small municipalities, especially in Sozopol (–16‰) and Sredets (–15‰).

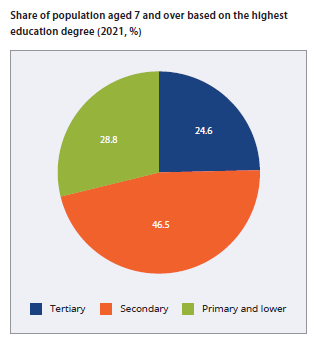

The educational structure of the population is relatively favorable, with 24.6% of the population aged 7 and above having a university degree in 2021, and 28.8% with primary education and below. However, the illiteracy rate is relatively high – 1.6% on average for the center, but significantly higher in Kameno (4.1%) and Sredets (5%). Student achievements are above the average for the center, with the average score at the state matriculation exams in BLL being Good 3.73 and an average score at the NEA in mathematics after grade 7 of 37.3 out of 100 points. Only students in the center around the capital and those in the Varna–Devnya center achieved better results on this test.

Latest news

Sofia for another year breaks away from other regions in economic development 16.02.2026

In 2024, Sofia continues to stand out more and more clearly in its economic development from the other...

Bansko on the eve of the Winter Games 09.02.2026

Today is the official opening of the 25th Winter Olympic Games in Milano Cortina. Two decades after the...